In the past week, BlackRock’s Bitcoin ETF has been attracting hundreds of millions of inflow each day, more than any other bitcoin ETF.

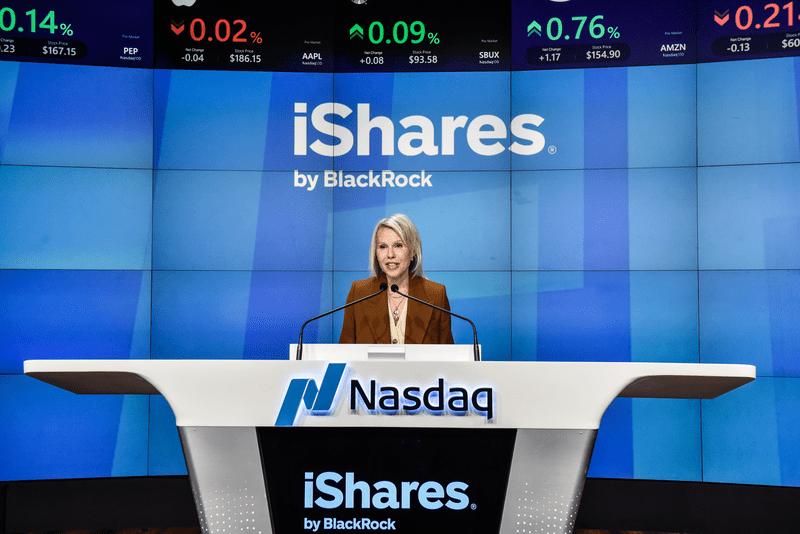

In fact, no other ETF in history has reached such an asset level that quickly, Blockworks said this week, after BlackRock’s iShares Bitcoin Trust (IBIT) crossed the $10 billion assets under management mark, after just seven weeks of trading.

The fee for the IBIT is 0.25%, which falls at the lower end of the spectrum, while the Grayscale Bitcoin Trust fee stands at 1.5%.

“The Grayscale converted ETF is actually one of the few funds that actually has seen a net outflow of assets. And that’s because the other competitors –BlackRock, Fidelity, ARK 21 shares – have very low rates, very low fees, something around 1.9 to .25%,” says Howard Fischer, partner at Moses Singer LLP and former SEC litigator.

Price climb

We are in the midst of a major price rally that began at start of the new year.

Some commentators think this is driven by “mom-and-pop” retail investors flooding in. User-friendly apps and exchanges, major companies now accepting bitcoin as a form of payment, and traditional financial platforms integrating digital assets, are all factors.

But others say the cause is mainly institutional, as a result of the ETF launch.

“Spot ETF volumes shot through the roof, with BlackRock beating its own daily record by 30%, and annualized funding rates in BTC perpetual futures rose to highs unseen in at least a year. This is an all-institutional rally driven by expert traders,” Lucas Kiely, Chief Investment Officer, Yield App.

“What’s happened in the cryptocurrency world is what’s happened in the financial services world over the last thousand years, but compressed into a three to five-year period.”

Howard Fischer, partner at Moses Singer LLP and former SEC litigator

Another factor contributing to the optimistic outlook, particularly for those with an understanding of the tech fundamentals behind bitcoin, is the approaching halving event, due to take place some time in April.

“Bitcoin undergoes a halving approximately every four years, reducing the rate at which new coins are created by half. The supply of new bitcoin entering the market decreases, creating a potential supply shock that historically has correlated with significant price increases,” says Nigel Green, CEO, deVere Group.

“As the issuance of new bitcoin slows down, the existing scarcity of the digital asset becomes even more pronounced, typically leading to increased demand and, subsequently, higher prices.”

Compliance and concentration

But despite the optimism, investment platforms are asking what the profit potential is for these products.

One of the biggest, Vanguard, has said it will not offer bitcoin ETFs.

“In Vanguard’s view, crypto is more of a speculation than an investment. This is at the root of our decision to not offer crypto products, whether our own or others. With equities, you own a share of a company that produces goods or services, and many also pay dividends. With bonds, you get a stream of interest payments. Commodities are real assets that meet consumption needs, have inflation-hedging properties, and can play a role in certain portfolios,” says Janel Jackson, Global Head of ETF Capital Markets and Broker and Index Relations, adding the crypto can “create havoc within a portfolio.”

Bitcoin futures ETFs existed before January 2024. But a spot bitcoin ETF holds actual bitcoin, offering direct exposure to its real-time market value, and doesn’t simply deal with future price contracts.

“The approval and launch of spot bitcoin ETFs, which track the price of the cryptocurrency directly rather than futures contracts, have provided institutional investors with a more accessible and regulated means of entering the crypto market, accelerating institutional adoption, and bringing more liquidity and stability to the market,” notes Green.

But the compliance implications of these offerings are not yet clear.

And another concern is that some exchanges, notably Coinbase, exert too much power over the industry.

“What’s happened in the cryptocurrency world is what’s happened in the financial services world over the last thousand years, but compressed into a three to five-year period. We have developed the rules that govern our financial services world over literally hundreds and hundreds of years”, says Fischer.

“You’ve seen doubling or having a price of prices within very short periods of time. So, you’re going to see a lot of significant compliance issues. One is going to be reluctance by advisors to even talk to customers about this.”