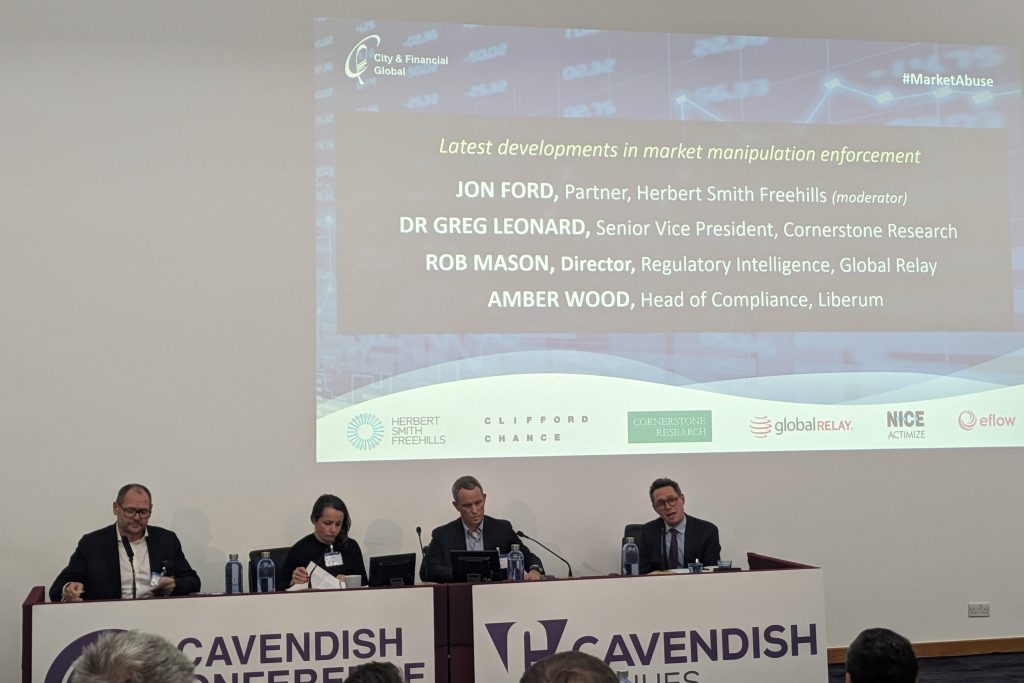

The panel was moderated by Jon Ford, partner, Herbert Smith Freehills with panellists:

- Dr Greg Leonard, senior vice president, Cornerstone Research;

- Amber Wood, head of compliance, Liberum;

- and Rob Mason, director, regulatory intelligence, Global Relay.

The discussion covered important market manipulation cases, recent FCA Market Watches 76 and 77, market surveillance techniques and questions from the audience on how the panel perceive the effectiveness of the FCA’s enforcement powers.

Trends in market manipulation cases

The panel’s view was that there have not been many published market manipulation decisions but there could be more publicity going forward if changes to the FCA’s enforcement publicity go ahead.

The last 10 years has seen cases around “conduct and spoofing”. Leonard said the focus has shifted away from analysis of communications and documents to more data analytics. He said the first case to use big data to prove market manipulation was Coscia.

In November 2015, New Jersey trader Michael Coscia became the first person to be convicted of “spoofing”, a form of market manipulation, under the 2011 Dodd-Frank Act. Spoofing involves placing bids to buy, or offers to sell, futures contracts with the intent to cancel them before execution. By creating an illusion of demand, spoofers can influence prices to benefit their market positions. Coscia was accused of using computer algorithms to quickly place large orders that he never intended to execute into markets on exchanges based in the US and UK in 2011.

The last enforcement decision was published by the FCA at end of 2022, Ford says. It was related to three bond traders who were spoofing/layering in relation to the bond futures market. He noted that there were not that many communications references in the decision notice.

“There is absolutely no recipe to distinguish legitimate conduct from illegitimate conduct, but intent is really a very important part of it.”

Dr Greg Leonard, senior vice president, Cornerstone Research

Mason described the case as a classic spoofing and layering case in breach of Art 15 of MAR, with a fine of £395,000 ($506,000) for one of the traders, and £100,00 ($128,000) each for the other two. The defendants said that they had been pressured by management to get more of their activity executed. They claimed their spoof orders were valid and authentic, potentially to hedge their broader portfolio should they have traded.

