A number of Revolut customers have resorted to complaining via the Financial Ombudsman Service (FOS) after having their fraud reimbursement requests ignored.

The numbers emerged as Revolut secured its long-awaited UK banking license. It now enters the Prudential Regulation Authority’s (PRA) ‘mobilization’ stage. This is designed for new banks to complete the build-out of their banking operations.

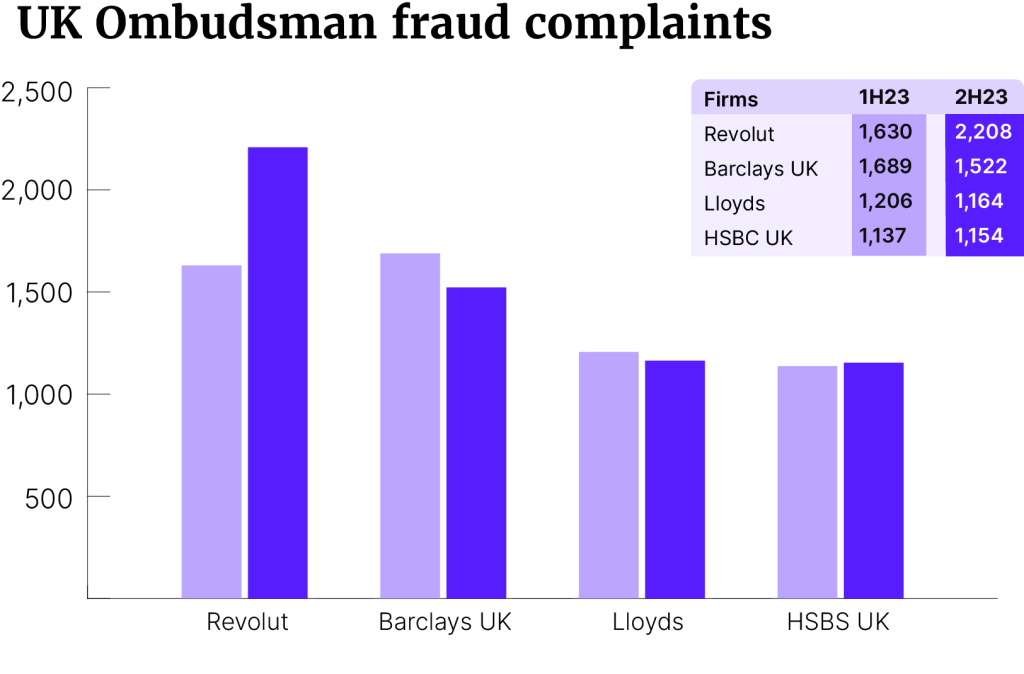

The rise in the number of fraudulent transactions is alarming, with Revolut receiving 2,208 fraud complaints in the second half of 2023, nearly 50% more than Barclays and nearly double that of Lloyds and HSBC. This figure was up from 1,630 in the first half of 2023, while other banks have lowered their figures.

UK license

Commenting on the granting of a license, Revolut’s UK CEO Francesca Carlesi said: “Today’s announcement is a significant step forward for Revolut and for our customers. It is a tremendous responsibility to be a bank in the UK and we will work relentlessly to offer products and services that improve the financial lives of everyone who uses Revolut.”

Revolut has been highly successful since it launched in 2015. By January 2024, app downloads had reached 12.5m in the UK alone. It was the best funded neobank in 2023, with $1.71 billion in funding, according to Fintech Global.

“The licence will help support a valuation that could reach up to $45bn if Revolut can pull off a planned sale of existing shares – something that would make it a contender for the title of the UK’s third-most-valuable bank,” the Financial Times said.

“We have robust protections in place for our millions of customers and analyse over half a billion transactions a month. Our security features include AI models, over 4,000 trained anti-financial crime professionals as well as experienced data scientists.”

Revolut spokesperson

Fraud on the rise

But the news glosses over the frustrations of a growing number of customers whose funds have disappeared without a trace.

To deal with the complaints, the neobank will have to conform to the FSCS scheme, which reimburses customers up to £85,000. It may also be able to offer loans and mortgages.

UK consumer rights body Which? issued a warning about the bank to consumers in March, after two Revolut customers reported having their business accounts drained by scammers who passed the e-money firm’s ‘selfie’ security checks. The incidents happened just two days apart.

“We have robust protections in place for our millions of customers and analyse over half a billion transactions a month. Our security features include AI models, over 4,000 trained anti-financial crime professionals as well as experienced data scientists,” a Revolut representative told Banking Dive.

Revolut is not the only banking services provider facing these issues. Monzo and Starling, also neobanks, have struggled with fraudulent transactions, according to figures complied by the Payment Systems Regulator (PSR). In 2022, 141 per million transactions sent using Monzo were fraudulent, while for Starling the number was 127 per million.

In the year to March 2024, current accounts were the most complained about product.

Fraudsters are taking advantage of the increasingly digital banking ecosystem, where data circulates freely between vendors.

APP prevalence and ISO 20022

According to the PSR, in 2022 (the most recent data set available) £389,022,456 ($500,105,873) was stolen by fraudsters, of which only £237,219,623 ($304,956,500) was reimbursed to customers. APP accounted for 40% of losses. Many of these cases are low value transaction scams.

The government said in June 2023 that APP fraud continues to be a priority for the FCA and that it will proactively consider a range of potential policy initiatives to tackle the scale and impacts associated with this type of crime, both for victims and the firms that it regulates.

The PSR and the Bank of England have introduced a mandatory reimbursement scheme for APP victims due to come into force in October. This promises a mandatory reimbursement up to a maximum of £415,000 ($533,501) within five working days, with costs split 50/50 between sending and receiving PSPs.

In 2024, banks will not only contend with the changing liability landscape, but the upcoming adoption of ISO 20022 in 2025. This will streamline data sharing, which is crucial for fraud detection and mitigation.

But many firms are unprepared for implementation.