Finextra’s Payments Modernization: The Big Survey, conducted in early 2024, includes responses from 350 senior bankers, with a mix of C-level (32%) and senior management executives (68%) from different regions and organizational sizes.

The report emphasizes the need for rapid and effective payment system modernization driven by customer expectations and regulatory demands.

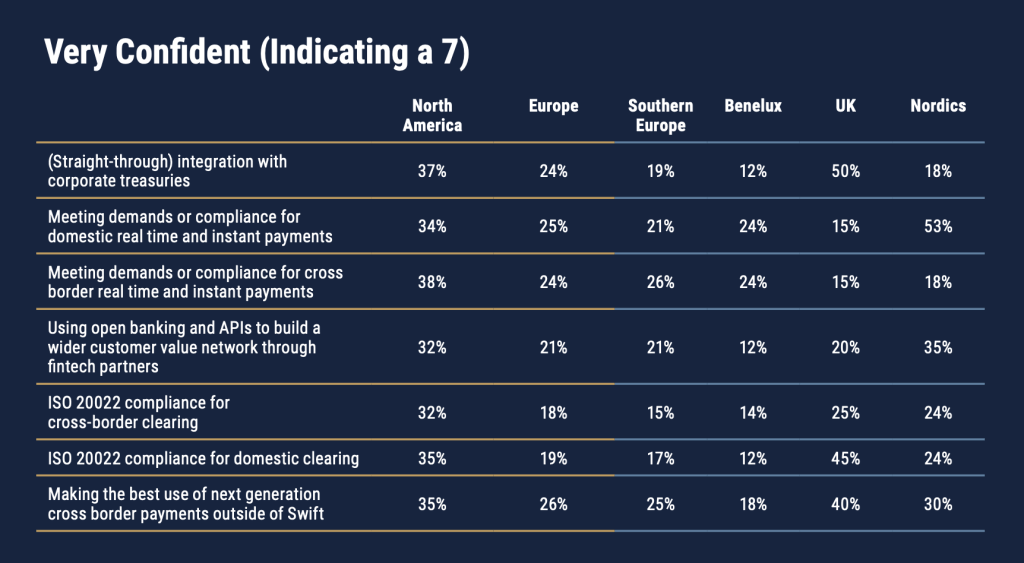

But there’s an overall lack of willingness on the part of banks to allocate big budgets towards hitting compliance, and confidence levels are correspondingly low, with some regional variation.

North American banks show higher confidence (35%) in achieving cost-effective compliance compared to European banks (19%).

Graphic: Finextra

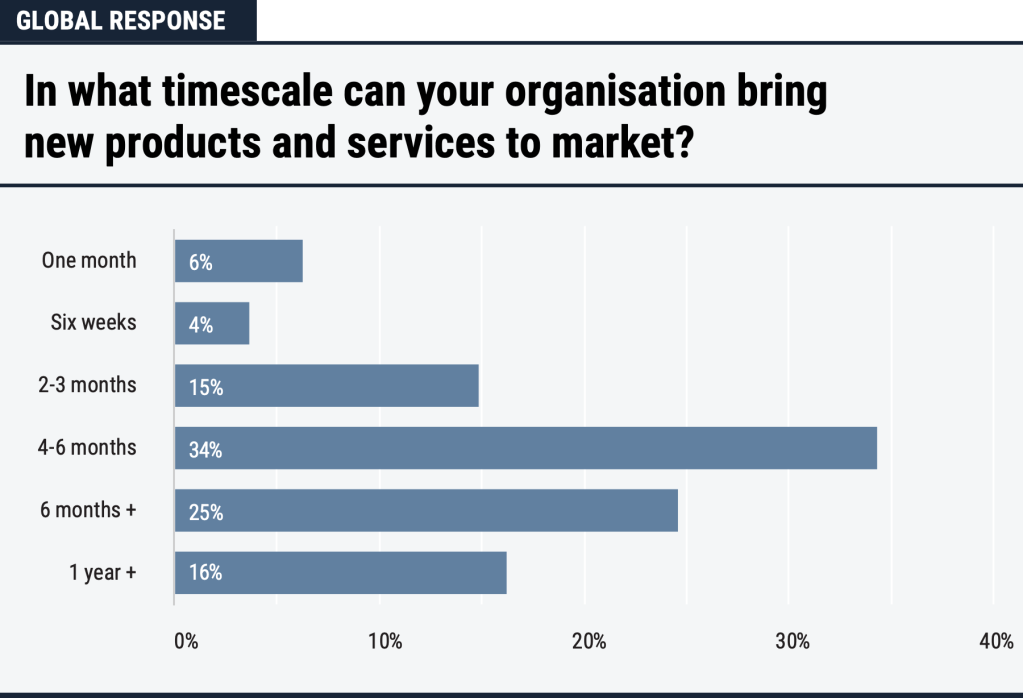

“Despite these challenges, the speed of bringing new solutions to market is impressive, with 75% of banks able to launch within three months. This agility is crucial in an era where customer expectations for rapid, efficient services are higher than ever,” Deepak Gupta, EVP Product, Engineering & Services, Volante Technologies, says.

Shifting deadlines

ISO 20022 is the international standard for the electronic exchange of financial information. It is hoped that ISO 20022 will provide a common platform for the development of messages used in the exchange of data between financial institutions.

Components include a data dictionary defining the meaning of each data element used in financial messages, a business process catalog specifying the processes involved in financial transactions, and message schemas providing the actual structure of the messages used for different types of financial transactions.

The original deadline was set for 2023. This has already been repeatedly delayed to allow for preparedness. The new deadline is November 2025.

But concerns about the timeframe needed to bring new products to market differ across regions. 44% of North American respondents said they can bring to market products in six weeks or less, while the figure was 42% among European respondents.

And while for customers ISO 20022 emerges as one of the main pain points in Europe, ‘Meeting regulatory and industry changes (for example ISO 20022 adoption)’ ranks at the bottom of the list of factors leading banks to invest in payments modernisation.

“As we navigate 2024, the financial services sector is in the midst of profound transformation,” Gupta says. “The preference for a Payments as a Service (PaaS) model is overwhelming, cited by 92% of respondents, indicating a strategic move towards leveraging third- party expertise and infrastructure.”

As Finextra points out, there are also other regulations keeping firms occupied, namely the EU Data Act, DORA, and the EU AI Act, meaning we are at a tipping point now where banks have some constraints under which to experiment with technology.