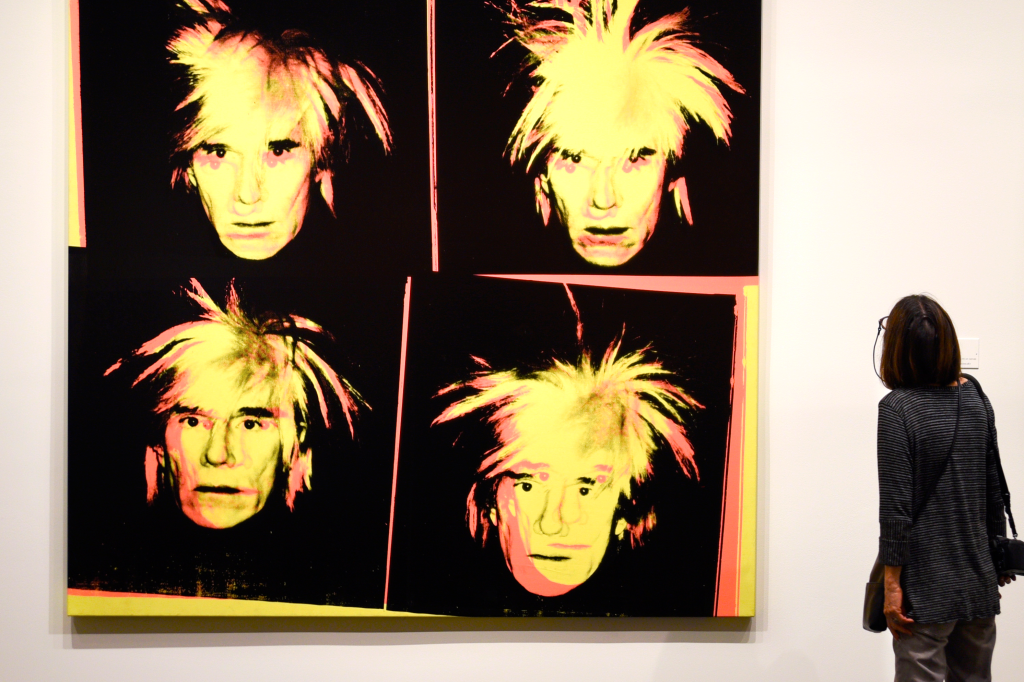

What links expensive jewellery, fine wine, antiques and works of art? All these high-value goods offer the potential for criminals to keep dirty money out of the financial system and convert illicit cash into high-value, eminently portable assets.

But, one of these routes to sanitizing ill-gotten gains has only recently

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day