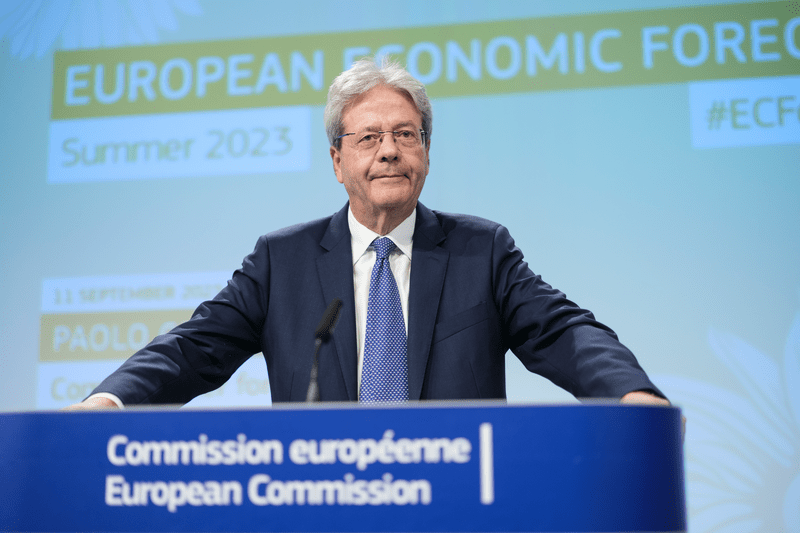

New, simpler rules that could reduce tax compliance costs by up to 65% for businesses that operate in the EU have just been proposed by the European Commission.

The proposal, Business in Europe: Framework for Income Taxation (BEFIT), is a key package of initiatives to reduce tax compliance costs for large,

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day