The US Supreme Court on Tuesday appeared skeptical of the payday lending industry’s challenge to the Consumer Financial Protection Bureau’s (CFPB’s) funding structure. But the case could dismantle an agency set up to curb predatory lending and enforce consumer financial laws.

A ruling is expected sometime in June 2024, so all we can go on right now is what reporters from Reuters heard in the courtroom. The high court’s ruling could have broad and significant impacts for consumers and businesses alike in terms of the agency’s existence, its rulemaking and prior enforcement decisions, and the similar funding mechanisms behind such integral government agencies as the US Federal Reserve.

The legal challenge

The justices heard arguments in the administration’s appeal of a lower court’s ruling that the CFPB’s funding mechanism, established when Congress passed Democrat-backed legislation in 2010 creating the agency, violated a constitutional provision by giving the executive branch of government the power of the purse, instead of the legislative branch.

The legal challenge was brought by a trade group which first sued the CFPB in 2018, seeking to invalidate a rule that cracked down on payday lenders.

The agency draws money each year from the US Federal Reserve rather than budgets passed by Congress, which the petitioners claim violates the US Constitution’s “appropriations clause”.

The legal challenge was brought by a trade group representing payday lenders called CFSA, which first sued the CFPB in 2018 at lower court levels, seeking to invalidate a 2017 rule that cracked down on payday lenders.

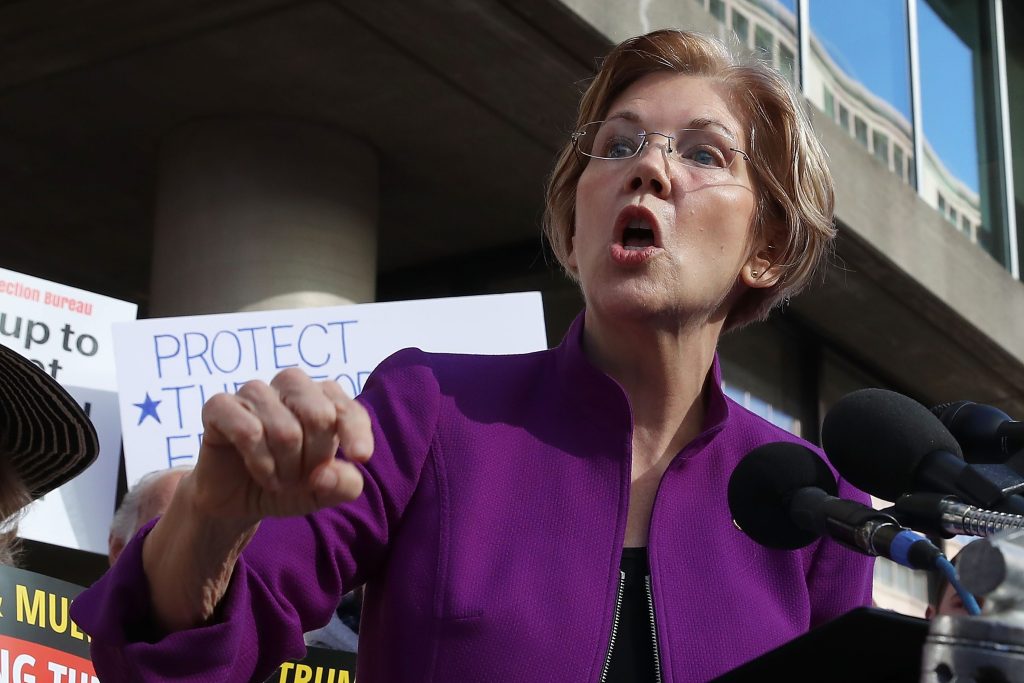

The case was most recently heard by the US Court of Appeals for the Fifth Circuit, which ruled in October 2022 that the CFPB’s funding mechanism violated the appropriations clause noted above. Its funding structure was designed by Congress in this manner as an attempt to shield the agency from political pressures, as legislators such as Senator Elizabeth Warren, who championed its creation soon after the 2008 global financial crisis, said at the time.

The CFPB director requests the agency’s funds each year, capped at 12% of the Federal Reserve System’s total operating expenses, or $785.4m currently.

Justices seem split

Questions posed by the court’s three liberal justices and at least two of the six conservative justices – Brett Kavanaugh and Amy Coney Barrett – signaled doubt over the argument by the challengers that the CFPB’s funding design violates the US Constitution’s “appropriations clause,” which vests spending authority in Congress, Reuters said.

Kavanaugh pushed back against the assertion that the structure unlawfully lets the agency determine its own funding without a meaningful limit set by Congress.

“Congress could change it tomorrow. And there’s nothing perpetual or permanent or about this,” Kavanaugh said.

Barrett expressed reservations about how the challengers, two payday lending trade groups, would rectify the funding issue.

“I think we’re all struggling to figure out, then, what’s the standard that you would use,” Barrett told Noel Francisco, who argued for the challengers, adding: “How do you decide how much is too much or how specific is specific enough?”