Mason noted the final notice was quite damning. “I take your point about data but they were sat next to each other and perhaps had there been recorded communication then the demonstration of intent would have left them with little hope, as it stands they are taking it to Tribunal of Appeal”, said Mason.

There is often a debate about what constitutes a legitimate trading technique and when someone is trying to be manipulative. Leonard said that it is ultimately a question of intent. There is “absolutely no recipe to distinguish legitimate conduct from illegitimate conduct, but intent is really a very important part of it.”

Market Watch 76 ‘printing’ and ‘flying’

Mason explained that flying is where a firm, most often a broker, convinces clients it has offers which aren’t true in order to generate some brokerage. When a trader then gets caught on one of those fictitious trades in the comms, Mason noted, you may see something associated with this such as, “I’m in trouble! Somebody help!”. This has been picked up by some of his clients when monitoring trades.

“The FCA clearly thinks this is a prevailing risk and it’s been highlighted in two Market Watches”, said Mason. He also added that Jamie Bell, the FCA’s head of secondary market oversight, reiterated this point at a recent event, “there’s too much of it and we don’t like it. And we’ll probably see something coming down the enforcement pipeline”.

(For further analysis on Market Watch 76 on GRIP see FCA says that misleading market communication practices persist and a review of Jamie Bell’s fireside chat on GRIP see Pragmatic and enabling: FCA’s Jamie Bell explains role regulator wants to play.)

Market surveillance techniques and management

The panel considered surveillance techniques and management oversight in the light of the FCA enforcement of BGC Brokers LP, GFI Brokers Limited and GFI Securities Limited (together, BGC/GFI) who were fined £4,775,200 ($6,114,000) for failing to ensure they had appropriate systems and controls in place to effectively detect market abuse.

Mason explained BGC/GFI had manual, automatic and communications surveillance processes that were deficient, and therefore, inadequate in properly addressing the risk of market abuse. Additionally, BGC/GFI’s systems for monitoring market abuse did not have proper coverage of all asset classes which are subject to MAR.

Mason said that monitoring voice for market abuse is now seen as a standard requirement where “significant market abuse may prevail”. He acknowledged that high frequency trading requires much less communication in the vast majority of cases “unless something goes wrong”. FX and Fixed Income products have much more interaction and complexity mean controls need to be applied. Managing communication is clearly a focus for that.

“We don’t live in a sufficiently resourced society to be able to follow up on every single instance of poor behavior … So some monetary value is likely to be attached.”

Rob Mason, director, regulatory intelligence, Global Relay

With the demands from the SEC around record keeping and recent enforcement cases, firms have been encouraged to have a suite of policies in place, including data governance, data collection, data delivery, and which channels should be in scope for monitoring. “You need flexible technology to capture all of those things”, said Mason.

Leonard said “there’s a challenge when you think of complex market manipulation investigations – how can surveillance systems be designed to create the right alerts, the right number of alerts that can actually be reviewed and processed, and still have that layer on top of it so you can conduct a detailed investigation and evaluate the conduct?”

He added that there is an interesting discussion on whether AI can improve surveillance monitoring and filtering the responses. However, “from experience, probably a long way off for AI to tackle complexity of those cases in detail”.

Wood considered senior management and oversight in BGC decision notices. She suggested that the failure lay with senior management, and that they were either given the wrong management information or got the correct management information but didn’t do anything about it. SMCR bestows on senior managers an obligation to take reasonable steps to ensure there are suitable systems and controls in place.

“If you’re a senior manager you have an obligation to challenge and say you did take reasonable steps. You need to do what you’re supposed to”, she said.

Questions from the audience

In relation to Market Watch 77 on organized crime, is the FCA shaping up to use further interventions in relation to market abuse?

Wood said Market Watch 77 is designed to make anyone who is thinking of engaging in criminal activities or behavior think twice. The FCA is not shy to act in relation to what it set out in its publications and it has a range of tools, both civil and criminal, to enforceme its powers. Firms should look at the detail of final notices for insight into the behavior that that caused the problems that caused the FCA concern. Firms should use that guidance to better train and surveil staff so firms can robustly defend their compliance strategies to FCA if they come under scrutiny.

Mason agreed and said that credible deterrence is fundamental to the FCA’s enforcement strategy. There is limited value in bringing numerous cases around opportunistic insider dealing. However, by thematically sending the message the FCA is making sure that even if you’re operating in different segments of the market or across different asset classes, you’re still receiving the same FCA warning shot.

