US brokers and those operating in course of their trade or business are now required to report crypto transactions worth of $10,000 to the Internal Revenue Service (IRS), in line with a provision amending the Tax Code of the Infrastructure Investment and Jobs Act that came into force on January 1.

The full Act passed Congress and was signed by President Biden in November 2021, and now requires all who receive $10,000 or more in cryptocurrency in their trade or business to make a report to the IRS about that transaction.

The report must include, among other things, name, address, and Social Security number of the person sending the funds, including the amount, date and nature of the transaction. It also needs to be filed within 15 days of receiving the transaction – those not complying with the rule can be found guilty of a felony offense.

Section 6050I applies – trade or business

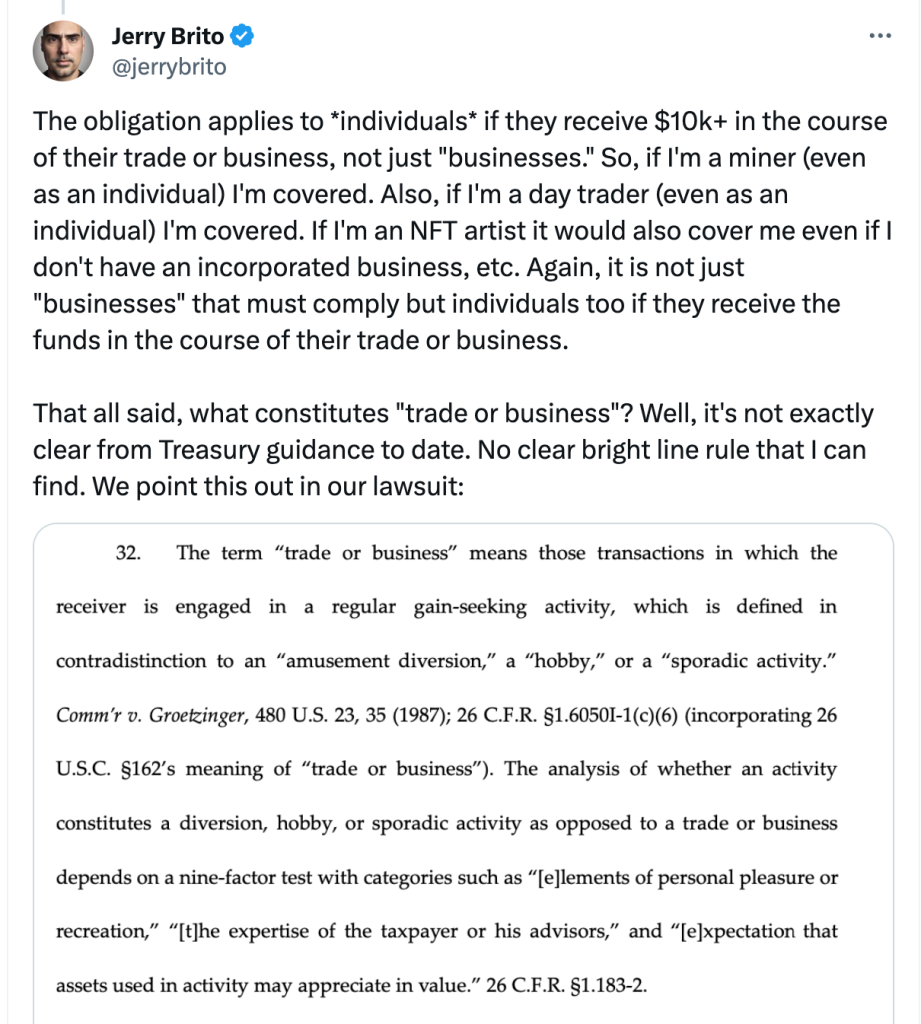

Section 6050I of the Tax Code is very clearly targeted and only applies to individuals or businesses who are engaged in a “trade or business”.

If you are a simple crypto investor, you are very unlikely to be engaged in a trade or business for which contributing to a decentralized autonomous organization (DAO) is a full-time/self-employed job and main source of income.

In a scenario where your investing is a “hobby” or a “sporadic activity” supplementing your other income you are almost certainly not going to see your activities fall within the scope of 6050I and you will not feel any impact from the new reporting requirements.

The law could be clearer

With that said, the law could be a lot more clear about how the “trade or business” nine-factor test is going to be applied in connection with crypto, especially since any trading of digital assets can lead to (sometimes rapid) value appreciation, whether the trading is a person’s hobby, part-time or full-time activity.

As a result of this lack of clarity the Act and its reporting obligations are facing an early critique from Coin Center, a leading nonprofit research and advocacy organization focused on policy issues facing cryptocurrencies.

“If the government wants us to report directly about ourselves and the people with whom we transact, it should prove before a judge that it has reasonable suspicion warranting a search of our private papers.”

Jerry Brito, Executive Director, and Peter Van Valkenburgh, Research Director, Coin Center

They’ve pointed out the ‘vagueness’ of the reporting guidelines to members of Congress and their staff, arguing that they represent “counterproductive and unconstitutional” parts of the bill’s crypto provisions.

“[I]f a miner or validator receives block rewards in excess of $10,000, whose name, address, and Social Security number do they report?” said Jerry Brito, Executive Director. “If you engage in an on-chain decentralized exchange of crypto for crypto and you therefore receive $10,000 in cryptocurrency, who do you report?”

Unconstitutional financial surveillance

In June 2022, Coin Center filed a suit against the Treasury Department, challenging the amendment of Section 6050I of the Tax Code.

Photo: Coin Center

Jerry Brito said that the new law will force “ordinary people to collect highly intrusive information about other ordinary people, and report it to the government without a warrant,” which is “unconstitutional under the Fourth Amendment.” He also contends that the amendments will result in political organizations creating and sharing lists of donor names.

According to Brito sharing such information with the government is “unconstitutional under the First Amendment” and constitutes “a clear overreach for the government to force citizens to spy on each other without a warrant.”

“The really tricky nature of this requirement will become clear when someone makes such a donation, but does so anonymously by simply sending us Bitcoin or Ether to our public addresses.”

Jerry Brito, Executive Director, Coin Center

“If the government wants us to report directly about ourselves and the people with whom we transact, it should prove before a judge that it has reasonable suspicion warranting a search of our private papers,” argue Jerry Brito and Peter Van Valkenburgh, Coin Center’s Research Director.

Brito also points out the practical difficulties of complying with the new law, focusing in on an individual making a private donation with crypto: “[t]he really tricky nature of this requirement will become clear when someone makes such a donation, but does so anonymously by simply sending us Bitcoin or Ether to our public addresses. Who could we possibly list as the sender in that case?”

Brito says that Coin Center will “continue to fight this law in court and work to figure out how compliance can be possible in the meantime.”

While the merits of the suit will be considered by the courts, the fact that those representing the crypto industry are concerned about amendments stemming from the Infrastructure Investment and Jobs Act as well as potential Tax Code changes is another indication of the challenges facing the entire crypto eco-system on multiple legal and regulatory fronts.

It may also be an indication of just how pervasive crypto trading has become, which may be a concern to lawmakers and regulators worried about financial system and economic stability.