When the US Securities and Exchange Commission (SEC) introduced its Regulation Best Interest (Reg BI) rules in June 2020, broker dealers were expected to apply a higher standard of care when providing investment recommendations to retail clients. Many had dubbed the new framework ”suitability on steroids,” given that it bulked up existing rules that required brokers to only recommend investment products that were ‘suitable’ for clients.

But more than two years later, little has changed. A report at the end of last year by the North American Securities Administrators Association (NASAA) found that, while the firms it surveyed were engaging in slightly more pro-investor best practices and slightly fewer harmful conflicts, most had remained ”fairly stagnant” and were operating ”precisely the same under Reg BI as they had under the suitability rule.”

“There has been some incremental progress but generally there haven’t been the tide-turning reforms in firms’ practices that regulators were hoping for,” says Kiran Somashekara, a partner at law firm Reed Smith.

The purpose of Reg BI was to move broker dealers closer to the fiduciary standard expected of investment advisors by ensuring that recommendations are in the best interest of the customer at the time of the recommendation and not in the interest of the broker making the recommendation (if they would receive more commission for recommending a certain product over another, for instance).

Point of sale

To achieve this, broker dealers are now required to disclose to clients at the point of sale how they are being compensated and what conflicts of interest they might have, while also making sure clients know what they are investing in and are aware of any potential risks. Brokers also have a duty of care for their clients, such as understanding the full extent of their financial circumstances (how much debt they have, for instance).

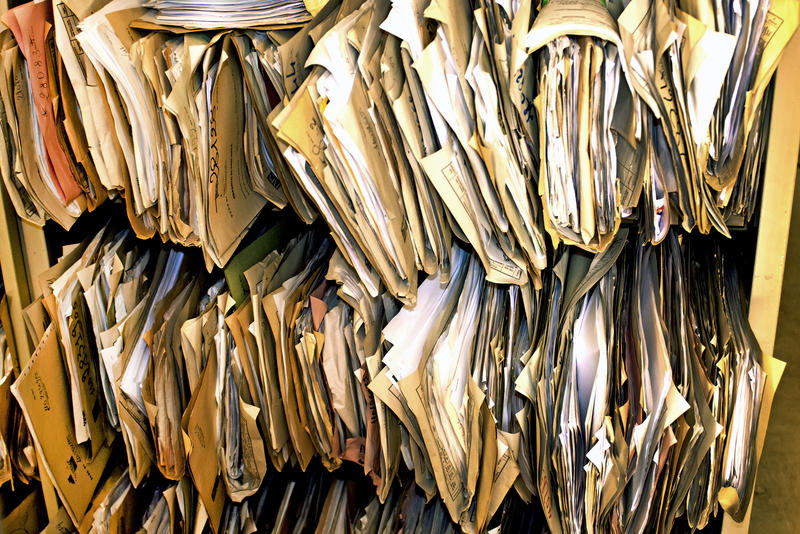

All of that is creating mountains of new paperwork and administration for brokerage houses.

“Everything is much more documentation-focused because firms need to demonstrate that recommendations are in accordance with the Reg BI components,” says Jennifer Szaro, chief compliance officer at XML Securities.

In the past, sales reps would typically focus notes on getting to know clients and their needs. Supervisors would be able to check those notes to ensure the recommendation made sense according to those needs. Now, notes need to capture more about clients’ financial situation and analysis of why a recommendation is in their best interest.

“Getting reps to document the notes for the new rule has been a challenge because they are now required to articulate their analytical thought process with a regulatory perspective.”

Jennifer Szaro, chief compliance officer at XML Securities

“Getting reps to document the notes for the new rule has been a challenge because they are now required to articulate their analytical thought process with a regulatory perspective,” Szaro says.

Another regulation that came into effect at the same time as Reg BI was ‘Form CRS’ – a document that financial professionals must provide to retail investors that summarizes fees and expenses, services and conflicts, and which is intended to make it easier for clients to compare what different firms offer. That has only added to the strains on firms’ operational and compliance resources.

