The 2023 Geography of Cryptocurrency Report unearths key trends and data from different geographical regions. The latest report is the fourth to be issued by US blockchain analysis firm Chainalysis, and it ranks data from 155 countries based on five sub-indexes;

- on-chain cryptocurrency value received at centralized exchanges, weighted by purchasing power parity (PPP) per capita;

- on-chain retail value received at centralized exchanges, weighted by PPP per capita;

- peer-to-peer (P2P) exchange trade volume, weighted by PPP per capita and number of internet users;

- on-chain cryptocurrency value received from DeFi protocols, weighted by PPP per capita;

- on-chain retail value received from DeFi protocols, weighted by PPP per capita.

US stablecoin regulation

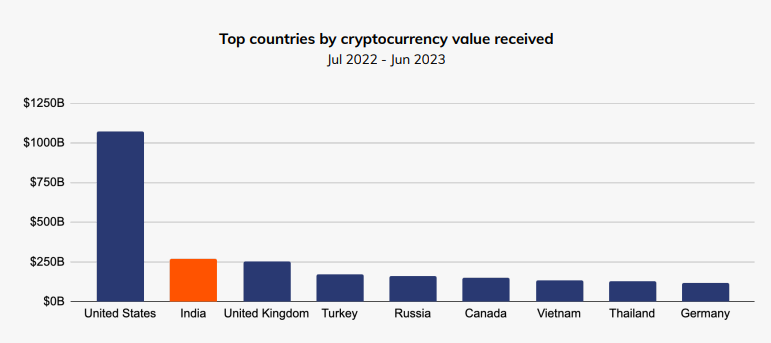

North America accounts for 24.4% of crypto transactions worldwide, valued at an estimated total of $1.2 trillion, despite regulatory uncertainty. Chainalysis found that more than half of all on-chain transactions between 2022-2023 took place in stablecoins, and more than 90% of stablecoin activity is pegged to the US dollar. But more and more stablecoin activity (currently around 60%) is occurring through entities not licensed in the US.

US regulatory oversight of stablecoin activity could limit their use in pernicious forms of crime that affect national security. “Stablecoin regulation also gives regulators a chance to help ensure that the US is home to the cryptocurrency businesses that will play a big role in expanding how the US dollar is used globally as the digital economy continues to grow. However, data suggests that more and more stablecoin activity is occurring through entities that aren’t licensed in the United States,” the report says.

But so far, only two proposed bills have been put forward. These are the Clarity for Payment Stablecoins Act (July 2023) and the Responsible Finance Innovation Act (reintroduced in July 2023).

Since early 2023, the majority of stablecoin inflows to the 50 biggest crypto services have reportedly shifted from US-licensed services to non-US-licensed services, undoing a shift in the opposite direction that occurred over the course of late 2022 and early 2023. A 54.6% share of stablecoin inflows to the top 50 services are now going to non-US-licensed exchanges.

“There continue to be important debates around the regulation of stablecoins, such as the appropriate role of state regulators in registering and supervising stablecoin issuers. These debates are resolvable and should be solved soon in the interest of global competition and necessary regulation,” Jason Somensatto, Head of North America Public Policy at Chainalysis, says.

Asia rising

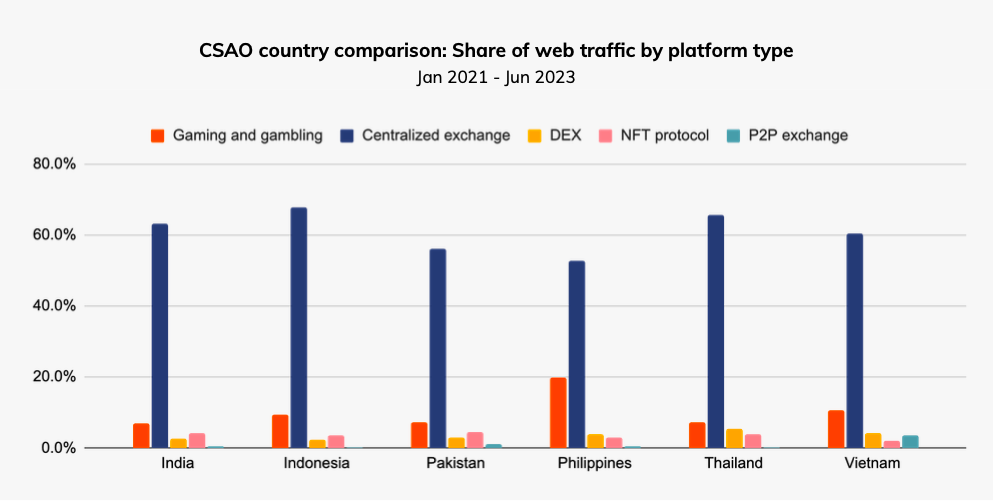

Adoption in Central and Southern Asia and Oceania (CSAO) is particularly strong, notably in India, Vietnam, the Philippines, Indonesia, Pakistan, Thailand, and Bangladesh. Most of these countries fall within the lower middle income level in terms of gross national income (GNI) per capita.

Although transaction volume is slightly larger in North America and Europe, Chainalysis says: “Raw transaction volume doesn’t tell the full story. When we account for purchasing power and population to measure grassroots adoption, CSAO dominates. Crucially though, CSAO is not a monolith when it comes to cryptocurrency adoption. Different factors are driving adoption in different CSAO countries, which leads to different rates of usage for different types of cryptocurrency services.”

Axie Infinity, a videogame-based NFT, kicked off crypto adoption in the Philippines. “I think Axie Infinity was the moment crypto really arrived in the Philippines,” says marketing expert Donald Lim. While the game was most popular amongst the younger generation, Lim saw people from all walks of life playing. “You’d get into a pedicab and see that the driver had his phone mounted at the top of the windshield playing Axie — there were so many stories like that.”

In Pakistan, high inflation and currency devaluation rather than gaming and speculation have been the drivers of crypto adoption.

“Five years ago, Pakistan’s inflation was 10.6%. Right now, it’s officially reported as 29.4%, but in reality much higher. The equities market and stock exchange have tanked. And any gains you achieve can be wiped out by inflation,” Zeeshan Ahmed, Country General Manager, Rain exchange, said. “It’s the only option we have to hedge.”

Pakistani citizens are barred from holding physical foreign currency; it has to be deposited in a bank. For many, this makes crypto, and in particular stablecoins, a necessity. Much of the activity in Pakistan is also off-chain, meaning transaction volume could in reality be much higher.