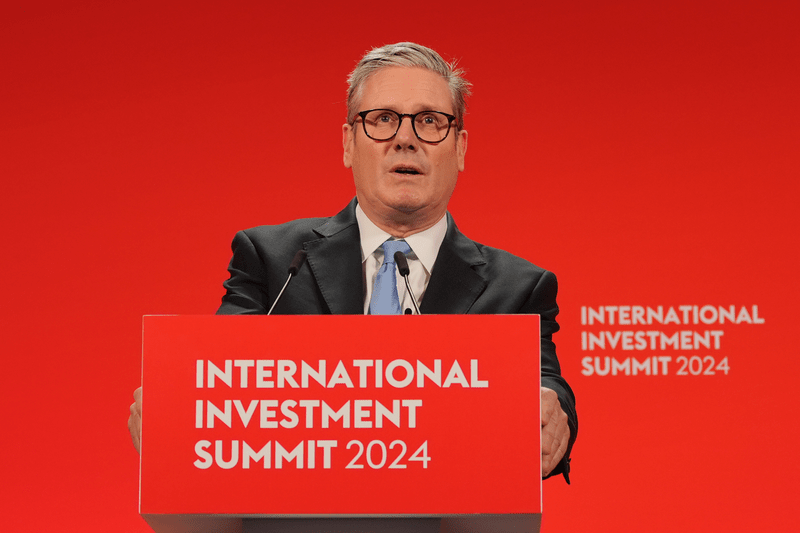

The UK government has promised to put an end to regulatory practices that are “needlessly holding back investment” in the country. Prime Minister Keir Starmer told an International Investment Summit in London on Monday he would pave the way for foreign investors to come and invest in Britain by “ripping

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day