More companies are choosing to voluntarily report instances of potential criminal misconduct after the US Department of Justice upped the rewards for doing so, a senior DOJ official has said.

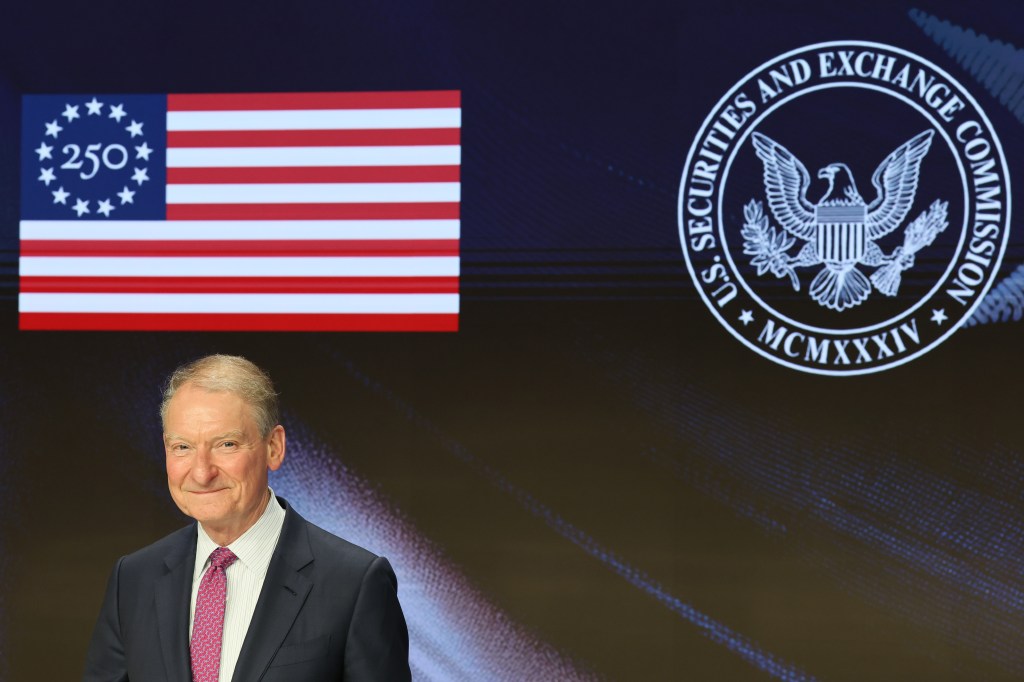

Assistant Attorney General (AAG) Kenneth Polite Jr., who leads the DOJ’s criminal division, told attendees at a white-collar crime conference hosted

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day