There has been an increase in the number of authorized push payment (APP) scams in the UK, but a commensurate decrease in the value of them. That’s according to the latest report from the Payment Systems Regulator (PSR).

The PSR collected faster payments data from 14 of the largest banking groups in the UK, and the report also includes information on 11 smaller firms identified as being “one of the 20 highest receivers of APP scams by volume and value.” The data relates to scams where the victim is a consumer, small business or charity with an annual income lower than £1m ($1.27m).

Key trends observed for 2023 are:

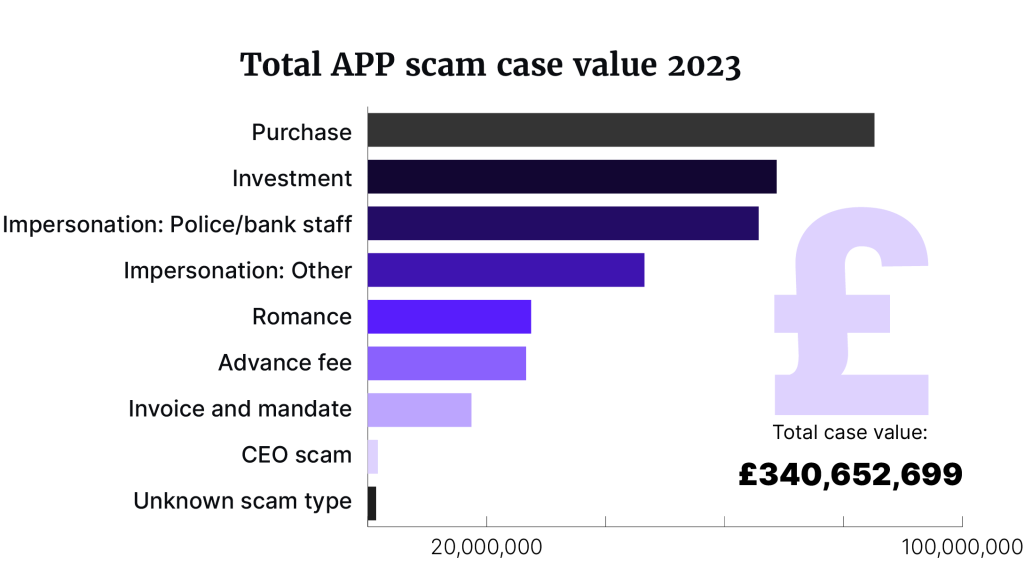

- 12% decrease in value of APP scams – £341m ($433m);

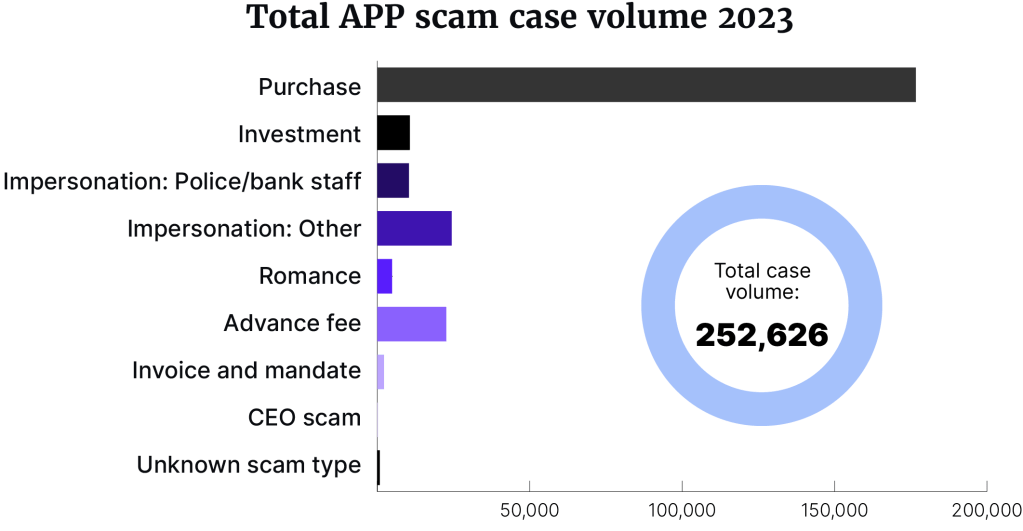

- 12% increase in volume of APP scams – 252,600 cases;

- a 32% increase in purchase scams by volume;

- reimbursement by value increasing to 67% in 2023 from 61% in 2022;

- 80% of scams fully or partially reimbursed, a 5% increase compared with 2022;

- smaller firms attracting a higher proportion of scams; and

- 80% of scams involve sums of under £1,000 ($1,269), and correspond to just under 14% of scam losses.