“The firms need to determine when it must be provided, provide it, verify that it has been provided, and maintain records of when it was provided to the retail investor. What that has done is that you now have your back office staff, representatives and principals all focusing on when this form was provided to the client,” says Szaro.

High-risk offers

Yet, as the NASAA report found, many firms have been struggling to go much beyond the previous suitability standard. For instance, less than a third of firms (31%) made it a policy to offer or discuss in person the existence of lower-cost products that the firm could also provide, while only roughly a fifth (19%) discussed in person lower-cost options available elsewhere. In both instances, that was around 10% higher than percentages reported under the suitability standard.

“Clearly, these firms are not disclosing all material facts related to the conflicts associated with their recommendations,” NASAA wrote in its report.

The report also found that financial incentive conflicts were little changed. For instance, under the suitability rules, 31.5% of firms reported third-party compensation beyond commission from a product manufacturer or sponsor. That only fell to 25% under Reg BI. By contrast, only 2% of investment advisers reported receiving compensation in addition to commission. Meantime, product-agnostic sales contests also only saw a minor reduction, from 28% to 24%, NASAA data show (just 1% of investment advisors participated in such contests).

In February, the US Financial Industry Regulatory Authority (FINRA) released its 2022 report on its examination and risk monitoring program, outlining some of the issues it has found with firms falling short of Reg BI requirements. For example, some firms have written supervisory procedures that fail to identify the specific individuals responsible for supervising compliance with Reg BI or fail to detail how they will comply with the requirements. FINRA also found some firms failed to comply with conflict of interest obligations, as well as failing to provide adequate staff training.

“Because Reg BI is now in place, some firms believe they are complying with it and that they can take on a little bit more risk .”

Kiran Somashekara, partner, Reed Smith

One potential unintended consequence of Reg BI is that it has actually increased the likelihood that firms will offer customers riskier products. The NASAA report found that firms offering high-risk investments such as hedge funds, private securities, cryptocurrency, and structured products rose more than 10% after Reg BI was implemented.

“Because Reg BI is now in place, some firms believe – correctly or incorrectly – that they are complying with it and that they can take on a little bit more risk in terms of what they offer to retail customers,” says Somashekara. “That’s obviously not what Reg BI was intended to do but businesses are businesses and if there’s an opening that certain firms see based on what they believe is a higher compliance standard that they’re meeting, they may feel like they can make those recommendations.”

Advisory businesses

Another potential consequence of the new rules is that firms with advisory businesses are increasingly steering clients away from brokerage to managed money accounts.

“The level of disclosures that need to be made to ensure that all conflicts of interest are disclosed and the increased compliance costs that go along with that are encouraging wealth managers to direct customers to advisory accounts where the advisory fee structure better supports the cost of compliance,” said Michael Watling, a partner in law firm King & Spalding’s securities enforcement and regulation group.

For some brokerage firms, that increased regulatory burden could start to restrict the number of retail investors they can handle, potentially making it harder for less profitable customers to access more personalized brokerage services.

“Reg BI has increased the time for making recommendations, and so the time and resources for each client account has increased. My concern is how firms who provide personalized, high-level support balance that service without expansion,” says Szaro.

One reason that firms have not moved much beyond the suitability standard is that regulatory guidance has been limited. That could start to change as enforcement actions tick up and firms respond to ensure that they aren’t hit with similar penalties.

“At some point the SEC is going to want to show that Reg BI has teeth and it’s meaningful and it’s not just a suggestive program, it’s a regulation that needs to be complied with,” says Somashekara. “The difficulty is that it’s a very principles-based regulation, it doesn’t define best interest, and so there is a concern that the SEC is going to fill out guidance through enforcement actions. So there will be a fair amount of test cases to flesh out where some of these regulatory obligations fall.”