A reduced cap on the maximum liability banks face for fraud is being considered by the UK Payments Systems Regulator (PSR) and could be in place as early as October 7, 2024.

The PSR said in a statement that it has now considered additional evidence from the industry and FCA about the maximum liability amount. If confirmed, the new cap would be in line with the Financial Services Compensation Scheme (FSCS) limit which is currently £85,000 ($111,864) and well understood by consumers. The PSR said this would still ensure enhanced consumer protections against APP scams, with clear incentives on financial firms to continue doing all they can from preventing fraud from happening in the first instance.

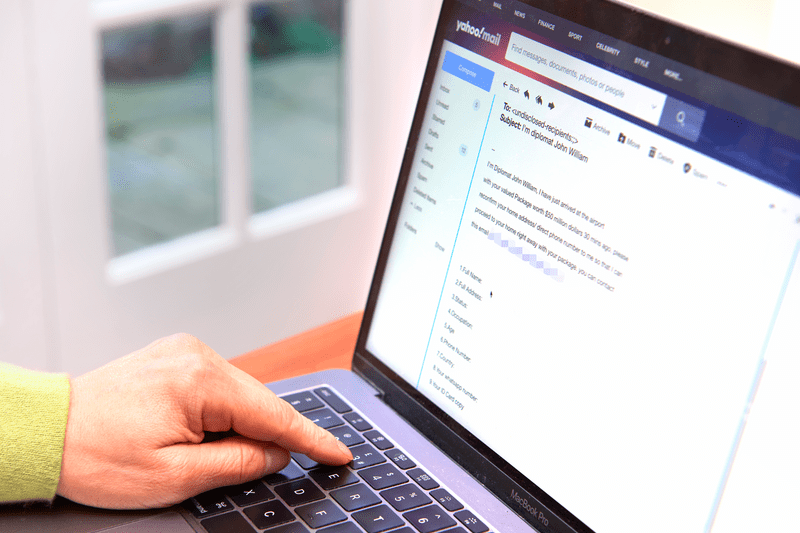

Authorized push payment (APP) fraud is a significant issue and can have a devastating impact on victims. The PSR is now taking a leading role in improving outcomes for consumers by introducing new protections for victims of APP scams, while incentivizing industry to implement enhanced fraud prevention tools. Banks and payments companies currently reimburse, on a voluntary basis, customers for fraud at widely varying rates, with some refunding almost 100% of cases, and others less than 10%.

When the PSR published its requirements for payment firms to reimburse APP scams victims in December 2023, it committed to consider high value APP fraud claims and publish the findings. The PSR’s review found that – out of over 250,000 cases – there were 18 instances in 2023 of people being scammed for more than £415,000 ($546,160), and 411 instances of more than £85,000 ($111,864). The analysis also highlighted that almost all high value scams are made up of multiple smaller transactions, reducing the effectiveness of transaction limits as a tool to manage exposure.

Strong pressure from tech firms

The previous maximum reimbursement value had been set at £415,000 ($546,160), in line with the Financial Ombudsman maximum reimbursement limit at that time. The FT reported that the UK regulator received strong pressure from fintech firms and ministers that the higher amount could have encouraged criminals to exploit the compensation system leading to potentially for some firms to be put out of business.

Treasury insiders told the FT the planned regime had been “a disaster waiting to happen.” Tulip Siddiq, City minister, had expressed concern about the impact of the new system on the financial sector, while her Tory predecessor Bim Afolami said there were “significant problems” with the planned regime.

The proposed new cap will still see over 99% of claims (by volume) covered. The PSR said their measures to protect people against APP fraud and make sure victims get their money back remain stronger than anywhere else in the world. The regulator has also committed to keeping this under consideration through its post-implementation review. The PSR fully expects all firms to meet their obligations as responsible providers and will continue to follow up with all firms to support this.

David Geale, the PSR’s managing director, commented: “We listened to concerns about the reimbursement limit and committed to collecting more evidence to inform our approach. As a result, we are now consulting on a limit that still covers the vast majority of authorized push payment scams and strikes the right balance.

“Under our proposals, consumers in the UK will still receive world-leading protection, payment providers will still be heavily incentivised to improve anti-fraud protections and we maintain effective market competition and innovation.”

Commenting on the lower threshold of £85,000 ($111,864), Rob Mason, Director of Regulatory Intelligence at Global Relay, said: “Interesting move this, and claims that this aligns compensation with the depositors scheme does result in less protection against fraud. This has the appearance of the government conceding some ground to industry … one wonders if this is in return for something else?” Importantly, the implementation date for these major APP fraud protections is unchanged, meaning people will still see the benefits in October.

What next?

Pay.UK, which operates Faster Payments, the payment system to which the protections apply and through which most APP fraud flows, has confirmed it will be ready for October 7, 2024.

The consultation closes on September 18, 2024. The PSR will consider the responses carefully and confirm its final approach before the end of September 2024.