In part because of the “complex and evolving landscape of APP scams” payment firms can hold different views on whether a claim can be assessed as a APP scam. One key issue is establishing precisely when a customer has lost control. This issue is particularly pronounced in connection with payments sent between accounts in the same name and payments made to crypto exchanges.

New reimbursement framework

This is frustrating to the regulator who points out that “being reimbursed still depends largely on who you bank with.” In part to address this very issue a new reimbursement framework will launch in the UK in October 2024. This will expand scam protections to encompass both sending and receiving firms who will both “be equally liable for the cost of reimbursement.” The current framework places the financial liability solely on the sending firm “ignoring the vital role receiving firms play in preventing scammers from accessing the UK payment systems.”

The summary of the data for the 14 largest banking groups is ranked here in terms of percentage of total losses reimbursed (higher number being better) with the value and volume lost to scams included as comparators.

The summary of the data for the 14 largest banking groups is ranked here in terms of percentage of total losses reimbursed (higher number being better) with the value and volume lost to scams included as comparators.

| Percentage of total losses reimbursed to consumers | Value lost to scams per £1m ($1.27m) of transactions (£) (£ lost to scams / £1m transactions) | Volume of scams per 1m consumer transactions (# scams / 1m transactions) | |

|---|---|---|---|

| TSB | 88% | 266 | 108 |

| Nationwide | 87% | 219 | 129 |

| HSBC, First Direct | 76% | 159 | 58 |

| NatWest, RBS, Ulster Bank | 76% | 92 | 88 |

| Santander | 73% | 162 | 89 |

| Barclays | 72% | 135 | 91 |

| Clydesdale, Virgin Money | 68% | 160 | 92 |

| Lloyds, Bank of Scotland, Halifax | 55% | 228 | 105 |

| The Co-operative Bank | 49% | 125 | 51 |

| Starling | 48% | 105 | 124 |

| Metro Bank | 46% | 266 | 137 |

| Monzo | 17% | 213 | 131 |

| Danske Bank | 13% | 44 | 54 |

| AIB | 9% | 38 | 56 |

Data for smaller banks and payment firms (new market entrants and fintechs whose access to the interbank payment system is facilitated by others) illustrates that they continue to be attractive targets for APP scams. The PSR report does emphasize that progress here is being made as well, indicating that although the volume of scams targeted at these entities has increased by 18% since 2022 “the scam rate of the worst performing firm in 2023 is nearly 70 times smaller than that of the worst performer in 2022.”

| Volume of scams per 1m consumer transactions (# scams / 1m transactions) | |

|---|---|

| PayrNet | 2,705 |

| Modulr | 2,571 |

| Zempler Bank | 2,340 |

| Kroo | 2,277 |

| PrePay Technologies | 1,716 |

| Wise | 1,619 |

| PayPal UK | 907 |

| Revolut | 537 |

| JP Morgan/Chase | 265 |

Well worth noting in the report was the published data on the scam values and case volumes by scam type with strong growth in terms of both value and volume being registered for ‘purchase’ and ‘romance’ type scams, against a backdrop of a general decrease.

| Case value (£) | Percentage change on 2022 | Case volume | Percentage change on 2023 | |

|---|---|---|---|---|

| Purchase | 85,169,655 | 27 | 176,685 | 32 |

| Investment | 68,732,511 | -20 | 10,611 | -4 |

| Impersonation: Police / Bank staff | 65,705,019 | -33 | 10,357 | -39 |

| Impersonation: Other | 46,497,418 | -25 | 24,384 | -16 |

| Romance | 27,454,960 | 9 | 4,824 | 20 |

| Advance fee | 26,613,253 | -3 | 22,623 | -16 |

| Invoice and mandate | 17,416,604 | -11 | 2,188 | -16 |

| CEO scam | 1,680,239 | -28 | 189 | 13 |

| Unknown scam type | 1,382,950 | 33 | 765 | 554 |

The PSR is also conducting research to establish which entities outside of the payments sector are enabling the most fraud against UK payment users, which will be published shortly.