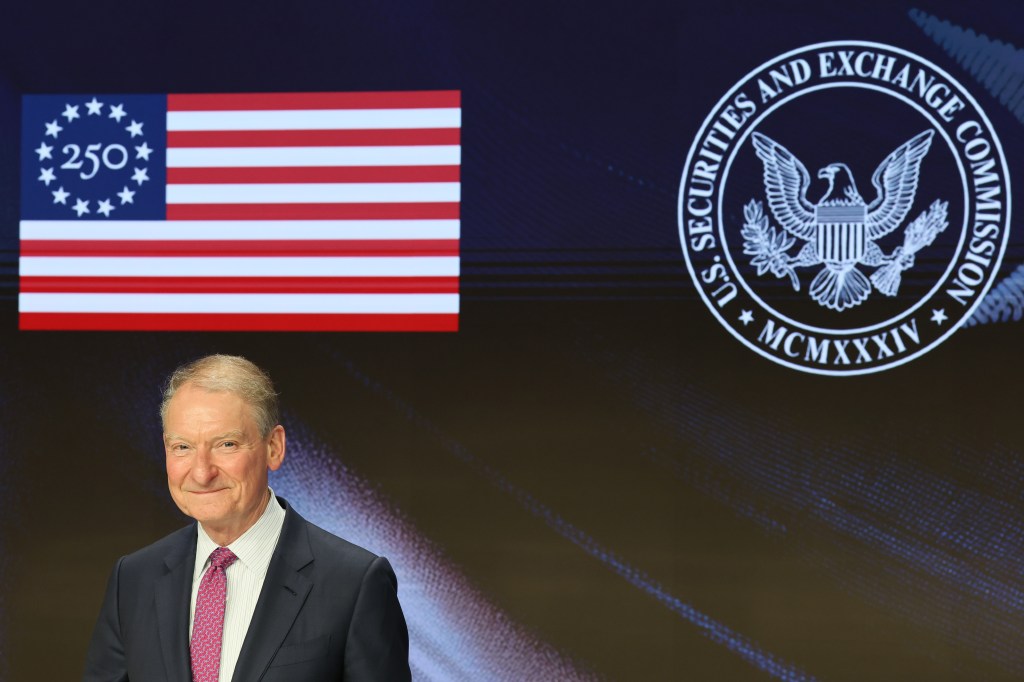

Violation of antifraud, reporting, books and records, and internal controls provisions of federal securities laws have led to accounting fraud charges against Toronto-based cannabis company Cronos Group Inc and a three-year officer and director bar for its former Chief Commercial Officer.

The US Securities and Exchange Commission (SEC) found material

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day