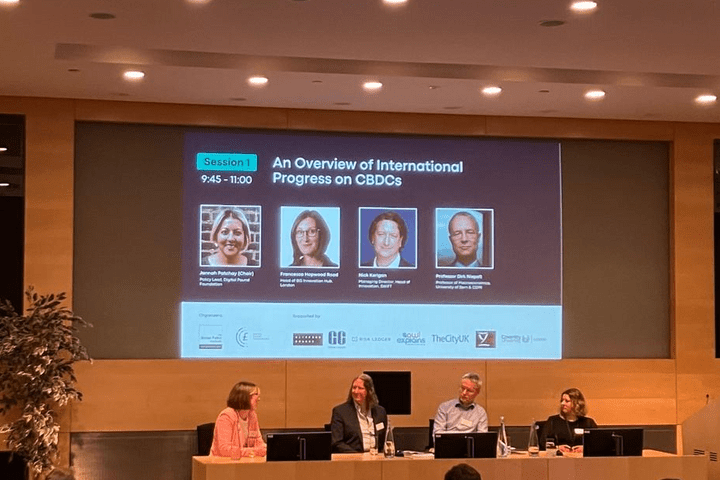

GRIP attended the day-long event, entitled ‘The CBDC Revolution: The Global Implications of Central Bank Digital Currencies’, hosted by Clifford Chance in London’s Canary Wharf. A series of panels including lawyers, academics, and policymakers spoke on the implications of central bank digital currencies (CBDCs) domestically and globally.

Some 114 countriesdigital

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day