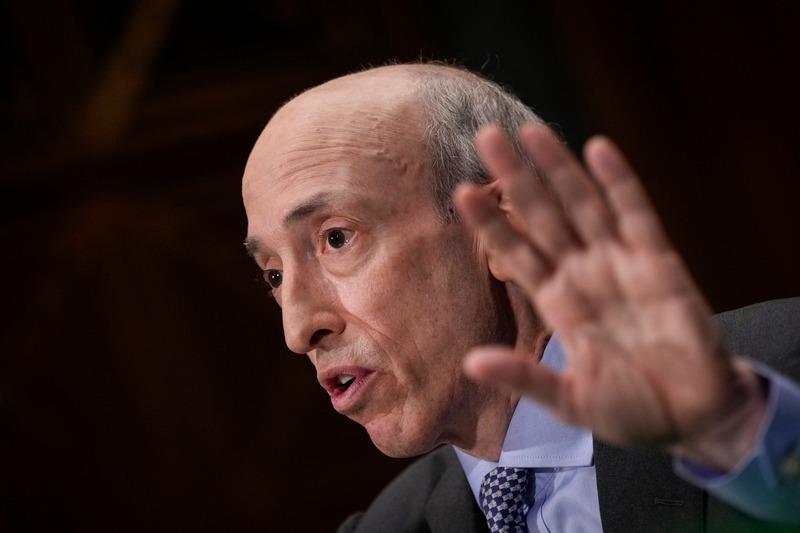

Gary Gensler, chair of the SEC, took center stage at the start of the week at the SIFMA 2024 Annual Meeting in New York and he covered a variety of topics related to the issue of Modernizing Equity Markets. These revolved around equity market structure, clearing, transparency of short sellinghere

Register for free to keep reading.

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day