Digital assets have sparked a “modern gold rush” and they need to be properly regulated to protect retail investors from manipulation and fraud. Market regulators must coordinate a federal approach to maximizing the opportunities presented by innovations such as cryptocurrency, decentralized finance, and NFTs while, at the same time, minimizing the risks.

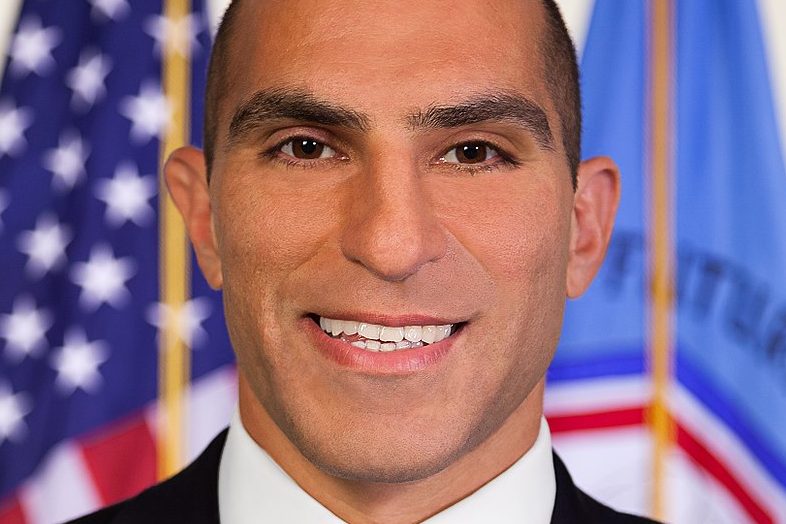

That was the message from Rostin Behnam, chairman of the Commodity Futures Trading Commission (CFTC) to members of the US Senate Committee on Agriculture, Nutrition, and Forestry earlier this year.

He told the committee that the regulator’s history of ensuring the stability and integrity of the US derivatives market made it “well situated” to play a central role in overseeing the cash digital asset commodity market. And he called for a coordinated federal approach, with the CFTC as a proactive participant.

“The speculative fervor around digital assets, frequently feeling like a modern gold rush, has led many investors to regularly take on high levels of leverage when trading, leading to heightened price volatility, often exacerbated by cascading liquidations during price downturns.

“It is important that we find ways to sensibly bring this emerging market within the regulatory fold,” he said.

Digital asset market

Behnam began his testimony to the committee on the risks, regulation, and innovation of digital assets by outlining the CFTC’s role as the primary regulator of the US derivatives market through the Commodity Exchange Act, which allows the CFTC to “implement rules and regulations aimed at fostering open, transparent, competitive, and financially sound markets; to prevent and deter misconduct and disruptions to market integrity; and to protect all market participants from fraud, manipulation, and abusive practices”.

It has to have a deep understanding of underlying cash markets (where producers such as farmers and manufacturers exchange commodities, energy products, precious metals and digital assets with one another), over which it has the authority to enforce fraud and manipulation regulations.

“The potential for fraud or manipulation in these underlying markets often poses the most immediate threat to the integrity of derivatives markets,” Behnam told senators.

Describing the digital asset market as “unique,” Behnam said there were gaps in the regulations governing it. “[T]here is no one regulator, either state or federal, with sufficient visibility into digital asset commodity trading activity to fully police conflicts of interest and deceptive trading practices impacting retail customers.”

“If, in fact, the future global economy holds a place for digital assets, tokenization, blockchain technology, decentralized finance, and other elements of the fintech-driven ecosystem, the need to uphold American leadership and stewardship of this technology is clear.”

Rostin Behnam, chairman Commodity Futures Trading Commission (CFTC)

The size of the digital assets market is just one reason why it needs coherent, effective regulation. Behnam told committee members that the hundreds of thousands of unique digital assets currently in circulation have a combined market capitalization of about $2trn. Playing a central role in this “burgeoning” market, he said, are the trading platforms that allow investors to access the market, operating globally and hosting marketplaces for digital assets and derivative contracts.

Every month during 2021 bar one saw trading volume of more than $1trn in the digital asset cash market, with a high of $2.23trn in May. And the derivatives market is even bigger, with notional exchange volumes in bitcoin futures alone surpassing those numbers.

Behnam highlighted three “unique elements” that meant the digital asset cash commodity market would “benefit greatly” from CFTC oversight:

- It is characterized by large numbers of retail investors, mostly speculating on price.

- This speculative fervor has led investors to take on high levels of leverage when trading, making prices more volatile.

- Most investors entrust their digital assets to the trading platforms, leaving them vulnerable to hacks, exploits, and poor cybersecurity.

“I believe these unique characteristics, combined with the growing size and customer, operational, and potential future financial stability risks associated with the cash market necessitate a proactive federal regulatory approach to ensure that the standards that American investors have come to expect from our financial markets are equally present in digital markets,” he said.

“If, in fact, the future global economy holds a place for digital assets, tokenization, blockchain technology, decentralized finance, and other elements of the fintech-driven ecosystem, the need to uphold American leadership and stewardship of this technology is clear.”

National security, trade, and tackling climate change were among the “critical issues” also at stake.

Missing important principles

Outlining the CFTC’s role in the digital asset commodity market, Behnam admitted that the current collective approach by a number of different US regulators had fallen short – between them, state and federal regulators had created a “very incomplete” regulatory environment with important principles missing.

The CFTC had aggressively used its limited fraud and manipulation authority in the digital assets market since 2014, bringing nearly 50 enforcement actions, overseeing an increasing number of registrants offering digital asset-based derivative products, and keeping ahead of innovations.

But there were still challenges, Behnam said, and the CFTC was spending more of its attention, time, and resources on the digital assets market. “We are past the stage where digital assets and decentralized financial technologies are a research project, sandboxing what may come in the future. The issues are at the front and center of our thinking at the Commission in addition to our traditional regulatory, oversight, and enforcement responsibilities.”

Behnam pledged that, as chairman, he would ensure that the CFTC would continue to use its enforcement authority “to the fullest extent” to protect customers from fraud and manipulation; however, the challenges would go far beyond the Commodity Exchange Act. Any regulatory response must bring more transparency to the digital assets market, and he had directed the CFTC’s Climate Risk Unit and LabCFTC to examine its climate implications.

He concluded: “I expect there will be an increasing need to ensure a coordinated federal approach in this area, and I plan to have the CFTC be a proactive participant in this process. The continued emergence of digital asset technology presents risks and opportunities, and the CFTC stands ready to leverage its expertise and experience to confront both.”