Following its State of Financial Crime report earlier this year, ComplyAdvantage has set out a detailed appraisal of firms’ compliance strategies.

In response to a rise in financial crime, 58% of firms have increased the size of their compliance staff. “History teaches us that such crimes almost always increase during times of economic turbulence and recession,” says Andrew Davies, Global Head of Regulatory Affairs, ComplyAdvantage.

“Many organizations I speak to continue to grapple with legacy technology systems, siloed data sets, and inefficiencies in their compliance operations that are holding them back. That’s why we commissioned this technology and talent survey. We wanted to understand better how financial crime leaders balance technology and hiring needs worldwide.”

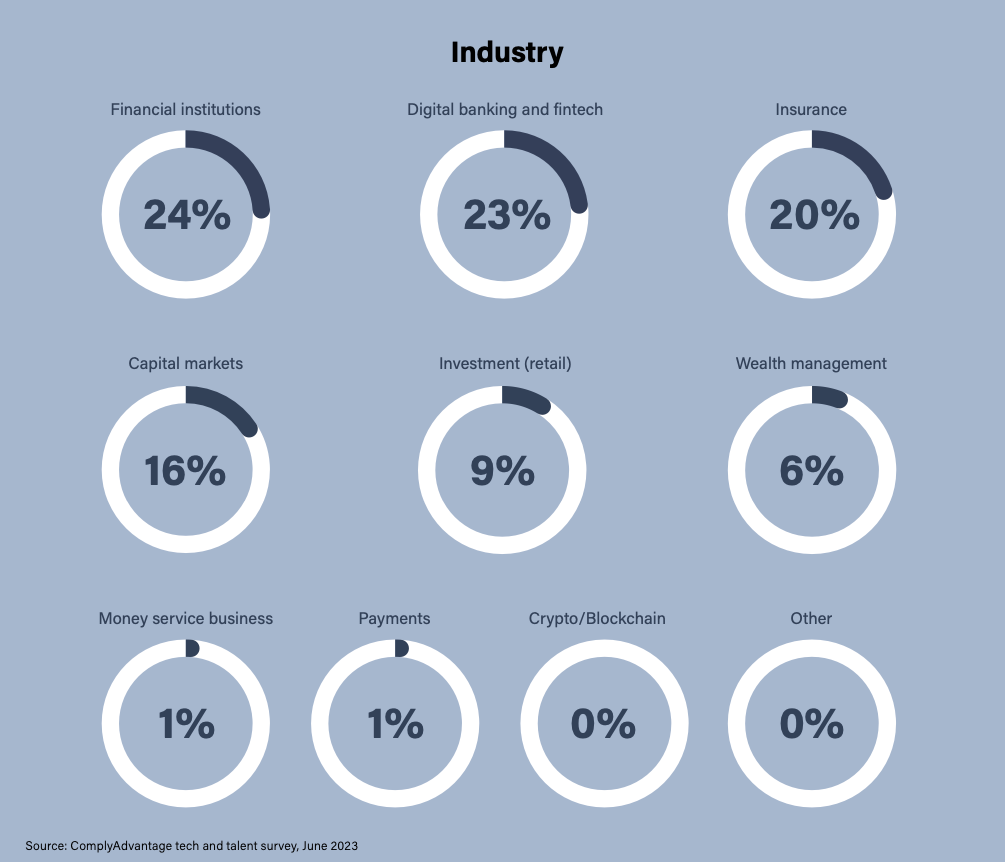

Some 43% of respondents work for firms with 1,000 or more employees, and the majority set the strategy and hold overall responsibility for fighting financial crime. Professionals in financial institutions, digital banks, and insurance firms together accounted for two thirds of those surveyed.

In terms of the talent market in the tech sector, the findings revealed three key trends:

- Almost all financial crime teams plan to invest more in both people and technology. Half of firms plan to hire 21-40 senior compliance staff in the next 12 months. These finding were consistent across Europe, the Americas and APAC.

- Technology: Integration across systems and a lack of explainability are key pain points – 48% of firms cited the ‘integration with the wider compliance tech stack.’ Similarly, fewer than 50% of firms said their adverse media screening tool is ‘very well integrated’ into their wider financial crime risk management architecture, and 39% cited integration with the broader compliance stack as their most significant pain point for transaction screening.

- Talent: Reporting, data science, and artificial intelligence (AI) are the most in-demand skills. More than 40% of firms selected governance, reporting, and management information alongside data science, AI, and software engineering as critical skills for new compliance staff.

Payment fraud

Payment fraud most powerfully underlines the challenges compliance leaders face in balancing their investments in tech and talent, says ComplyAdvantage. An increase in the number of payment fraud alerts in the last year had been seen by 61% of firms, with more than one in 10 saying their alert volumes have increased by 40% or more. The challenge was particularly stark in Asia Pacific, where 70% of firms reported increased alerts over the last twelve months.

“With countries like the UK introducing new legislation designed to crack down on soaring fraud typologies such as authorized push payment fraud (APP) and new fraud attack vectors continuing to emerge, the challenge of fraud is going nowhere fast,” says Iain Armstrong, Global Regulatory Affairs Practice Lead, ComplyAdvantage.

Screening transactions against categories such as sanctions and politically exposed persons (PEPs) is another area of concern. A quarter of firms reported that the average time to remediate an alert generated by their firm’s transaction screening solution was one day.

Employee morale

When asked, “If your organization were to invest in a new adverse media solution, what would be the primary benefit you’d be looking to achieve?”, firms replied:

Larger firms – those with 3,000-4,999 employees – recorded the highest level of concern about employee morale and adverse media.

Financial crime leaders are advised to benchmark their function’s performance against the data given, identify priorities and gaps, set tangible goals, and track change incrementally.