The 600 cross-border money-laundering cases brought to EU agency Eurojust was double the number registered six years ago, and brings the total number of registered cases to almost 3,000.

The scale of the problem is laid out in the first Report on Money Laundering to be published by Eurojust, the European Union Agency for Criminal Justice Cooperation. The report analyzed cases registered at Eurojust between January 1, 2016 and December 31, 2021. The number of money-laundering cases now registered represents 12-14% of all registered cases.

The report, compiled to provide national authorities with tips on prosecuting cases cross-border money laundering, identifies a number of key challenges, including;

- identifying the beneficial owner of criminal assets – often complicated by the use of shell companies;

- determining who is considered a victim in a given country;

- ensuring proportionate compensation for all victims when the amount frozen is not enough.

Cryptocurrencies are also identified as presenting a particular challenge as “they make it difficult to keep track of the assets held by those under investigation”.

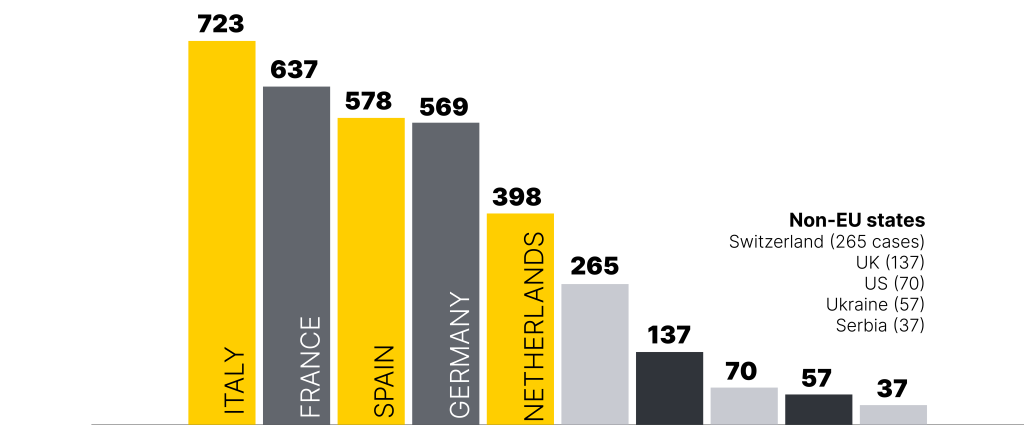

EU states involved in money-laundering cases between 2016 and 2021 are ranked in order of number of involvements, with the top five as follows;

- Italy (723 cases)

- France (637)

- Spain (578)

- Germany (569)

- Netherlands (398)

Over 60 third countries worldwide were found to be involved in money-laundering cases, with the top five non-EU states as follows;

- Switzerland (265 cases)

- UK (137)

- US (70)

- Ukraine (57)

- Serbia (37)

The report’s executive summary lists “10 most relevant legal and practical challenges” and “10 most relevant best practices”.