The SEC found ‘pervasive off-channel communications’ between January 2018 and September 2021 by employees of a number of firms at varying levels of seniority that included junior and senior investment bankers as well as debt and equity traders.

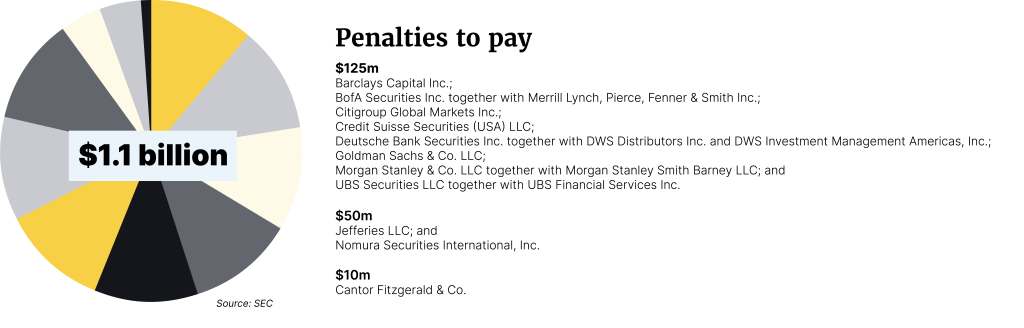

The firms and affiliates are:

- Barclays Capital Inc.

- BofA Securities Inc. together with Merrill Lynch, Pierce, Fenner & Smith Inc.

- Citigroup Global Markets Inc.

- Credit Suisse Securities (USA) LLC

- Deutsche Bank Securities Inc. together with DWS Distributors Inc. and DWS Investment Management Americas, Inc.

- Goldman Sachs & Co. LLC

- Morgan Stanley & Co. LLC together with Morgan Stanley Smith Barney LLC

- UBS Securities LLC together with UBS Financial Services Inc.

- Jefferies LLC

- Nomura Securities International, Inc.

- Cantor Fitzgerald & Co.

Employees at these firms routinely used personal devices to communicate about business matters and ‘the substantial majority of these off-channel communications’ were neither maintained nor preserved by the firms.

Enforcement actions by the SEC are the direct result of sweeps following the December 2021 SEC and CFTC settlement with JP Morgan Securities LLC connected with widespread and longstanding recordkeeping failures. 11 of the firms were also fined in a related settlement with the CFTC.

Gurbir S. Grewal, Director of the SECs Division of Enforcement, said that the actions and penalty size underscored “the importance of recordkeeping requirements”, which he also called “sacronsanct”. He pointed out that proper recordkeeping is required in order to enable the SEC to “determine what happened” in cases of allegations of wrongdoing and misconduct.

The SEC Chair, Gary Gensler, linked the charges against the 15 broker-dealers and one affiliated investment adviser, to the critical role that trust plays in finance. He said that “By failing to honor their recordkeeping and books-and-records obligations’ the market participants ‘have failed to maintain that trust”.

The SEC Chair described recordkeeping as being “vital to preserve market integrity” and pointed out that it has been so since the 1930s when the SEC was created in the aftermath of the Wall Street Crash of 1929. While acknowledging the obvious changes in technology since that time he asserted that the SEC would continue to ensure compliance with laws requiring appropriate recordkeeping.

He went further in stating that technological progress has made it “even more important” that communications about business should be conducted “within only official channels” and that such communications must be maintained and preserved. It is therefore not surprising that as part of the settlement the firms have agreed to retain compliance consultants and “conduct comprehensive reviews” of “policies and procedures relating to the retention of electronic communications found on personal devices”.

In a call to action to all market players, Sajay Wadhwa, Deputy Director of Enforcement, said that “the time is now to bolster your record retention processes and to fix issues” because the SEC “will continue its efforts to enforce compliance” with “essential recordkeeping requirements”.

Photo: Getty Images