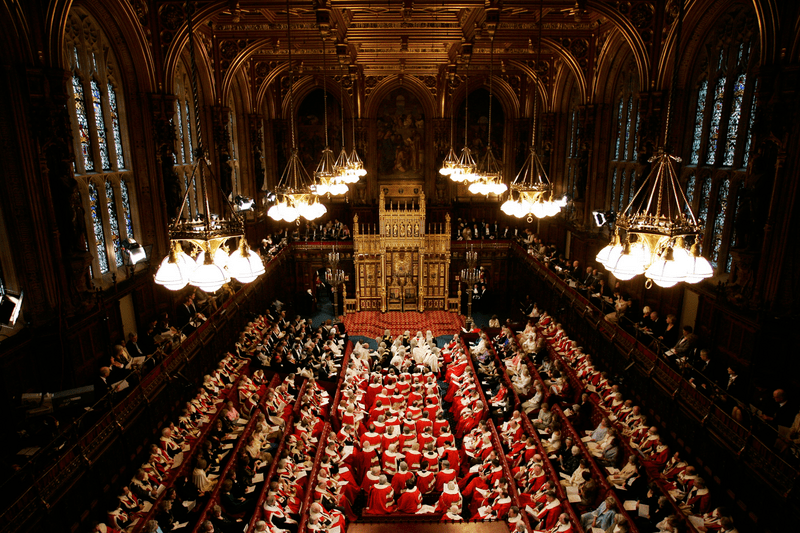

Following on from our coverage of the FCA’s name-and-shame proposals (CP24/2: Our Enforcement Guide and publicising enforcement investigations – a new approach), the House of Lords Financial Services Regulation Committee has now closed its call for evidence due to the calling of a General Election on July 4, 2024.

In response, Dame Harriett Baldwin MP, Chair of the Treasury Sub-Committee on Financial Services Regulations, has written to Nikhil Rathi, Chief Executive of the FCA, in advance of the dissolution of the Parliament and the Committee on May 30, 2024. The letter sets out some of the Committee’s views following evidence taken from Rathi on May 8, 2024.

During that session different members of the Committee each raised the following concerns:

- The approach the FCA has set out appears to be different to those of financial conduct regulators in other similar economies, such as the US, France or Switzerland.

- If the bar is set too low when assessing the public interest of publicising an investigation, and large numbers of investigations are published, the consequences could be a loss of investor confidence in UK financial services markets.

- Investigations undertaken by the FCA can take many years, and during this time companies who have been named will have an allegation hanging over them for long periods of time. The FCA must prioritize reducing the time it takes to conclude investigations.

- Publicising enforcement investigations appeared to be an FCA priority, compared to other work that might have been undertaken to increase international competitiveness.

- The FCA already has the power in exceptional circumstances to publicise an enforcement investigation.

Additionally, the letter confirmed that the Committee has been sent the views of organizations who do support the measures on the grounds of better protection for consumers, deterring poor conduct from firms, and increasing trust in enforcement against wrongdoing among the public.

GRIP comment

The FCA’s name-and-shame proposals have not been popular with industry or government. We previously reported that UK Chancellor Jeremy Hunt made a rare government intervention to urge the FCA to rethink its decision to name and shame companies under investigation. This followed a letter from Committee chair Lord Forsyth of Drumlean to FCA chief executive Nikhil Rathi asking for a pause, saying: “Innocent until proven guilty is a fundamental principle of our justice system.”

Industry reaction has been most vocal. When we asked a panel of experts for their views, comments included that the FCA’s approach was “disproportionate as they could result in firms suffering real damage in terms of their reputation and valuation, especially given the majority of FCA investigations are closed with no further action” and “could harm the UK’s competitiveness and attractiveness as a financial centre.”

However, not everyone is against the FCA’s plans, as the letter does acknowledge potential positive outcomes as highlighted above. Furthermore, Rob Mason, head of regulatory intelligence at Global Relay, said the regulator’s plans to name firms under investigation at an earlier stage could work to reduce lengthy legal battles. Mason said a compromise to the conflicting views could be the FCA describing the behaviors they have identified without naming the firms.

Following the General Election on July 4, 2024 a newly appointed committee may consider whether to reopen previous calls for evidence.