More than $20m in penalties was recorded by the Monetary Authority of Singapore (MAS), the central bank and financial regulatory authority announced in its new 4th Enforcement Report for the period January 2022 to June 2023.

The report details robust action in cases including some with links to the Wirecard saga, and also highlights MAS’s enforcement priorities for 2023-2024.

During the 18-month period, $12.96m was imposed in civil penalties over false trading (two individuals), insider trading (one individual) and disclosure-related breaches (one entity). A total of $7.88min was imposed in financial penalties and compositions against 13 banks, four insurers, one capital market services licensee, and two individuals.

Inadequate AML controls

About half of the financial penalties and compositions, $3.8m, were imposed on Citibank N.A., Singapore Branch ($400,000), DBS Bank Ltd ($2,6m), OCBC Singapore ($600,000) and Swiss Life (Singapore) Pte. Ltd. ($200,000) for breaches of MAS’ anti-money-laundering and countering the financing of terrorism (AML/CFT) requirements. The financial institutions were found to have failed to have to have adequate AML/CFT controls in place when dealing with individuals who were involved with or had links to Wirecard AG or its related parties.

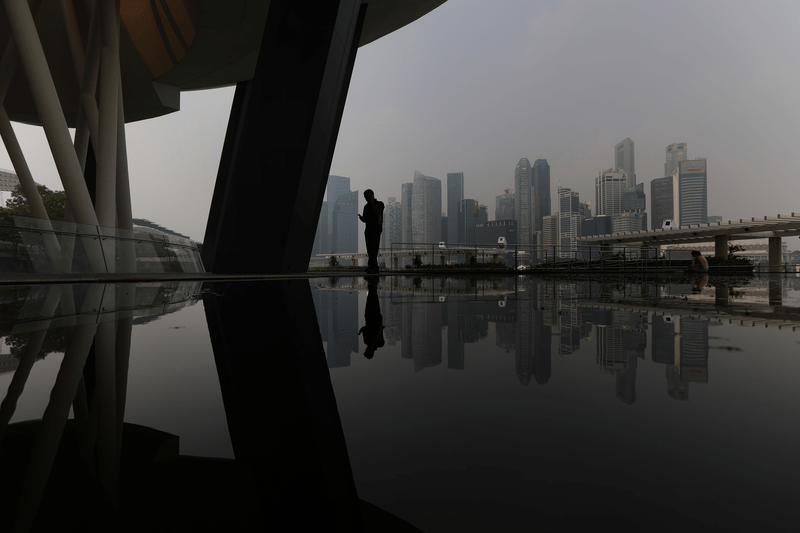

“As Singapore continues to position itself as a leading asset and wealth management hub, MAS is focusing on ensuring the integrity of these sectors. MAS has and will continue to take robust action against errant players who have breached applicable laws and regulations, including business conduct and AML/CFT requirements,” the report stated.

Insider trading and fraud

During the period, MAS made 39 criminal convictions, which resulted in:

- 13 individuals sentenced to imprisonment;

- 10 individuals sentenced to imprisonment with fine/disgorgement of profits; and

- 16 individuals being fined.

With the 39 convictions, 14 individuals were convicted for false trading, six for insider trading, seven for deception/fraud under the Securities and Futures Act, three for disclosure-related breaches, and nine for unlicensed conduct of regulated activity.

“The volume of digital evidence involved in our cases has increased exponentially. To address this, we have employed e-Discovery in our investigations.”

Peggy Pao-Keerthi Pei Yu, Executive Director Enforcement Department, MAS

Besides that, MAS took 455 other actions, which included seven reprimands, 112 warnings, 49 letters of advice, and 287 supervisory reminders. A total of 136 cases were opened during the time period.

MAS also set out 18 prohibition orders in which unfit representatives were banned from re-entering the financial industry; 12 were banned for a duration of one to five years, five for six to 10 years, and one individual was banned for more than 10 years.

“We will continually refine and enhance our processes to ensure that we remain well equipped to deliver effective enforcement outcomes. Together with our key enforcement partners, such as the Commercial Affairs Department of the Singapore Police Force, AGC and ACRA, we will strive to administer a firm and fair enforcement regime in Singapore’s financial sector,” said Peggy Pao-Keerthi Pei Yu, Executive Director Enforcement Department.

| Opened cases January 1, 2022 – June 30, 2023 Type of cases | Number of cases |

|---|---|

| Insider trading** | 32 |

| False trading** | 22 |

| Deception / Fraud under the Securities and Futures Act** | 6 |

| Disclosure-related breaches** | 25 |

| Breach of requirements for offer documents | 3 |

| Carrying on regulated activities without license** | 20 |

| Misselling of financial products | 1 |

| Breach of business conduct rules | 1 |

| Referral by other agencies for assessment of fitness and propriety | 14 |

| Money laundering-related control breaches | 7 |

| Other | 5 |

** Includes all cases under the MAS-CAD Joint Investigation Arrangement.

Besides its own enforcement actions, MAS also rendered assistance in 71 International Organization of Securities Commissions (IOSCO) requests from 25 international regulators, and sent five IOSCO requests to four international regulators.

Digital asset focus

MAS was formed in 2016, and aims for early detection of misconduct and breaches of law, to have effective deterrence, and to shape business and market conduct. MAS says that it will now focus on enforcement in the evolving digital asset ecosystem to address key money-laundering and terror-financing risks, technology risks and risks to consumers.

The work to start regulating digital assets started earlier in August, when MAS published a new regulatory framework for stablecoins that will apply to single-currency stablecoins that are pegged to the Singapore Dollar or any G10 currency, and are issued in Singapore.

“MAS’s stablecoin regulatory framework aims to facilitate the use of stablecoins as a credible digital medium of exchange, and as a bridge between the fiat and digital asset ecosystems,” said Ho Hern Shin, Deputy Managing Director (Financial Supervision), MAS.

“MAS has and will continue to take robust action against errant players who have breached applicable laws and regulations, including business conduct and AML/CFT requirements.”

MAS

Another focus area is to continuing watching assets and wealth managers, and MAS says it “expects them to comply with applicable laws and regulations, including business conduct and AML/CFT requirements, and will step up supervisory engagements to focus on serious regulatory breaches such as those involving dishonesty, gross conflict of interest and poor risk management”.

Pao-Keerthi added that the authority’s cases will increase in novelty and complexity. “The volume of digital evidence involved in our cases has increased exponentially. To address this, we have employed e-Discovery in our investigations and will continue to leverage technology to improve our effectiveness and efficiency,” she said.