What is enabling some companies to reap the full rewards of adopting artificial intelligence in their operations? A new report by the Boston Consulting Group (BCG) has looked at examples of AI successfully adding value – with leading examples showing higher revenue growth and higher shareholder returns.

Where is the Value in AI? also looks into “where others fall short, where the value is coming from, how individual sectors are performing, and how companies can change their own AI trajectories.”

The report gathered data from 59 countries in Asia, Europe, and North America and from more than 1,000 companies in 10 industries: consumer goods, energy, financial services, health care, industrial goods, insurance, public sector, technology, media, and telecommunications.

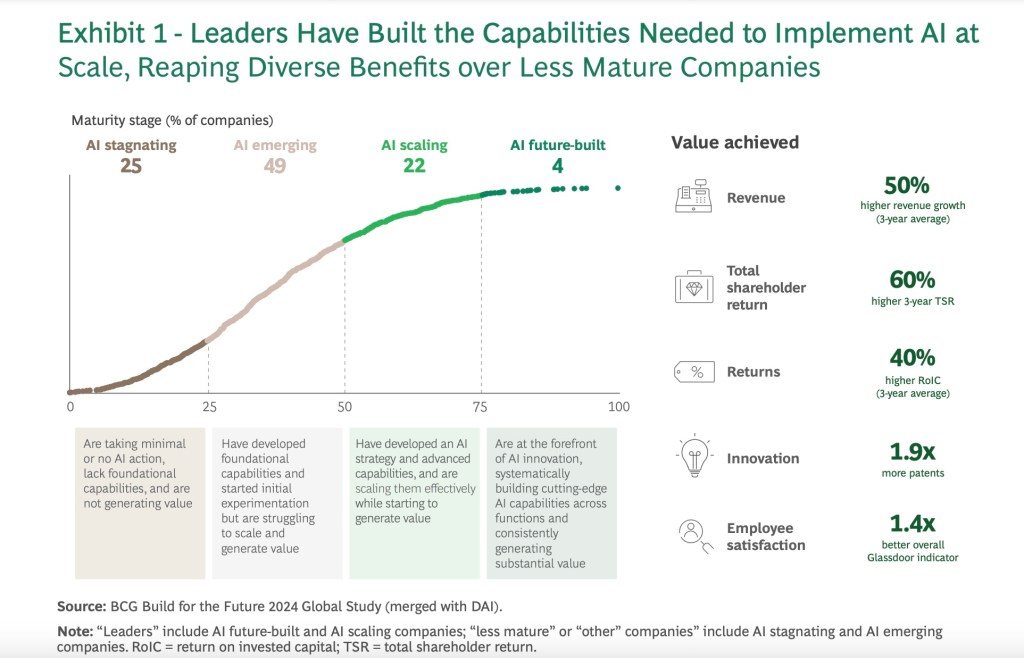

The key finding is that the process of AI adoption and utilisation is still a “steep curve.” Of the companies surveyed, “only 4% have developed cutting-edge AI capabilities across functions and are using them to consistently generate substantial value.”

Generating value

Another 22% have put suitable AI strategies and capabilities in place, and are starting to generate value. These companies, together with the 4% mentioned above, have been categorised as leaders.

The remaining three quarters of firms still have work to do, as they have “not yet shown any tangible value from their use of AI,” according to the report.

The criteria for being in the leaders category is that “revenue growth has been 50% greater than the overall average. Their total shareholder returns are 60% higher, and they gain 40% higher returns on invested capital.”

AI leaders

According to the report, there is a set of qualities that companies in the leaders category have that set them apart from everyone else, and enables them to generate true value in AI.

- First, the true value of AI is not just in streamlining support functions around operations and cost-cutting. The bigger reward in AI adoption can be found by focussing on the core business processes. That’s where 62% of value is being generated by leaders.

- Companies in the leaders category expect a 60% higher revenue growth by 2027. They also expect to cut costs by 50%. They are simply more ambitious in those two categories compared to other firms in the survey.

- These companies are picky. They don’t invest in everything, but focus on the most promising opportunities around AI adoption. In return they also expect a higher return on their investment.

- AI adoption is a two-way agenda for leaders. They use it to both cut costs as well as revenue growth. And they do so at a much higher percentage than other firms.

- People and processes are at the heart of the AI adoption journey for leaders. That’s where 70% of their resources go. Technology gets 20% and the remaining 10% goes to algorithms.

- Leaders are also ahead of other firms in their adoption of generative AI (GenAI). This gives them a clear advantage in areas such as content creation, qualitative reasoning, and connecting other tools and platforms.

The report also highlights the fact that not all firms in the leaders category are digital natives. Some of them are companies that faced digital disruption more than a decade ago, but were quick to put in pace suitable AI strategies and have built on their capabilities ever since. “They include fintech (49% are leaders), software (46%), and banking (35%),” according to the report.

Where is the value?

Companies in the leaders category see and generate value in AI adoption beyond the support functions. They have been able to reap rewards by extending their AI adoption to “core business functions, including operations (23%), sales and marketing (20%), and R&D (13%).” That’s where 62% of their value is being generated.

Even in the core businesses category, some sectors generate a much higher value than others. Software, media, fintech, insurance, biopharma and telecommunications generate 70% to 90% of their AI-related value in core businesses.

Sales and marketing departments are seeing more value generation from AI adoption compared to other parts of operations. The report suggests that GenAI can carry out transactional tasks, allowing human staff to focus on more important areas such as strategic and relationship selling.

“Leaders are not only deploying productivity plays but reshaping core business processes and inventing new revenue streams,” the report says.

The report suggests there are four key processes through which AI adoption could have a profound impact on marketing. These include:

- helping developers see market opportunities and prepare designs, thanks to faster data collection and analysis.

- helping to adapt, localize and disseminate content, with better workflows and feedback processes.

- realtime feedback, and the opportunity to see trends and shape campaigns accordingly at greater speed.

- less time spent on repetitive administrative tasks, allowing teams to focus on more strategic objectives.

How to win with AI

The report concludes by summarizing some of the key lessons that other companies can learn from those in the leaders category in order to kick-start their AI adoption journey and start generating value.

- Set a bold strategic commitment from the top, and be prepared to support it over multiple years.

- Maximize the potential value of AI with a balanced portfolio of initiatives.

- Focus on fewer but higher-impact lighthouse programs, starting with implementation with one to three high-RoI, easy-to-implement initiatives to fund the journey.

- Ensure that the minimal viable infrastructure required for these initiatives exists, especially with respect to integration with IT systems and access to quality data.

- Identify your company’s capability gaps vis-à-vis the leaders in the known critical capabilities for success, and invest in parallel to build these capabilities.

- Ensure that implementation governance focuses on end-to-end transformation and on people and processes.

- Set up guardrails to deploy AI responsibly in all initiatives through transparency, control, and accountability to ensure ethical and legal compliance and to manage business risks.