- Compliance

- Regulation

Latest News

- Technology

Latest News

- Data

- ESG

- Resources

- All Resources

- Announcements

- Book Reviews

- Conferences and Events

- Country Guides

- GRIP Extra

- Podcasts

Topics

Latest News

-

What's next for UK data privacy in 2025?

Jean Hurley, Martina Lindberg3 min read

-

GRIP Extra: PwC reduces partners in China, Thailand liberates scam center hostages in Myanmar

GRIP2 min read

-

Stockholm FinTech Week 2025: Using AI and innovation to combat a fast-changing threat landscape

Alex Viall1 min read

-

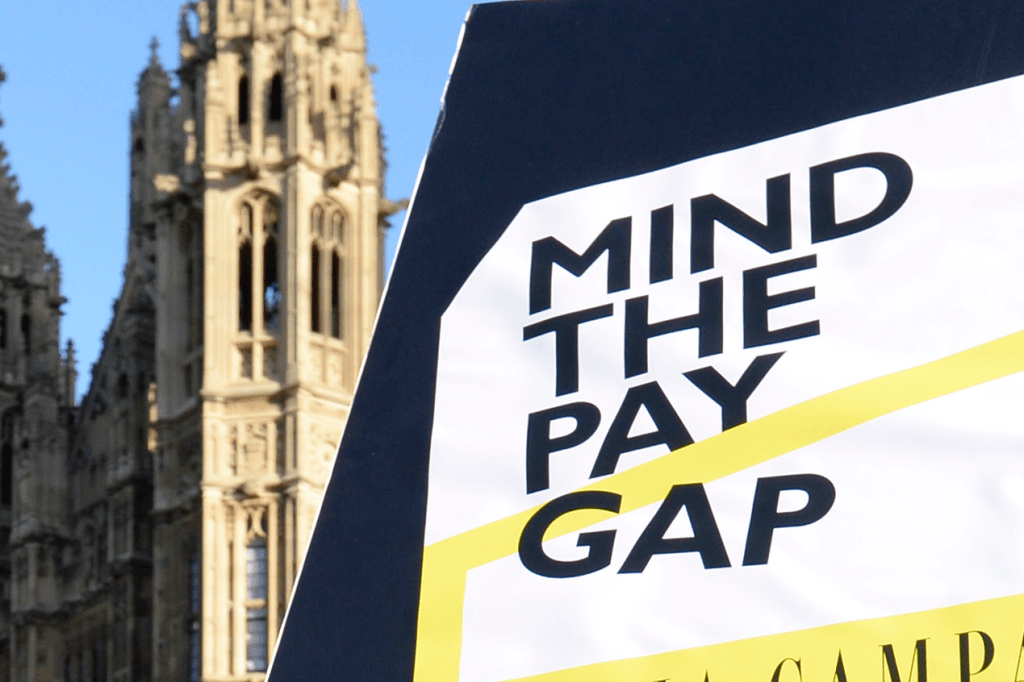

Gender pay gap down 5 percentage points across UK financial services boardrooms

Latest research from EY enables comparison of executive package trends and gender splits across UK, US and Europe.

Jean Hurley2 min read

-

PRA and FCA propose reform to ease bank remuneration rules

Assessing proposals to make the remuneration regime for banks “more effective, simple and proportionate”, while still ensuring accountability for risk taking and appropriate outcomes for consumers and markets.

Billy Bradley | CMS, Mark Walker | CMS, Connie Fan | CMS8 min read

-

Restrictions on bonuses relaxed for UK senior bankers

Top bankers will be able to access their bonuses faster as regulators relax City deferral and clawback rules.

Jean Hurley3 min read

-

The Investment Association’s new Principles of Remuneration: What’s changed?

Revised Principles are less prescriptive, allowing companies to tailor remuneration arrangements to make UK a more attractive place to list.

-

What you need to know about the revised UK Corporate Governance Code and Guidance

The main changes relate to risk management and internal controls, audit committee reporting, governance reporting, DE&I and remuneration.

Jack Shepherd | CMS, Yee Rou Quah | CMS10 min read

-

The EU gender pay gap and UK DE&I developments

Guide to the directive’s key requirements, plus comment on broader DE&I developments in Europe and US.

-

How employers should navigate the scrapping of the banker bonus cap

Now that the cap has been removed, we look at the practical implications for banks, building societies and PRA-designated investment firms.

-

Bankers’ bonus cap axed in bid to boost UK competitiveness

UK bankers can make unlimited bonuses again.

Jean Hurley2 min read