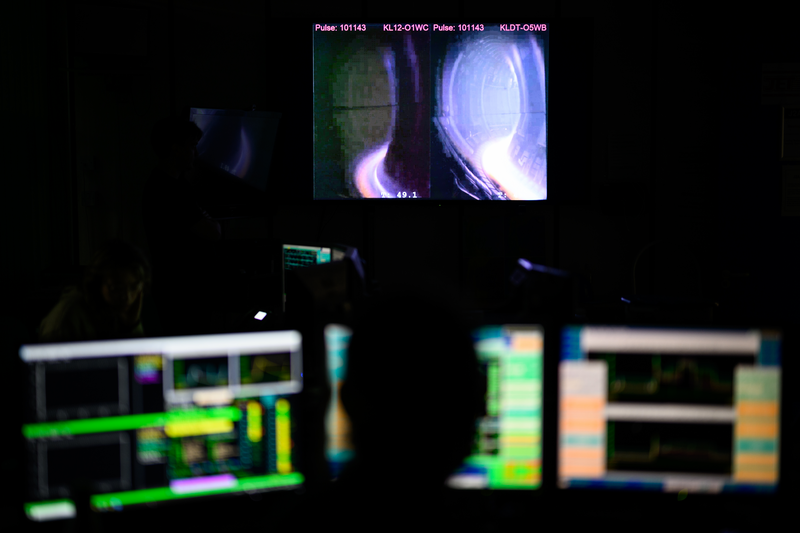

As we countdown to COP28, it is worth examining how far UK businesses have come in reference to the “E” in ESG. Many companies are not just embracing opportunities associated with net-zero transition, but genuinely lead the field – and have been for some time – in terms of embedding ESG values to enable a just transition.

But there are also developing risks alongside the increased emphasis on ESG. The last year has seen a rise in litigation globally against governments and companies alike, seeking to hold them to account for climate commitments it is alleged they should have made – or ones they have made but are not seen to be demonstrating they can deliver. Regulatory enforcement is also on the rise.

Greenwashing, and the quality of climate change corporate reporting, continues to be a major focus area for regulators. This was most-recently reflected in the UK in the Regulatory Initiatives Grid published by the Financial Services Regulatory Initiatives Forum. While of obvious relevance to the financial services industry, the ESG focus areas are significant to businesses more generally; initiatives in the next 24 months include a review of the corporate governance code, net-zero transition plans, sustainability disclosure requirements for asset managers, a new anti-greenwashing rule that will apply to all regulated firms, and proposals to bring ESG data and ratings providers into the FCA’s regulatory perimeter.

Transition plans

Many companies already report on net-zero commitments. Focus has turned to transition plans – the roadmaps setting out how the company will deliver on those commitments with interim targets being a key component. Companies must ensure they dedicate sufficient resource to preparing those plans; they will be carefully scrutinized by stakeholders, and challenged if not supportable. The Government is committed to the UK becoming the world’s first net zero-aligned financial centre and sees transition plans as a key component of that ambition. The Transition Plan Taskforce is expected to report later in 2023 with a “gold standard” framework. FCA guidance already encourages UK-listed companies to publish their transition plans for financial years from 1 January 2022.

UK companies are also now reporting – for many it is a legal requirement – in accordance with the Taskforce on Climate-related Financial Disclosures (TCFD). Disclosures will be made by larger private companies for the first time in 2023. Once the International Sustainability Standards Board finalizes sustainability disclosure standards later this year the FCA will be looking to implement them in the UK for listed companies, replacing the not-long-implemented current TCFD reporting requirements.

Another area of focus for many companies is going to be the Corporate Sustainability Reporting Directive. A number of UK businesses, and other non-EU headquartered companies that nevertheless have a footprint in the EU, are currently seeking advice on the application of CSRD to their business. CSRD requires enhanced non-financial reporting on a variety of sustainability issues – such as environmental rights, social rights, human rights and governance factors.

Tip of the iceberg

These developments are just the tip of the iceberg. While climate remains a core focus, there are many other aspects of ESG that governments, regulators and other stakeholders are expecting companies to provide enhanced governance around, including in relation to supply chain due diligence, and to report on those issues in a meaningful way. Attention is also turning to diversity and inclusion, including at board level, both through regulatory requirements for listed companies and voluntary initiatives.

It should be great news for everyone to see corporates demonstrating genuine leadership on this, and seeing legislators taking it seriously is also heartening. But it also means a huge array of regulatory and legal developments companies need to stay abreast of – and ensure they are addressing in their strategy, operations and reporting. The challenge for some will be whether they have the resources, expertise and data they need. However, failing to invest in compliance is not an option. The enforcement and litigation cost of failing to comply is a risk businesses cannot afford to take.

Kari McCormick is a partner in Eversheds Sutherland’s Financial Services Disputes and Investigations group. She specialises in defending claims against accountancy firms and auditors and representing them in regulatory investigations. She has over 25 years’ experience as a litigator representing clients in the financial services sector in civil disputes and regulatory proceedings; with a particular focus on consumer financial products and misselling.