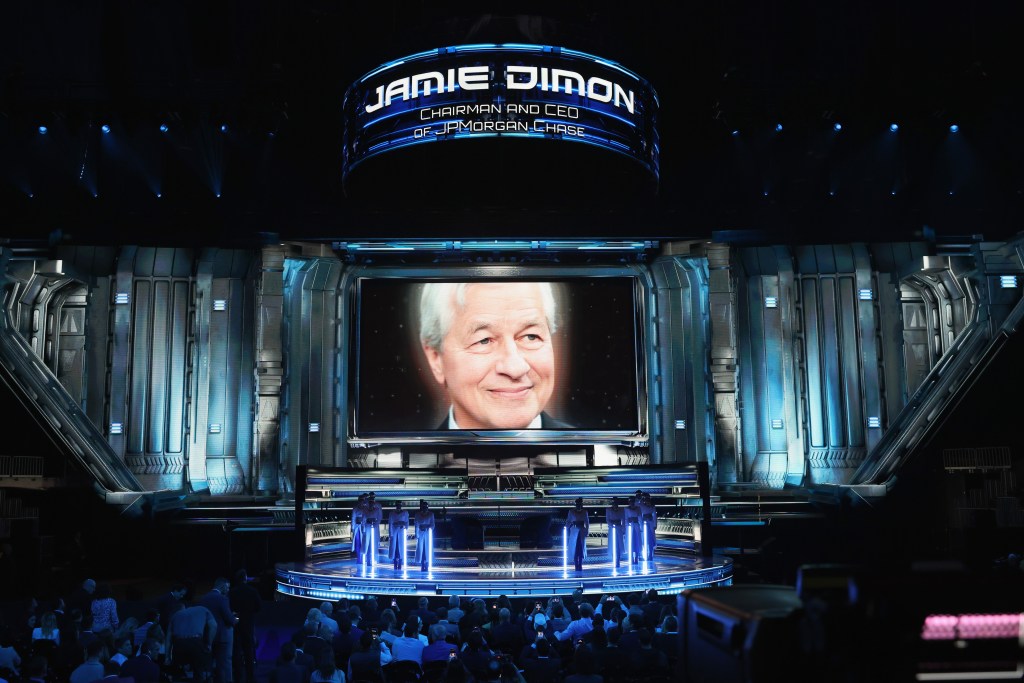

Financial and professional services companies should ensure at least 50% of senior leaders come from working class or lower socio-economic backgrounds by 2030. The target has been set by the City of London Corporation, which oversees work in the capital’s Square Mile.

A report published by the Corporation-led Socio-Economic Diversity Taskforce

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day