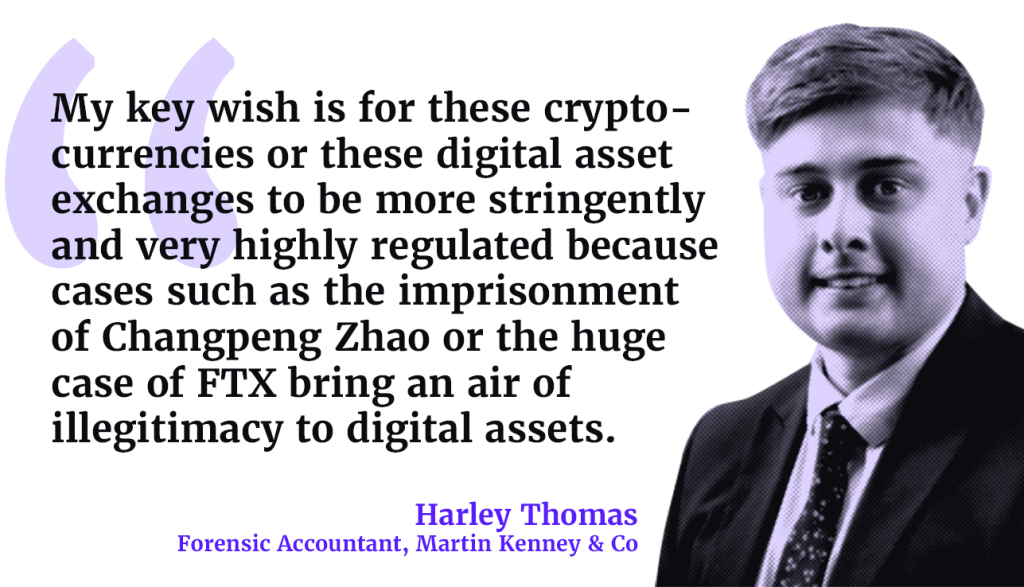

In this episode, GRIP’s commissioning editor Jean Hurley spoke with Harley Thomas, a forensic accountant and senior investigator at Martin Kenney & Co, to discuss the US crypto lawsuit – Ripple, digital assets regulation in the UK, digital currency use in illicit finance and asset tracing.

We discussed:

- The US Ripple lawsuit and why the outcome of this case will affect the future of cryptocurrency regulation in US. Also see A landmark lawsuit is sending ‘ripples’ through the world of cryptocurrency and The Ripple effect: SEC files Notice of Appeal in case against Ripple

- Other cases involving digital assets in US Courts including SEC v Terraform Labs and SEC v LBRY, which concern interpretations of the Howey Test while contributing to a broader regulatory framework that may apply to other crypto tokens in the future. Also see Terraform and CEO charged with defrauding investors in multi-billion crypto schemes.

- The UK’s Digital Assets Bill and how it will shape the ownership of crypto tokens in the UK.

- Harley’s work in asset recovery and the differences between tracing digital and assets held in traditional bank account including:

- pseudonymity and privacy in cyptocurrencies;

- blockchain transparency and complexity;

- lack of central authority;

- cross-border transactions;

- use of mixers and tumblers; and

- custodial vs. non-custodial wallets.

- The role of banks in tracing digital assets.

- Crypto currency and illicit finance.

- Use of AI and machine learning as an aid to asset tracing.

A transcript of this podcast is available here.