“Different groups and sectors need to recognise they are subject to these regulations and they need to be adhering to, applying appropriately and understand that the consequences will be significant if that doesn’t happen”, said Mason.

He said remediation is more expensive than solving the problem. Adding up the trading loss, enforcement fine and legal bill will cost more than providing tools to resolve the compliance problem. “That’s a key weapon in the regulator’s enforcement strategy”, said Mason.

Leonard explained that enforcement notices are informative when they are specific enough to “inform and help other traders guide their actions in what is in quite a grey area of what is and what isn’t acceptable.”

(For further analysis on Market Watch 77 on GRIP see Organised crime active in equity markets according to the FCA.)

Do you have a view or gut sense of how much goes undetected or otherwise avoids successful enforcement? What is it about those cases that allows them to fly under the radar or avoid successful prosecution?

Mason, leaning on his experience as a regulator at the FCA said, “Much as we might not see an enforcement sanction come out as a public message, that doesn’t necessarily mean it’s been undetected. The FCA does a lot of work around the policing of the market that never gets public or shown publicly but, nevertheless, it is corrective action that probably makes up a significant proportion of their enforcement activity.”

Photo: Global Relay

“It’s really tough to say how much stuff goes undetected, there will be some risk-based rationale around that and we don’t live in a sufficiently resourced society to be able to follow up on every single instance of poor behavior, poor conduct or market abuse. So some monetary value is likely to be attached to that in order to justifiably chase after the miscreant on occasion, which is difficult but the FCA goes through, in particular, (I’m sure other regulators do to) a very rigorous process to prioritize the cases it brings.”

“It’s not random and it’s not done likely. But it’s interesting to see the changing of the guard. The incoming co-heads have been clear to put their own stamp on it, streamlining and bringing more cases to courts has to be a positive for the industry.”

“If you’re a senior manager you have an obligation to challenge and say you did take reasonable steps. You need to do what you’re supposed to.”

Amber Wood, head of compliance, Liberum

It is difficult to distinguish between abusive behavior and genuine decision making. There are more cases around systems and controls than market manipulation itself. Genuine and abusive behavior can look so similar. When Market Watch 76 on ‘flying and printing’ came out, a lot of participants in the industry said ‘but this is what we do all of the time – is it abusive?‘

Wood said the obligation to submit a STOR is on a reasonable suspicion and not on absolute proof. She explained that it is always a judgement call on whether you’re over-reporting and firms go through an agonizing process as to whether or not they have reached that hurdle. But it’s not for firms to have that absolute proof that market manipulation has occurred, that’s the role of the regulator to look at the information that has been submitted.

The general theme from the FCA is that firms should be doing more and can be doing more and that’s the purpose of Market Watches 48, 57 and 76. “Manipulation is often across product, across broker, and when you’re executing you don’t always get to see all of the trades that go on with third parties. I think that does present more of a challenge as it’s often not very simple.”

The FCA needs information across assets from all broker dealers to see “reasonable suspicion in a way in which firms in isolation don’t”, she said.

Mason agreed, noting that all of the stakeholders “are tooling up”. He added that the regulators had earlier in the conference day said that, “they were investing in technology themselves to help seek to identify risk and abuse. All the firms here would say they have an investment budget to invest in technology which is seen as the silver bullet. The challenge is we’re chasing hard and trying to keep up and we are getting better equipped and narrowing the gap. Not everyone is statically saying we can’t do it because it’s too difficult.”

In Market Watch 76, there’s a paragraph on senior management not dealing [with such infractions] in an appropriate and robust way. This is sending a warning shot across the bows of those senior managers. We’re well into SMCR and we know there haven’t been very many outcomes at all. Why is the FCA saying this? Flying and tipping is nothing new.

Wood said Market Watches are an education process, “saying ‘we’ve done this all of the time, it’s fine’, might have been fine at the time but now it is absolutely not!” There have been a number of FCA publications which have made this clear. She suggests that it “comes down to the management information which is given to senior mangers. The challenge to them is not turning a blind eye to certain behaviors because they are creating financial gains for the firm.”

In fact, she noted that seeing financial gains in an area where generally market activity is fairly low should lead to the questions, “How is this being done? Are our practices appropriate given regulatory environment we’re working on?” And, she said, there is a continuous challenge for compliance to educate management.