Summer in the New York financial district is traditionally a time of promise. New analysts and associates from all over the world launch promising careers, armed with optimism and the dream of success.

But just last year – summer 2023 – discouraging headlines threatened the financial community. Pandemic rebounds were interrupted by uncertainty and pessimism.

- 2023 – the year of the biggest bank failures since the Global Financial Crisis.” (Remember Silicon Valley Bank, Signature Bank and First Republic?).

- Lukewarm outlook on IPO Activity for 2024.

- US Inflation Cycle’s Damage is Worsening.

Many expected financial market layoffs to bump to high levels and new hire programs to suffer.

Fast forward to summer of 2024, and we can breathe a sigh of relief that the dominos didn’t fall. The banks stabilized, deal activity strengthened – maybe not to all-time highs, but with respectable positive trending and, fingers crossed, inflation is beginning to relax its grip.

And, like summers before, elite, new hire training programs on Wall Street and beyond are in high gear. Numerous analyst and associate candidates must pass three or four high-stakes, increasingly difficult licensing exams in a compressed period of one to two months before they can hit the desk. For some candidates, the pace is one exam per week.

Exam fundamentals

Pressure mounts as candidates digest hundreds of pages of technical and regulatory content and complete thousands of practice questions to earn their passing scores. At some firms, candidates are given just one or two attempts to pass an exam. Those that don’t pass an exam the first time face a 30-day wait before re-testing and must continue training for other aspects of their role. The pace is fast and furious, but somehow these candidates consistently come through, with many firms reporting first time pass rates of 97 – 100%.

Meticulous organization and synergy between the firm’s licensing/registration team and its training partner are essential for top-tier results. The fundamentals that drive success don’t change.

More study time isn’t always better.

Entry level candidates fresh from rigorous college studies know how to cram, and they will never have more study time than before they hit the desk. Program managers should allow a solid week for preparation, and then have them test. If candidates are permitted to wait until they are on the desk and working 12-14 hours a day, finding study time becomes challenging. Experience proves that the highest exam pass rates are achieved when candidates test seven-ten days after training begins. Candidate success diminishes as time passes.

Candidates need support, but must be held accountable.

Even with the highest caliber candidates, it’s important to remember that most are beginning the first or second full-time job of their life. If candidates are off track or falling behind, program managers can add value with proactive outreach. By asking candidates how they can help without accusing them of procrastination, program managers often help candidates turn the corner and score a pass (even though they might admit to procrastination when it’s all said and done).

Trust the process – no exceptions.

Candidates are supplied with training plans that incorporate multiple study resources and a roadmap for their use. Some may try to “go rogue”, but the likelihood that a candidate’s buddy or the internet has a better study plan is virtually zero.

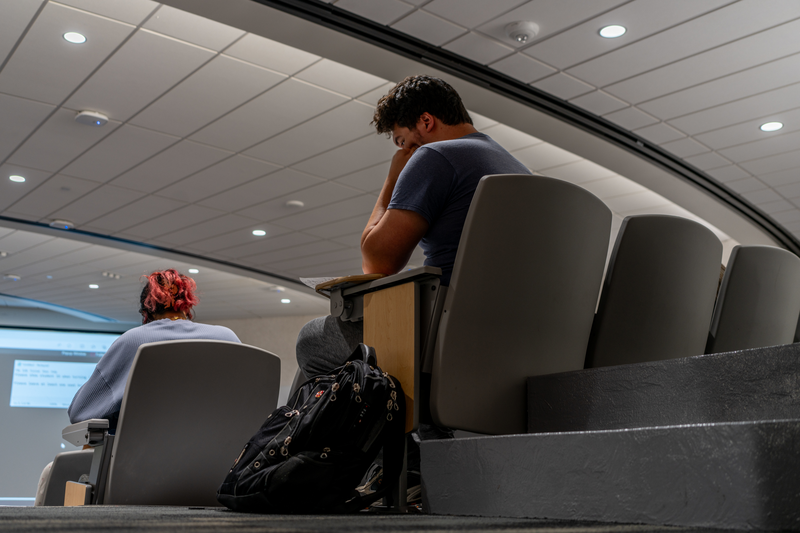

The delivery of exam prep training programs has changed dramatically in recent years. In many firms, immersive training seminars – with all new hires gathering for instructor-led training in a large auditorium – no longer exist. Today’s candidates demand a more streamlined, self-paced, and engaging experience. They increasingly study and prepare from home and expect shorter spurts of concentrated content delivery when in virtual study mode.

Candidate surveys confirm that the optimal virtual training experience relies on building virtual community and student engagement. Just teaching content is “last decade” –application of content is where faculty adds value in a live session. By bringing energy, joy, and jokes into the experience, faculty helps create the momentum for exam success and a fulfilling learning experience.

Training firms rely on curated readiness exams, with stats gathered from use by thousands of candidates, to identify individual areas of strength and weakness.

Technical content isn’t the only area of emphasis in the training sessions that have most impact. Interjecting tips for confidence, control, and high performance helps candidates develop and perfect skills that will serve them for their entire career.

The application of technology to analysis of individual candidate performance data is a program enhancement offered by the most successful training firms. Predictive analytics of individual study program performance is applied proactively to give final stage study guidance. Training firms rely on curated readiness exams, with stats gathered from use by thousands of candidates, to identify individual areas of strength and weakness. These personalized performance stats inform candidates on how to focus limited study time, instilling confidence that gives them the exam-day edge.

We all know that Industries are only as extraordinary as their people. That said, the class of 2024 gives us reason to believe. We salute the future of financial markets, the Class of 2024 candidates, and the dedicated licensing and registration teams that will ensure an outstanding launch for Wall Street’s new talent.

Marcia Larson, Faculty and Writer at Knopman Marks Financial Training. Marcia brings years of industry experience in various roles not only teaching securities series, but writing securities, insurance, CE, AML and compliance meeting content. She also has over eight years working in the industry as director of market distribution and annuities. During her free time, she enjoys playing the piano, traveling, and reading.