The Taskforce on Nature-related Financial Disclosures (TNFD) has published 10 new guidance documents to assist companies in applying the TNFD recommendations, including specific advice for financial institutions. The Taskforce has also published its latest adoption statistics.

Following an 18-month process of iterative development, the Taskforce has launched its first set of Additional Sector Guidance, covering eight real economy sectors and Additional Guidance for Financial Institutions for banks, re/insurance companies, asset managers and owners, and development finance institutions. This sector guidance includes recommended sector-specific metrics for disclosure in line with the TNFD recommendations published last September.

Additional Guidance on consideration of nature-related issues across value chains was also released. This shows how organizations can approach analysis of their upstream and downstream value chains. It outlines value chains characteristics that can create challenges assessing nature-related issues and how organizations can approach these issues when applying the TNFD’s LEAP approach. (This is an integrated assessment approach: “Locate, Evaluate, Assess and Prepare”.

The Additional Sector Guidance covers the following real economy sectors:

- Aquaculture

- Biotechnology and Pharmaceuticals

- Chemicals

- Electric Utilities and Power Generators

- Food and Agriculture

- Forestry and Paper

- Metals and Mining

- Oil and Gas

Adoption statistics

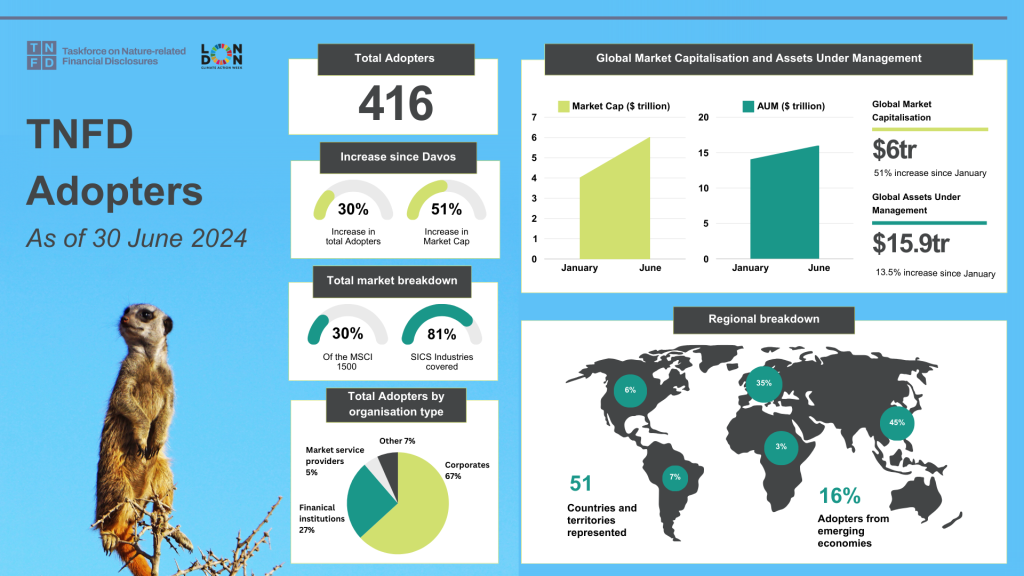

According to the TNFD, since January, total adoption has increased by 30%, with an additional 96 organizations joining the initiative, leading to a total of number of 416. These organizations have committed to disclosing material nature-related issues to investors and other stakeholders based on the TNFD recommendations.

TNFD said there are now 114 financial institutions registered as early adopters, representing $15.9 trillion in AUM, including Norges Bank Investment Management, Bank of America, Federated Hermes, Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group.

Most of the uptake has been in Europe and Asia, which represent 35% and 45% of the total adopters, respectively. Only 6% of the adopters come from North America.

The adoption graphic released by the TNFD last week is below. A list of adopters is available on the TNFD website.

David Craig, Co-Chair of the TNFD, said: “The ongoing uptake of the TNFD’s recommendations is further evidence that the mindset in business and finance is quickly shifting to a recognition that accelerating nature loss is imposing costs and risks on society as a whole as well as to individual business models and capital portfolios.

“Voluntary uptake now of the TNFD recommendations is the best way to meet these shifting expectations and the best way to meet new regulatory requirements such as CSRD. We are delighted that organisations globally are also using TNFD to prepare for the forthcoming expansion of the global sustainability reporting baseline now that the ISSB has commenced its important work on nature building on the recommendations of the Taskforce.”