Last Friday, the SEC announced fraud charges against Brooge Energy Limited, a publicly-traded energy company located in the United Arab Emirates, the company’s former CEO, Nicolaas Lammert Paardenkooper, and its former Chief Strategy Officer and Interim CEO, Lina Saheb.

According to the SEC order, before and after going public through a special purpose acquisition transaction, Brooge misstated between 30% and 80% of its revenues in SEC filings related to the offer and sale of up to $500m of securities from 2018 through early 2021.

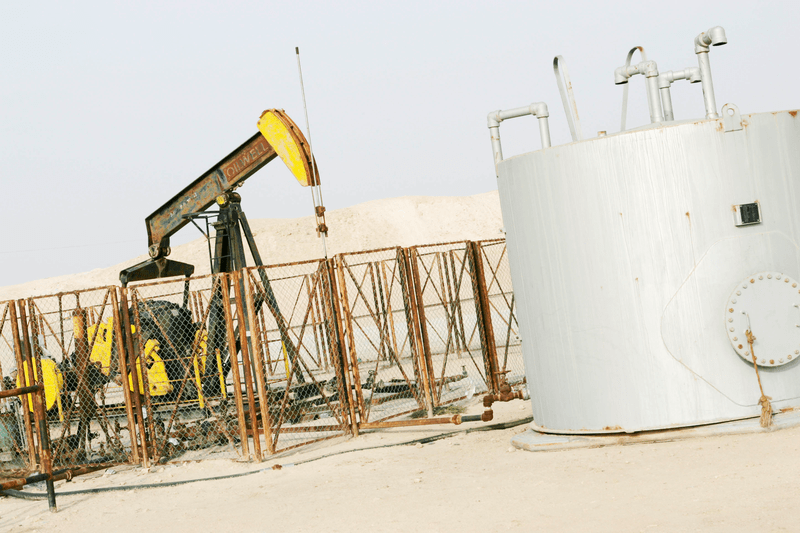

The order finds that Brooge created false invoices to support inflated revenues from its oil facilities in Fujairah, UAE by over $70m over three years, and that Paardenkooper and Saheb knew, or were reckless in not knowing, of the fraud.

The SEC order also finds that Brooge provided these false invoices to its auditors to conceal the inflated revenue. According to the order, Brooge agreed during the SEC’s investigation not to issue the $500m in securities.

In April 2023, the company announced a restatement of its audited financial statements from 2018 through 2020.

Compliance consultant ordered

In settling this action, the company agreed, at Brooge’s expense, to retain a qualified independent ethics and compliance consultant with extensive experience in developing, implementing and overseeing organizational compliance and ethics programs to conduct an ethics and compliance program assessment. The expert must focus on Brooge’s internal accounting controls and financial reporting, plus analyze its ethics and compliance program as it relates to the areas described in the order.

Brooge agreed to settle the SEC’s charges that found the company violated the antifraud, proxy statement, reporting, and books and records provisions of the federal securities laws and to pay a $5m penalty.

Paardenkooper and Saheb also agreed to settle the charges, to pay $100,000 each in civil penalties, and to accept permanent officer and director bars.