FINRA has imposed a $500,000 fine against Florida-based broker-dealer Dawson James Securities and suspended its CEO for one month. The action comes after a failure to preserve and review over 10,900 business-related text messages sent or received by at least 27 associated persons.

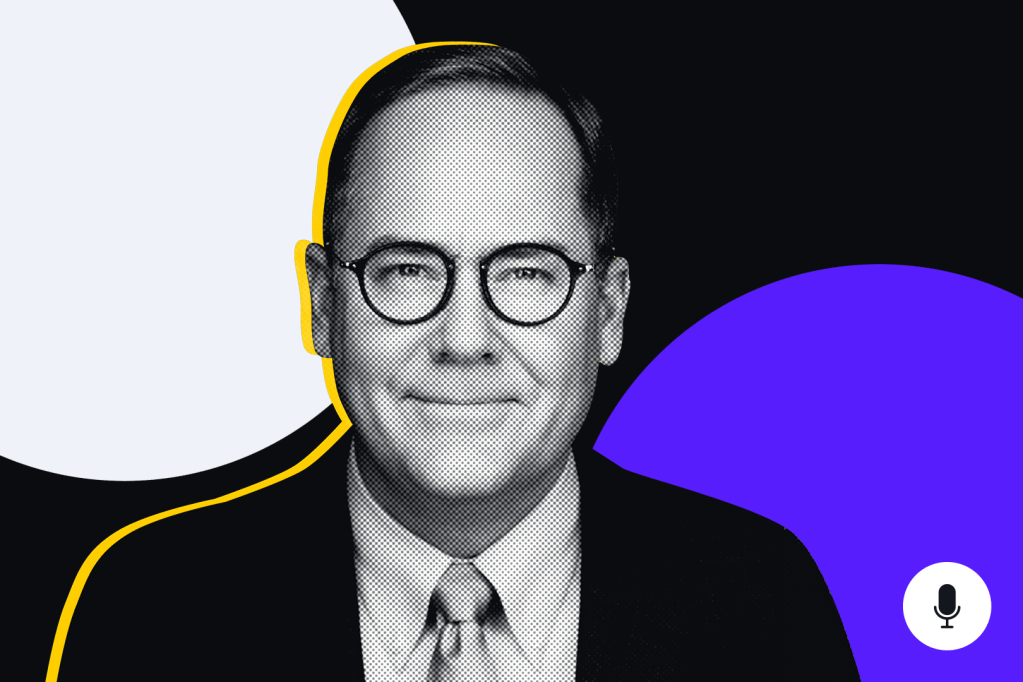

The CEO, Robert Dawson Keyser Jr, an industry participant since

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day