- Compliance

- Regulation

Latest News

- Technology

Latest News

- Data

- ESG

- Resources

- All Resources

- Announcements

- Book Reviews

- Conferences and Events

- Country Guides

- GRIP Extra

- Podcasts

Topics

Latest News

-

What's next for UK data privacy in 2025?

Jean Hurley, Martina Lindberg3 min read

-

GRIP Extra: PwC reduces partners in China, Thailand liberates scam center hostages in Myanmar

GRIP2 min read

-

Stockholm FinTech Week 2025: Using AI and innovation to combat a fast-changing threat landscape

Alex Viall1 min read

-

Deadline approaching: ESG corporate reporting requirements for large companies

Companies in scope include: those trading on an EU-regulated market, and non-EU companies generating annual EU revenues $166m+.

Neil Robson | Katten Muchin Rosenman2 min read

-

General Election 2024: What Labour and the Conservatives say on sustainability and sustainable finance

Harriet O’Brien looks at the pledges in the manifestos.

Harriet O’Brien | Danesmead ESG6 min read

-

UK General Election: What the manifestos mean for the financial services sector

A summary of the most significant proposals affecting the financial services sector.

-

The ‘G’ of ESG has become the top priority for investors

Many asset managers want regulations to further enhance sustainable investment adoption, but some barriers like lack of data and greenwashing remain.

Martina Lindberg3 min read

-

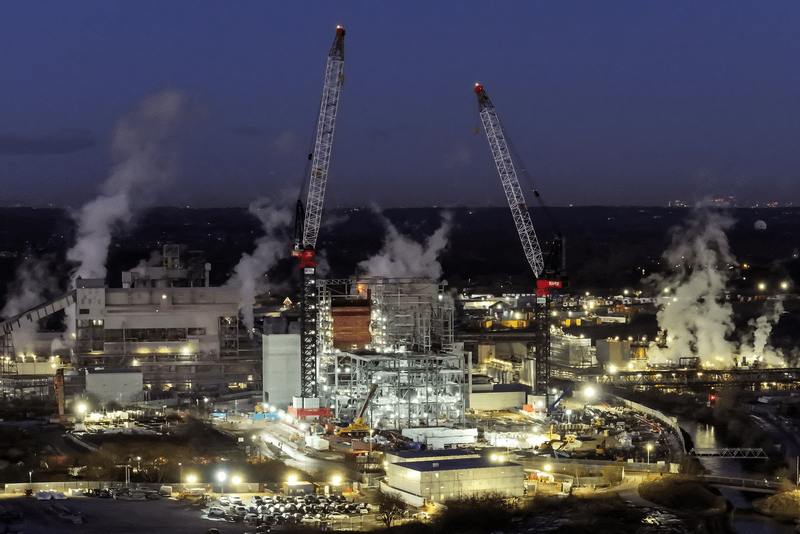

Report on green financial products aims to encourage capital flow

The UK Green Taxonomy will be an important tool to encourage capital flows into sustainable economic activities and ensure high standards for green investments.

Jean Hurley3 min read

-

KPMG Pulse of Fintech reports 17% global funding dip but AI and greentech thrive

Funding increased in the US, but fell by over half in the EMEA region.

Carmen Cracknell2 min read

-

Green gold: How big ESG data will become big business

Big data will be key to creating a more robust and reliable ESG framework.

Andy Pitts-Tucker | Apex Group4 min read

-

ESG disclosure regimes in the APAC region

Comparison table and individual country guides for ESG disclosure regimes in: Australia, Bangladesh, China, Hong Kong, India, Indonesia, Malaysia, Singapore, The Philippines, Thailand, and Vietnam.