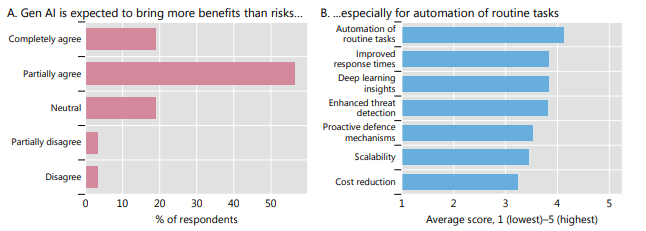

The Bank for International Settlements (BIS) says the financial sector is among the most exposed to the benefits but also to the risks of AI. Benefits include improvements for lending and payments, while risks include more sophisticated cyber attacks, herding, runs, and fire sales.

The BIS Annual Economic Report 2024 summarized economic progress around the world, factoring in recent events with long-lasting impacts such as the COVID-19 pandemic and Russia’s invasion of Ukraine. Inflation, synchronised monetary policy tightening, and post-pandemic recovery were all listed as concerns.

The increased importance of data as a cornerstone of the AI revolution has accelerated the need for central banks to adopt AI and large language model (LLM) technologies.

Data has become an even more valuable resource with the advent of AI and will be the cornerstone of central banks’ use of the technology.

Nowcasting

A major central bank use case for AI is nowcasting, a technique that uses real-time data to better predict inflation and other economic variables and to sift through data for financial system vulnerabilities, allowing authorities to better manage risks.

Nowcasting models could benefit from deep neural networks’ embeddings and their ability to quickly convert unstructured data into a structured format.

Thanks to data embeddings, LLMs have the ability to process vast amounts of text- or image-based data, and they can create readily available data series from, for example, news reports, social media postings, web searches or aerial images, such as of car traffic in retailers’ parking lots.

Graphic: BIS

“New generation AI models have captured our collective imagination through their uncanny abilities, but they also have a direct bearing on how central banks do their jobs,” Hyun Song Shin, Head of Research and Economic Adviser, BIS, said.

“Vast amounts of data could provide us with faster and richer information to detect patterns and latent risks in the economy and financial system. All this could help central banks predict and steer the economy better.”

Fiscal consolidation is crucial to relieve inflation pressure and maintain financial stability. Governments need to scale back discretionary measures, prioritize growth-enhancing spending, and strengthen revenue mobilization through tax reforms.

But stronger prudential regulation has helped, the BIS says. Banks are now much better capitalised than before the Great Financial Crisis due to these tighter regulations.

There remains room for improvement in the regulation of non-bank financial institutions (NBFI) such as insurance firms.

The standard way to limit moral hazard is by ensuring that risks are adequately priced and borne by market participants, the BIS says, especially through regulation. This has proved especially hard in the NBFI sector, in some forms of asset management and private credit, where hidden leverage and liquidity mismatches are prevalent.

Exacerbating inequality

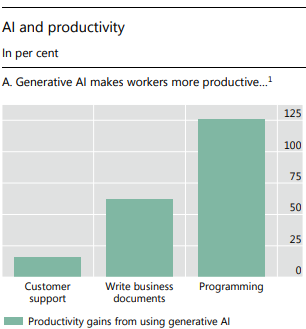

While AI may well create altogether new tasks, the extent of this will differ across occupations.

Displacement might eliminate jobs faster than the economy can create new ones, potentially exacerbating income inequality, the BIS says. A differential impact of benefits across job categories would strengthen this effect.

The “digital divide” could widen, with individuals lacking access to technology or with low digital literacy being further marginalized.

The report references the economist Daron Acemoglu, who argues that AI advances may generate only a modest boost to total factor productivity, just 0.5–0.7% over 10 years, while increasing inequality and widening the gap between capital and labour incomes.