The UK remains a global leader in the fintech space despite a big year-on-year drop in investment, the new Pulse of Fintech H2’22 report from KPMG shows. Higher interest rates, inflation and dampened investor appetite are the most likely causes of the fall.

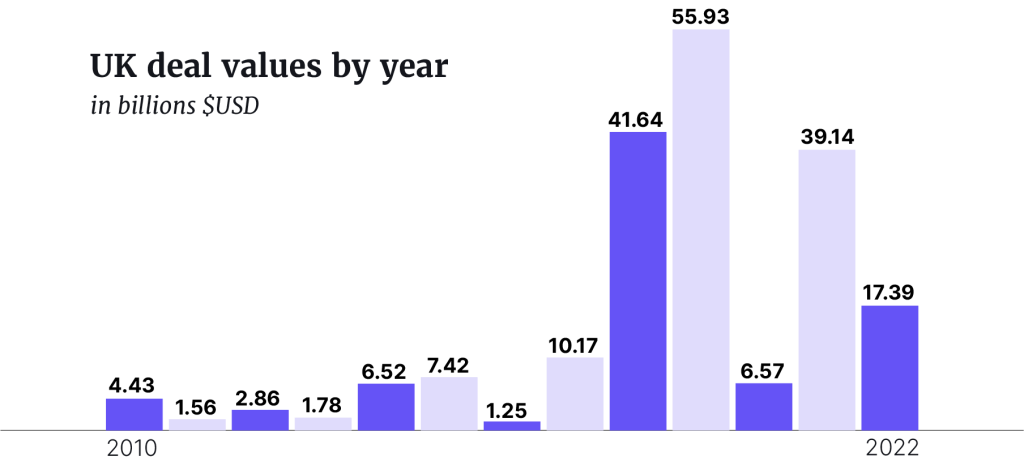

Investment in the UK fintech sector peaked in 2019 at $55.93bn, following a drop to $6.56bn in 2020. The figure rose to $39.14bn in 2021 but has now fallen to $17.39bn.

But Karim Haji, UK and EMA head of financial services at KPMG, reckons the UK fintech industry still had a strong year. “The UK is a major global player, with investment in UK fintech only behind that of the US and Australia,” he says.

“Globally, interest in fintech remained quite robust in many regions of the world during 2022, despite the drop in deal value associated with investors pulling back from later stage deals given macroeconomic factors and concerns about valuations.”

Judd Caplain, Global Head of Financial Services, KPMG International

A total of 593 UK mergers and acquisitions (M&A), private equity (PE) and venture capital (VE) deals were completed in the UK in 2022, down from 724 deals in 2021. Still, the UK remains the centre of European fintech investment, with British fintechs attracting more funding than the rest of the EMEA combined.

Regtech up

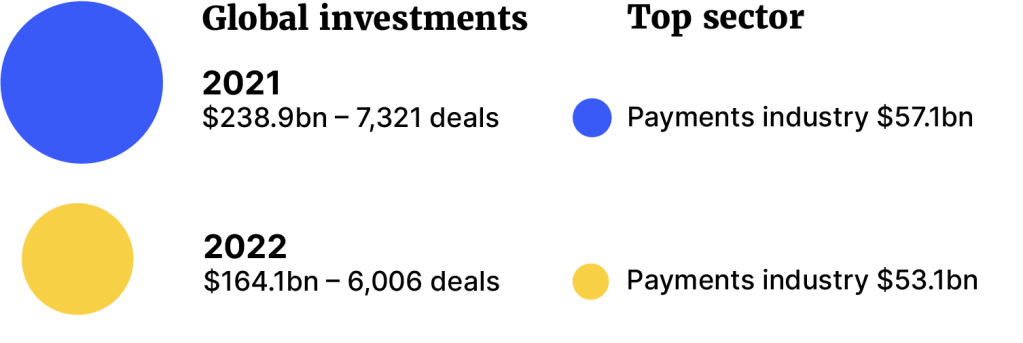

Globally, fintech investment dropped to $164.1bn across 6,006 deals in 2022 – from a record high $238.9bn across 7,321 deals in 2021. The payments sector remained the most popular with $53.1bn in investment compared to $57.1bn in 2021.

