Geopolitical tension and a reset in venture capital fundraising are identified as key drivers of a slowdown in global fintech investment by industry body Innovate Finance. Global investment fell 20% to $43.5 billion across 6,264 deals.

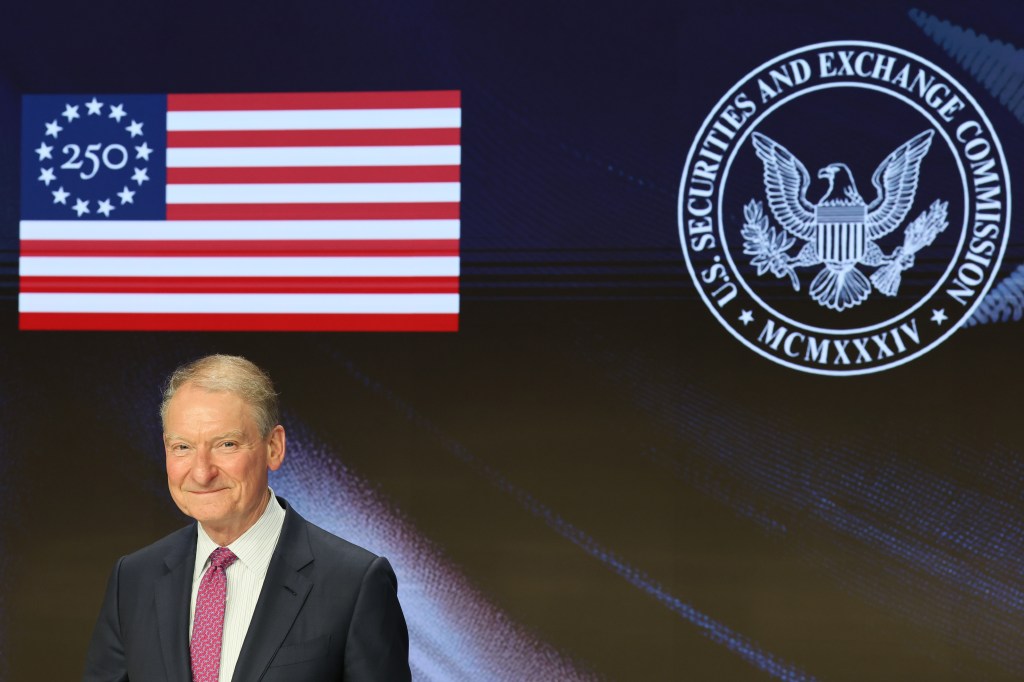

The US stayed in the number one market position, raising $22 billion. The main investment hubs remain

The

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day