According to the latest EY European Financial Services Boardroom Monitor, the gender pay gap across UK financial services boardrooms decreased five percentage points between 2019 and 2023, from 30% to 25%.

The difference in the overall remuneration of men and women across the UK’s financial boardrooms during the four-year period decreased due to a marginal fall in remuneration for male board directors at UK firms, and a concurrent uptick in remuneration for their female peers.

Overall, pay across UK financial boardrooms fell between 2019 and 2023 on an average basis, but remained higher than the European average every year through the period. The average remuneration for female non-exec board directors across UK financial services firms increased 7%, from $209,987 in 2019 to $225,275 in 2023. During this time, remuneration for male non-exec directors decreased 1%, falling from $301,966 to $299,076.

By comparison, over the same period, the gender pay gap across European financial services boardrooms increased by five percentage points, from 31% to 36%. The difference in the overall remuneration of men and women across Europe’s financial boardrooms within the four-year period increased despite a rise in the absolute level of pay awarded to female non-executive directors over the period.

Martina Keane, EY UK & Ireland Financial Services Leader, commented: “UK financial services firms have made clear progress towards more equitable pay for male and female board directors, but the pay gap between genders remains stark.

“While more men than women sit on committees and occupy chair roles, the fact that women on UK boards earn a quarter less than their male peers on average is a concerning reality. Global competition for talent at board level is only growing, and UK financial services firms must do more to further improve gender equity in their boardrooms and balance remuneration levels.”

Gender pay comparisons with US

North American non-exec directors were found to have received significantly higher overall remuneration than their counterparts in the UK, primarily as a result of receiving equity and stock options in addition to their fixed-fee compensation, which UK and EU boards do not offer for independence and objectivity reasons.

Between 2019 and 2023, the gender pay gap across the boardrooms of the largest North American financial services firms narrowed two percentage points, from 7% to 5%.

Remuneration awarded to female non-exec board directors across North American financial services firms increased by 13%, from $287,465 in 2019 to $324,250 in 2023. Pay awarded to male non-exec board directors increased at a slower rate of 10%, from $309,392 in 2019 to $340,481 in 2023.

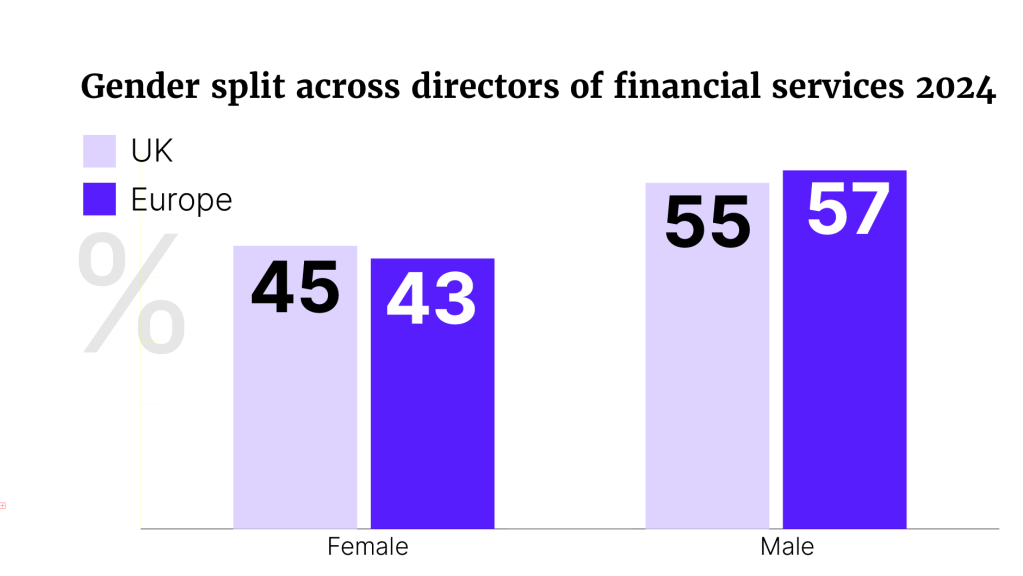

Gender splits

The gender split (as at the end of 2024) for directors of UK financial services firms stands at 45% female and 55% male, compared to 43% female and 57% male across European financial services firms more broadly.

Data for North American firms shows that at the end of 2023, board-level female representation was nine percentage points lower than the UK, at 36% female and 64% male.

Omar Ali, EY Global Financial Services Leader, concluded: “The landscape for boardroom remuneration across financial firms in Europe is shifting, and compensation is a key consideration for chairs as they build and maintain their boards in an increasingly global industry. This is particularly the case as chairs of UK firms contend with the more lucrative packages offered in North America, which often include equity and options awards.

“Offering competitive – and importantly, equitable – pay is essential to ensure that boards are equipped with the skills and diversity necessary to navigate evolving market risks and challenges. A structured review of regional pay disparities – and the steps that can be taken to address them – is now integral to maintaining the strength of the UK financial services sector.”