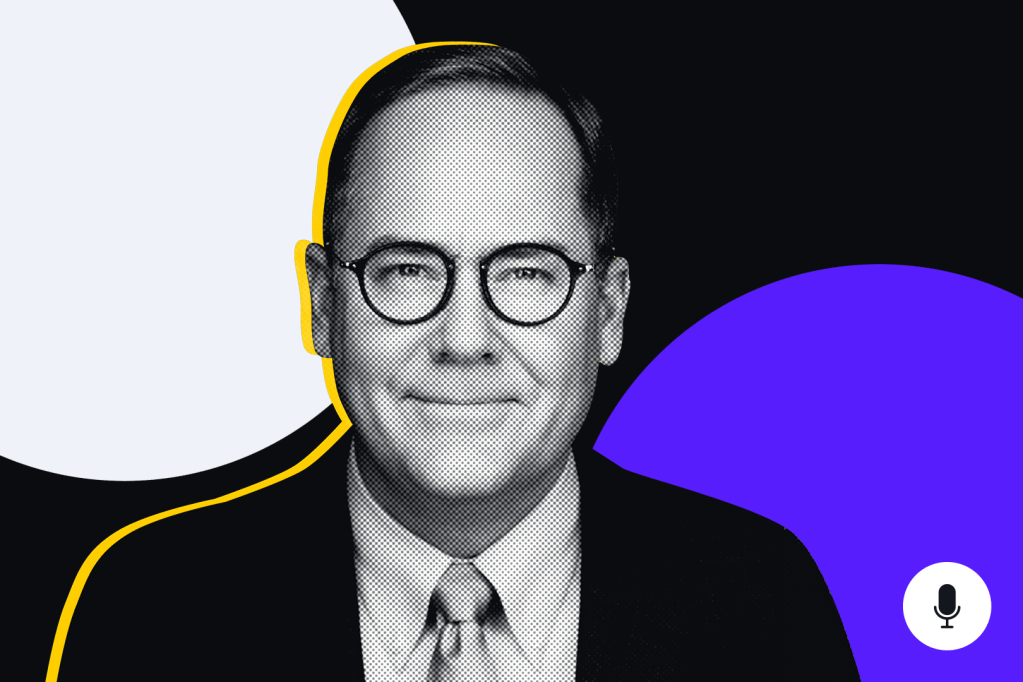

Kenneth Polite, Assistant Attorney General of the Department of Justice’s Criminal Division, was the subject of a well-deserved spotlight article in the WSJ this week – one that described his tenure at the helm of the criminal division, leading investigations into gang activity, cybercrime, and white-collar crimes such as

The

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day