“People must decide for themselves, not look to Mama Government to tell them what to do or not to do, nor to bail them out when they do something that turns out badly.”

SEC Commissioner Hester Peirce shared a personal reflection on the current state of the SEC’s cryptocurrency regulations. Writing on the SEC website, she offered insights into what to expect as the Commission moves away from its intense scrutiny of digital assets.

Peirce criticized the agency’s tendency to regulate cryptocurrency through enforcement over the last decade, calling the SEC’s enforcement and regulatory priorities under previous chair Gary Gensler a “meandering route with a destination not discernable.”

“It took us a long time to get into this mess, and it is going to take us some time to get out of it,” she wrote, urging patience.

Security or commodity?

Peirce was, of course, referring to the SEC’s historically aggressive and sweeping stance on crypto regulation, a situation partially caused by Congress’s failure to pass legislation defining which types of cryptocurrencies are securities and which are commodities. Failure to accurately taxonomize digital assets led to vacillations on questions such as whether ethereum was a security, and a major court loss when a judge rejected the agency’s classification of XRP as a security.

But that relief might be coming soon. Legislation such as the bipartisan FIT21 bill would give the SEC and CFTC respective jurisdiction over digital assets. And another recently-introduced bill would carve out a special status for stablecoins, which are pegged to the US dollar.

Peirce noted the series of ad-hoc positions the SEC took out of necessity since it first applied the 1946 Howey test to a cryptocurrency in 2017. This era of “legal imprecision and commercial impracticality” led to slow litigation, stagnant rulemaking, and frozen crypto projects, she stated.

Peirce suggested maintaining a strident focus on fraud and other misbehavior. She also anticipated an increased volume of applications for “exemptive relief, requests for no-action letters and registration statements,” and noted that it was important to adhere to diligent practices during this period to ensure regulatory clarity.

Crypto Task Force

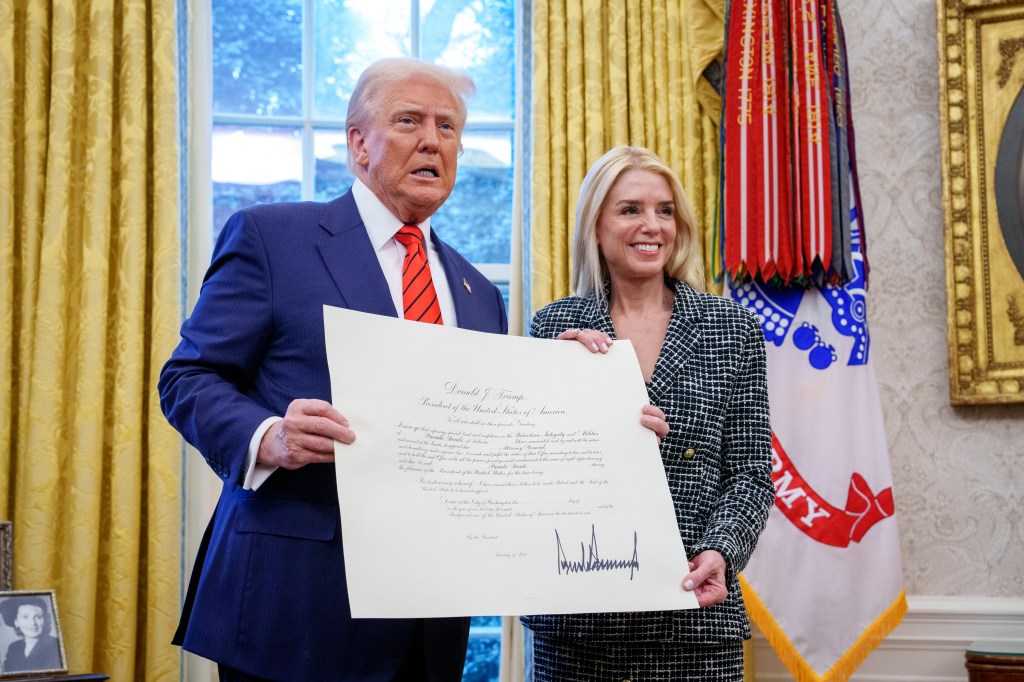

Peirce is set to lead the recently-announced Crypto Task Force, noting that the “new journey toward regulatory clarity still presents dangers.” She noted that the SEC has already achieved a major goal in that effort: the repeal of SAB 121, which required financial institutions to record crypto assets as liabilities.

According to Peirce, that path forward will likely involve several coordinated efforts. Some highlights include:

- Determining what kinds of crypto assets qualify as securities, and carving out regulatory exemptions through no-action letters.

- Providing “prospective and retroactive relief” for crypto offerings if an issuer provides certain information to the public, creating certainty that a token is a non-security so the assets can trade in the secondary market.

- Expanding the “special-purpose broker dealer no-action statement” to broker-dealers that custody both crypto securities and crypto non-securities.

- Providing clarity on whether crypto lending and staking, two forms of crypto interest-generating strategies, are covered by securities law.

For an in-depth discussion with Commissioner Peirce on SEC regulation in 2025, listen to her podcast episode with GRIP’s US content editor Julie DiMauro here.