Regtech was the only sector that went against the downward trend – investment rose from $11.8bn in 2021 to $18.6bn in 2022. The year’s second biggest deal was also within regtech, with Vista Equity Partners’ buyout of Avalara for $8.4bn.

“Globally, interest in fintech remained quite robust in many regions of the world during 2022, despite the drop in deal value associated with investors pulling back from later stage deals given macroeconomic factors and concerns about valuations,” says Judd Caplain, Global Head of Financial Services KPMG International. “On the positive side, we saw surging interest in seed and early-stage deals – which bodes well for the fintech ecosystem and deals pipeline long-term. While fintech investment is likely to remain soft in the first half of the year, there’s little doubt that investors remain optimistic about many of the subsectors of fintech.”

Leeds and London

Two of the 2022’s biggest fintech deals took place in the UK, in Leeds and London. However Australia took the number 1 spot with a $27.9bn deal.

- Afterpay – $27.9bn, Melbourne, Australia – Payments – M&A

- Avalara – $8.4bn, Seattle, US – Regtech – Public-to-private buyout

- Sia (Milan) – $3.9bn, Milan, Italy – Payments – M&A

- Bottomline Technologies – $2.6bn, Portsmouth, US – Institutional/B2B – Public-to-private buyout

- Tink – $2.1bn, Stockholm, Sweden – Institutional/B2B – M&A

- Yayoi – $2.1bn, Tokyo, Japan – Institutional/B2B – Corporate divestiture

- Interactive Investor – $1.8bn, Leeds, UK – Wealth/investment management – M&A

- Billtrust – $1.7bn, Lawrenceville, US – Payments – Public-to-private buyout

- Computer Services – $1.6bn, Paducah, US – Institutional/B2B – Public-to-private buyout

- FNZ – $1.4bn, London, UK – Wealth/investment management – PE growth

Gaming and risk assessments

Investment in crypto and blockchain fell from $30bn in 2021 to $23.1bn in 2022 – all in the wake of the Terra (Luna) crash in May, and the bankruptcy of FTX in November. Commenting on what future investments might bring on crypto and blockchain, Kenji Hoki, Director, Financial Services KPMG Japan, said: “The non-financial sector will be a key player in 2023 when it comes to digital assets and tokenization because, unlike the financial sector which is highly regulated on what they can do, they have a free hand to choose the token business to operate. So, gaming companies, telecoms and others will likely lead the crypto space next year – focused on offerings like NFTs, DAOs and the like.”

“We’re going to see VC investors doing a lot more comprehensive due diligence on C5 platforms — especially risk management framework and related-party arrangements.”

Alexandre Stachtchenko, Director Blockchain & Crypto assets, KPMG in France

With the latest crypto fall in mind, the Director Blockchain & Crypto assets KPMG in France, Alexandre Stachtchenko, believes that customers and investors will be more careful before investing in the future, assessing risks more thoroughly.

“Following on what happened with FTX, we’re going to see VC investors doing a lot more comprehensive due diligence on C5 platforms – especially risk management framework and related-party arrangements. They’re also going to be going through their existing portfolio companies to conduct risk assessments to identify any deficiencies or any vulnerabilities for bank-style runs. And they will also try and attain a level of control at the board level of these companies to ensure that appropriate governance procedures are undertaken and that decisions are made with suitable due process,” Stachtchenko says.

ESG and SME focus

Another trend expected is a shift in investor attention from blockchain companies with retail market focus to startups that focus on providing solutions for the SME market. The report also notes increasing attention on the provision of SME-focused decentralized finance (DeFi) solutions, including solutions focused on SME loan financing or trade financing.

Regtech growth is predicted to continue in the first half of 2023, as are AI-driven fintech solutions. The report also believes we’ll see an increasing investment focus on climate change. However, M&A deal sizes look likely to decrease.

Read the Pulse of Fintech H2’22 report in full here.