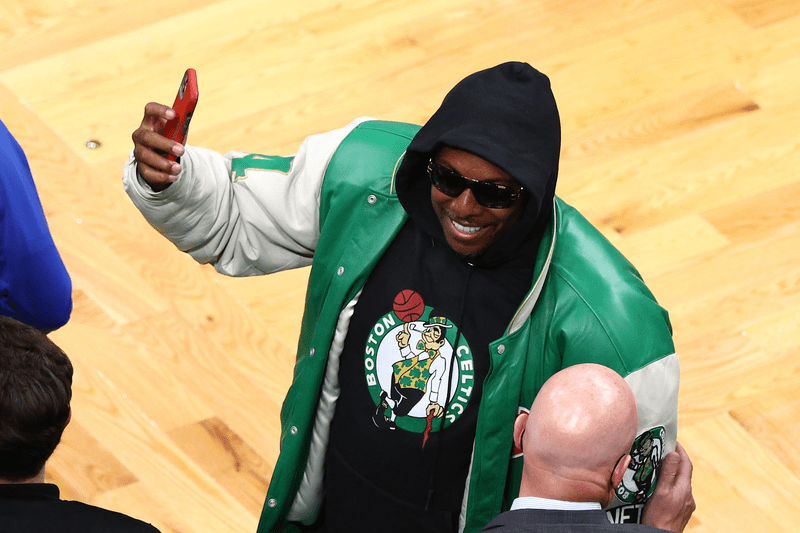

After charging Kim Kardashian in October 2022, the SEC is now taking action against former NBA player Paul Pierce for allegedly promoting the same EMAX tokens without disclosing his payment. Pierce, nicknamed ‘the Truth’ during his 15-year Celtics career, is also being charged for making false and misleading promotional statements about the token.

Pierce promoted the crypto asset security, which was offered and sold by EthereumMax, on his Twitter account without revealing that he was paid more than $244,000 worth of EMAX tokens to do so. He also tweeted misleading statements related to the EMAX offering, including a screenshot of an account that showed large holdings and profits – without disclosing that his personal holdings were in fact much lower than shown. One tweet also contained a link to the EthereumMax website which showcased instructions on how to purchase the EMAX tokens.

Reminder to celebrities

“This case is yet another reminder to celebrities: The law requires you to disclose to the public from whom and how much you are getting paid to promote investment in securities, and you can’t lie to investors when you tout a security,” said SEC Chair Gary Gensler. “When celebrities endorse investment opportunities, including crypto asset securities, investors should be careful to research if the investments are right for them, and they should know why celebrities are making those endorsements.”

The SEC found that Pierce violated the anti-touting and antifraud provisions of the federal securities laws. Without admitting or denying the findings, Pierce has agreed to pay a $1,115,000 penalty and approximately $240,000 in disgorgement and prejudgment interest. He has also agreed not to promote any crypto asset securities for three years.

“The law requires you to disclose to the public from whom and how much you are getting paid to promote investment in securities, and you can’t lie to investors when you tout a security.”

Gary Gensler, Chair, SEC

100 false rumors

In a busy start to a week that has already seen the SEC announce charges against Terraform and its CEO and against Chicago-based Options Clearing Corporation, in addition the SEC also revealed it has taken action against Milan Vinod Patel, of Cumming, Georgia, for spreading more than 100 false rumors about public companies in order to gain more than $1m in illicit trading profits. The SEC earlier charged Barton Ross, Mark Melnick, Anthony Salandra, and Charles Parrino for their roles in this scheme.

According to the SEC’s complaint, Patel got the rumors, which he knew to be false, from Ross, Salandra, or Parrino, and spread them to his contacts at financial news services, chat rooms, and on message boards. Patel also spread them to the stock trading webcast Melnick, which then shared them with his subscribers. The false rumours were spread between December 2017 and January 2020, and related to purported market-moving events such as corporate mergers or acquisitions of publicly-traded companies.

The circulation of the rumours caused the prices of the some of the companies’ securities to rise temporarily, which allowed Patel to sell his holdings and generate more than $1m in profits.

Central role

“Out of the five individuals involved in this scheme, we allege that Patel played the central role of using his contacts to repeatedly spread the false rumors via the internet, generating more than $1 million in illicit profits for himself,” said Joseph G Sansone, Chief of the Enforcement Division’s Market Abuse Unit. “Today’s action seeks to hold Patel accountable for his alleged misconduct and serves as a warning to others who might engage in similar schemes.”

The complaint was filed in the United Stated District Court for the Northern District of Georgia, and charged Milan Vinod Patel with violating Section 17(a) of the Securities Act of 1933, and Section 10(b) and Rule 10b-5 of the Securities Exchange Act of 1934.