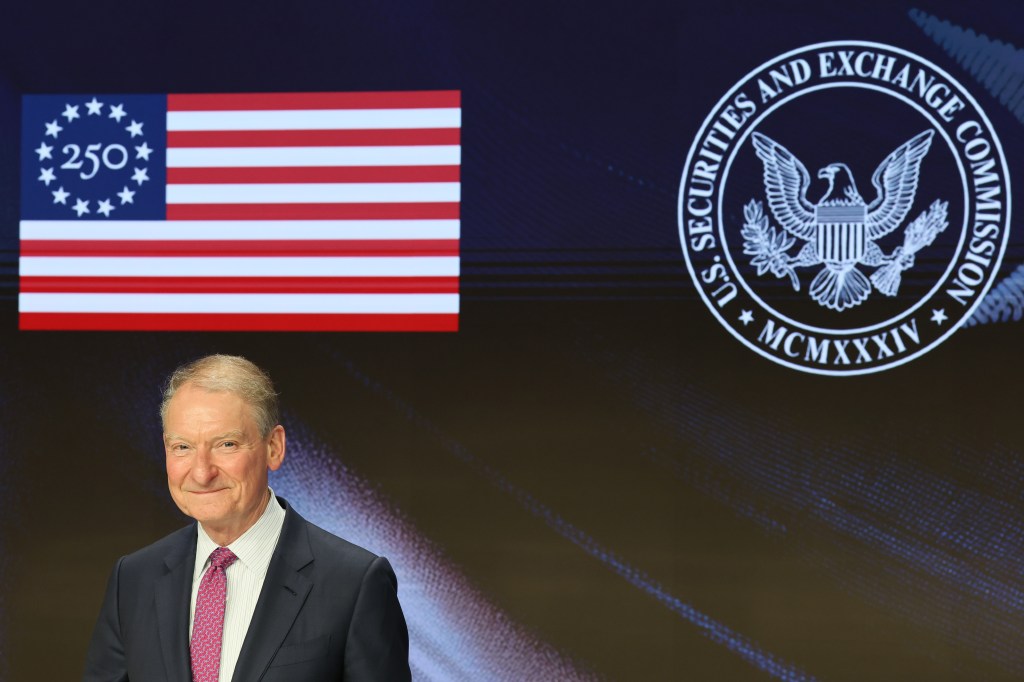

Proposed changes for Reg S-P will enhance the protection of customer information by requiring broker-dealers, investment companies, registered investment advisers, and transfer agents to notify individuals who have been affected by a data breach that may put them at risk of identity theft or other harm.

The proposal comes as

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day