RedCompass surveyed 300 senior payment professionals at US banks to find out if they were meeting the demands of corporate customers and whether legacy systems were holding banks back.

There is significant demand from corporate customers, with 63.6% of corporate bankers observing demand compared to 51.9% of retail bankers.

But despite the demand, fewer than a third of US banks are signed up for real time payments (RTP) and FedNow, partly due to the need for banks to overhaul their legacy systems and partly to the need to balance impacts on existing revenue streams.

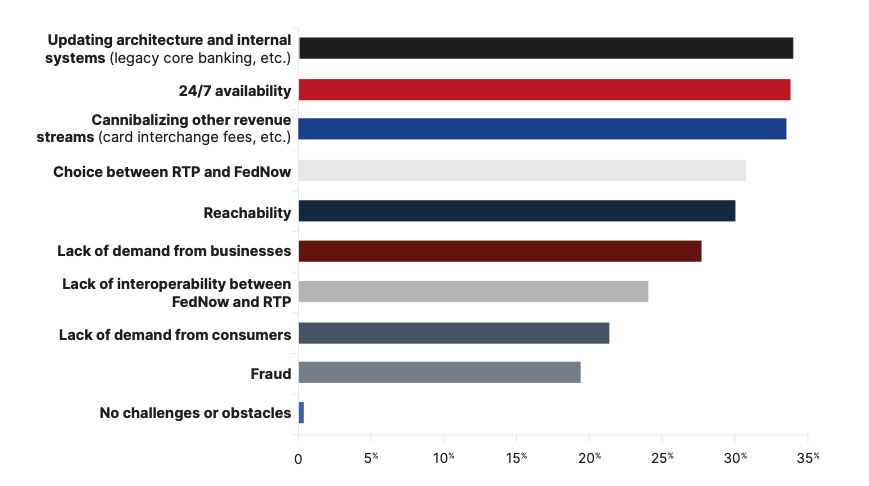

Respondents listed the following challenges to implementing RTP:

Lagging globally

Instant payments have transformed transactions in countries such as India, where the United Payments Interface (UPI) scheme has been critical for the country’s financial inclusion efforts and helping people escape poverty.

India, Brazil, and Thailand had the highest number of RTP transactions, according to Statista data, with year-on-year changes of 45%, 78%, and 38% respectively.

“Adoption has been slow compared to the rest of the world. Legacy systems ill-equipped for 24/7 availability, competition from card revenues and FinTechs, and the choice between the two schemes, have given banks plenty of reasons not to modernize.”

Tom Hewson, Partner and CEO, RedCompass Labs

Referencing steps taken in the UK, the report says: “Eye watering levels of authorized-push-payment scams have forced regulators to introduce Confirmation of Payee services across the pond, to notable success. The Netherlands saw an 81% reduction in scams after prompting payers to think twice before sending an irrevocable instant payment to a payee whose details do not match their account information, the report says.

Since launching in 2020, over 100 organisations have already implemented Confirmation of Payee, with more than 1.9 million checks being completed every day. Despite this, APP fraud losses in the UK totalled £459.7m ($582.7m) in 2023.

“Adoption has been slow compared to the rest of the world. Legacy systems ill-equipped for 24/7 availability, competition from card revenues and FinTechs, and the choice between the two schemes, have given banks plenty of reasons not to modernize,” said Tom Hewson, Partner and CEO, RedCompass Labs.

“To remain competitive, banks must overcome these challenges, find the business cases that work, and leave legacy behind.”

ISO 20022

The US will have to adopt the global standardized format for payments data, ISO 20022, which is already in use in over 70 countries.

It covers payments, securities, trade services, cards, and foreign exchange trading. Financial institutions are in various stages of migrating to ISO 20022. There are also mechanisms in place to allow coexistence with legacy systems, ensuring a smooth transition.

ISO 20022 messages are rich in data, which allows for better compliance, risk management, and innovation. The comprehensive data included in these messages supports enhanced processing and analytics capabilities.

Fraud prevention

Digital identification solutions are becoming increasingly important for banks as they battle against the huge threat of fraud.

By implementing robust authentication protocols, such as biometric scans or multi-factor authentication, banks can significantly reduce the risk of identity theft, fraud, and unauthorized access to sensitive financial information.

This not only protects customers from potential security breaches but also safeguards the bank’s reputation and credibility in the eyes of regulators and the public.