The UK Financial Ombudsman Service (FOS) has published it’s most recent bi-annual complaints data (January 2024 to June 2024), showing the volume of complaints received from various sectors and the outcome following its investigation.

Throughout the first half of 2024, FOS has continued to receive a high number of complaints. In the first six months of the year, it received 133,019 complaints, which is an increase of 40% compared to H1 2023 (93,114). In addition to the rise in complaints, the first six months also saw a rise in businesses featured in the Ombudsman’s complaints data, increasing by 10% (242).

What trends can be gleaned from the data?

Complaints data trends:

- 75% of complaints received by the FOS involved banking and consumer credit products, in which over half of these were submitted by professional representatives.

- Disputes about credit cards and unaffordable lending, car finance as well as fraud and scams were the main driver for the rise in banking and credit complaints.

- In H1 2023, the FOS received 59,690 complaints, with a quarter of cases referred by professional representatives.

- In the first six months of this year, the FOS upheld 35% of complaints resolved in favour of the consumer, compared to 37% in the first half of 2023.

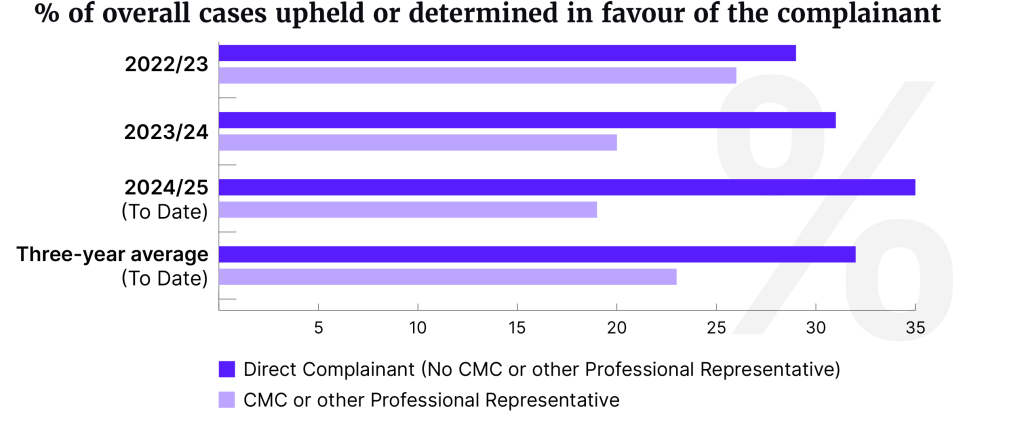

The graph below shows the success rate of CMC / professionally represented cases, compared to those referred directly by customers, which have been resolved over the past three financial years to date (April 2022).

The graph shows that consumers bringing their case without representation achieve greater success, with around 32% achieving a better outcome. This indicates that professional representatives are not only taking more complaints to the FOS, rather than customers who represent themselves, but are also taking complaints to the FOS with the knowledge that there’s little to no chance of the case being upheld.

Due to increases in professional representatives bringing complaints to the FOS (motor finance sector) and with consideration towards achieving good customer outcomes, the Financial Ombudsman’s board approved a principle of charging claims management companies, and other professional representatives, a fee in February 2024. The FOS proposes to introduce a £250 ($317) fee for CMCs and other professional representatives, reducing to £75 ($95) for cases where it is determined in favor of the complainant.

It would seem, the FOS’s objective regarding the proposal is to expend fewer resources on cases that are dismissed, withdrawn, and found to be out-of-jurisdiction. If the FOS’s proposals are implemented, it’s likely there will be a decrease in cases brought to the FOS by CMC / professional representatives, and a decrease in cases brought to the FOS.

What does good look like?

The data above shows that 75% of complaints received by the FOS involved banking and consumer credit products. The current cost-of-living crisis is contributing to the increase in complaints in this area, with more people dependant on credit throughout this volatile economic period.

The main driving factor behind this is due to an increase in professional representatives (CMCs) bringing complaints on behalf of customers. This is likely due to motor finance being a hot topic in the market, where professional representatives will request customers to complete an initial questionnaire regarding their current credit status.

This will increase the likelihood of professional representatives encouraging customers to complain beyond motor finance. The implication is that firms who have never sold motor finance will see an increase in their complaints as a result of the motor issue.

To gain assurance of your lending practices, you should consider the following:

- Lending: Is your framework robust? For example, affordability and credit worthiness assessments should duly consider the individual circumstances of each applicant, thus avoiding causing foreseeable harm.

- Default prevention: Where customers experience financial difficulties, in the past and present, are you assisting the customer by considering multiple options to prevent them defaulting before passing them to debt collection agencies (in-turn causing financial detriment)? For example, offering customers payment holidays, amended repayment structures, and / or temporary amendments to repayments and suspension of interest.

- Technology vs customer testimony: To what extent do you use either technology or customer testimony in your processes for assessing credit worthiness and affordability? For example, the use of open-banking data, Office of National Statistics (ONS) data and credit reference agencies.

- Credit: How long do you allow customers to repay their revolving credit with the minimum amount of payment permitted? What length of time could potentially mask an ongoing issue / financial difficulties? And do you have a minimum repayment tenure?

- Systems and controls: As a lender, do you have adequate processes in place (for example robust due diligence processes) to ensure you have sufficient oversight of your distribution chain (for example brokers)?

To ensure you’re appropriately identifying, handling, and investigating complaints, you must consider areas including the following:

- Ensure you have a detailed and effective policy and procedure in place to assist staff in the identification and handling of complaints. This should be clear and simple, with a specific focus on items aimed at achieving fair outcomes such as:

- defining what material distress and inconvenience means to your business;

- what monetary loss to you might include;

- approaches to root cause analysis;

- governance;

- a remediation framework.

- Provide your staff with the knowledge and skills to identify and handle complaints. Apply a rolling schedule of training on how to identify and handle complaints, with appropriate signposting and easy access to your procedural documentation.

- Have a dedicated and adequately resourced complaints team who specialize not only in the products you provide services for, but also the FCA’s dispute resolution rules (DISP). Make sure they’re also aware of the FOS’ approach and response to complaints of a similar nature.

- Confirm that Consumer Duty is embedded in your complaints process, including heightened bar expectation surrounding root cause analysis and points of customer contact.

- Approach complaints impartially, put yourself in the customer’s shoes, and actively review all complaints on the basis of what is fair and reasonable in the circumstances, not from the position of defending the firm.

- Have an effective quality assurance process in place surrounding complaints identification in operational teams, as well as in your complaints handling function, with a focus on continuous improvement.

Mac McGuire is a consultant in the Wealth team. He helps clients meet their regulatory requirements, provides guidance on specific regulatory issues and assistance with FCA authorization applications. Matt Browne is the practice lead in the Wealth team. He advises on discretionary management, financial planning, regulatory compliance and prudential obligations.