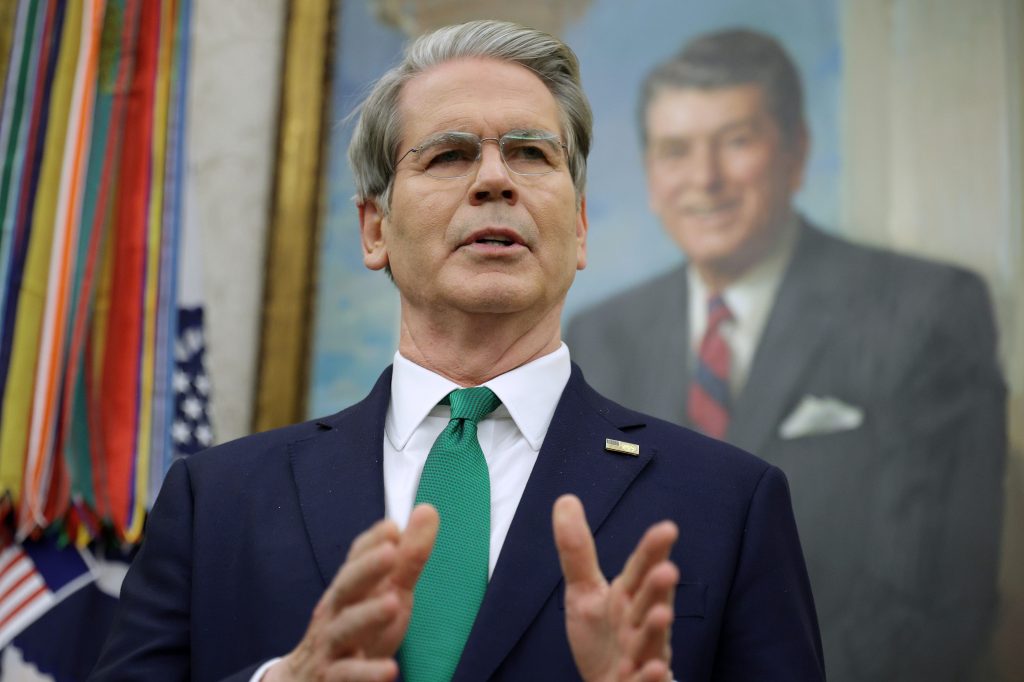

I recently sat down with Global Relay’s VP of Compliance Supervision, Donald McElligott, to discuss what he is hearing from clients and prospective clients about their technology solutions (and ongoing challenges) in the e-communications recordkeeping space.

His comments revolved around the needless complexity of using multi-vendor solutions, creating efficient workflows

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day