Conservative Justice Clarence Thomas asked whether the agency’s setup “eviscerates the kind of exacting control that Congress usually exercises in the appropriations process”.

“It sure seems that on your view, the Federal Reserve would also be unconstitutional.”

Elena Kagan, US Supreme Court Justice

Conservative Chief Justice John Roberts called US Solicitor General Elizabeth Prelogar’s view of congressional appropriations power “aggressive,” and said such a stance could undermine the constitutional separation of powers between the legislative and executive branches of government when both are controlled by the same party.

“In that situation, you can see Congress empowering the president in a way that might seem unusual to the framers” of the Constitution, Roberts added.

The liberal justices pressed the challengers on the repercussions of deeming the CFPB’s funding structure unconstitutional.

“It sure seems that on your view, the Federal Reserve would also be unconstitutional,” Justice Elena Kagan said.

Prelogar, arguing for Biden’s administration, called the funding mechanism lawful and said Congress has used a “materially identical” structure for other financial regulators including the Federal Reserve Board, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation.

Why the CFPB was created

Lawmakers created the federal agency to protect consumers from predatory financial practices. To date, it has collected $17.5 billion in financial relief for about 200 million eligible people, according to agency data. It often targets companies for using unfair, deceptive and abusive acts and practices, using a law called UDAAP (as an acronym for those terms).

The court challenge poses a threat to the CFPB’s operations and could throw into question – even invalidate – the agency’s prior rulings.

″[It] could cast legal doubt over every substantive action that the CFPB has taken since at least July 21, 2011, when the Bureau’s authorities went into full effect, if not since its inception a year earlier, as well as any future Bureau action,” the Congressional Research Service (CRS) said.

The CFPB’s chief funding source is similar to at least some other US agencies that are supported in whole or in part by direct spending bills, including other financial regulators.

“This would include myriad regulatory actions, such as dozens of rulemakings, enforcement actions, and examinations the Bureau has conducted over the past 12 years,” it added.

And it’s not the first challenge against its structure; the Supreme Court ruled against the agency in a 2020 case, Seila Law v. CFPB, finding part of its structure to be unconstitutional, but ultimately keeping the agency intact.

The CFPB’s chief funding source might differ from annually appropriated accounts for most executive agencies, but it is similar to some other US agencies that are supported in whole or in part by direct spending bills, including other financial regulators. The Federal Reserve, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, and the National Credit Union Administration, for example, cover all or part of their costs with funds derived from regulated entities or other investments.

That is why Justice Kagan mentioned the Federal Reserve’s funding structure during the oral arguments.

Implications of Fifth Circuit decision

The Fifth Circuit’s decision is already affecting other CFPB enforcement actions. Within days of the publication of its ruling, a number of defendants in CFPB enforcement cases petitioned courts to dismiss the CFPB’s claims or provide other relief as a result of the Fifth Circuit’s decision. At least one federal court has stayed an enforcement proceeding pending the Supreme Court’s review of the Fifth Circuit decision, the CRS said.

To be sure, even if the CFPB were to disappear as a consumer-protection agency with enforcement powers, other US consumer-protection and anti-discrimination legislation could at least mostly fill the void.

But the CFPB offers an exam manual for evaluating UDAAPs, which notes that discrimination can be unfair in cases where the conduct may also be covered by Equal Credit Opportunity Act (ECOA), as well as in instances where ECOA does not apply. For example, denying access to a checking account because the individual is of a particular race could be an unfair practice even in those instances where ECOA may not apply. So there would be some legal gaps in certain areas, which could introduce legal uncertainty in the consumer financial markets, which currently operate in accordance with the federal consumer financial laws implemented by the CFPB.

Casting doubt upon the legality of the regulations the CFPB has issued could disrupt these markets, subject financial institutions to legal risk, and make some statutory protections unenforceable.

As the CRS points out, these laws include the Truth in Lending Act, Real Estate Settlement Procedures Act, Equal Credit Opportunity Act, and Fair Credit Reporting Act, which govern a wide array of consumer financial products and services.

Casting doubt upon the legality of the many regulations the CFPB has issued to put into effect the objectives of these laws could disrupt these markets, subject financial institutions to legal risks by unsettling legal responsibilities, and make some statutory protections unenforceable.

And if the Supreme Court rules that the Bureau’s funding should be subject to annual discretionary appropriations, there is a huge window for uncertainty and stalemate there, given the makeup and tenor of the current US Congress.

US businesses must be prepared for possible changes, but appreciate that the local laws and regulations – plus other federal mandates – are not likely to give them the opportunity to suddenly engage in sweeping anti-consumer behavior, nor would consumer groups or the investing public allow it.

Still, there is a lot in the balance here if prior judgments are overturned. And corporate rulebooks (and the tech tools helping to track these imperatives) will need adjusting, as new laws might be proposed to fill in inevitable gaps.