The FCA’s latest Financial Lives survey features data from over 19,000 respondents, and was published July 26, 2023. The survey takes place approximately every two years and is designed to provide longer term

trend data.

Nisha Arora, FCA Director for Cross-Cutting Policy and Strategy said: “I encourage financial services firms to use these results to better understand the needs and experiences of their customers and target markets, as they are required to do under the Consumer Duty.”

Key survey findings

Consumer confidence: The survey showed less than half of UK adults, or 21.9 million people, had confidence in the UK financial services industry and just 36% agreed that most financial firms are honest and transparent in the way they treat them. Although a more positive picture emerged when people were asked to rate their own provider rather than the sector in general.

Lack of communication: In the 12 months before May 2022, 7.4 million people unsuccessfully attempted to contact one or more of their financial services providers, with the most vulnerable in society most likely to struggle with this. And 4.9 million people who used firm communications to help them make a decision in the 12 months before May 2022 found it did not help at all.

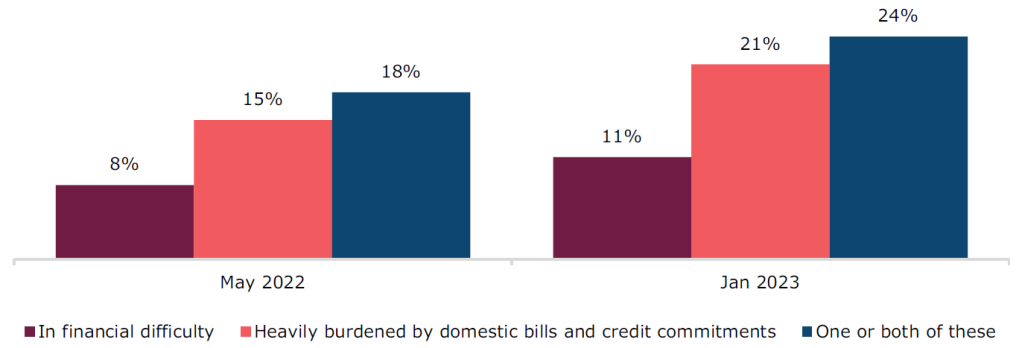

Cost of living crisis: The number of people struggling to meet bills and credit repayments has risen by 3.1 million since May 2022 (10.9 million, compared to 7.8 million in May 2022). The number of adults who missed bills or loan payments in at least three of the last six months has also gone up by 1.4 million, from 4.2 million to 5.6 million over the same period.

Being in financial difficulty and finding paying domestic bills and meeting credit commitments to be a heavy burden – experiencing either/experiencing both (2022/Jan 2023)

Vulnerable customers: Adults with one or more characteristics of vulnerability were more likely to report that customer support services did not help them at all to achieve what they wanted to do. For example, 20% of those with low financial resilience and 20% of those with low capability reported that provider communications did not help at all, compared with 12% of those with no characteristics of vulnerability.

Mortgage products: In May 2022, only 11% of adults expressed high trust in mortgage lenders, yet 54% of adults with a mortgage had high trust in their own mortgage provider.

FCA engagement

FCA action since the start of the cost-of-living squeeze has already led to an increase in the amount of engagement lenders are having with their customers. Following conversations with firms and new guidance set by the FCA, lenders supported over two million mortgage customers to manage their finances in the past year, including through budgeting tools, access to debt advice, and tailored mortgage forbearance.

Sheldon Mills, the FCA’s Executive Director, Consumers and Competition said: “Times like this show why it’s important people get the support they need as more people are likely turning to their financial services providers for help.”

Consumer Duty

The Consumer Duty will come into force on July 31, 2023. The Duty will require firms to act in good faith towards retail customers, avoid foreseeable harm, and enable and support retail customers to pursue their financial objectives.

Under the Duty, firms will have to:

- provide helpful and responsive customer service – for example, it should be as easy to complain about or switch and cancel products or services as it was to buy them;

- equip their customers to make good decisions through communications people can understand, provided at the right time;

- provide products and services that meet consumers’ needs and work as expected;

- explain and justify their pricing decisions. This includes being able to demonstrate that rates offer fair value.

“Our Consumer Duty will guide our ongoing work to improve the way firms provide customer support – getting through to your provider is the starting point for receiving help, so we will be working with them to improve in this area,” said Mills.

Rise in use of digital banking

The FCA’s survey also found that an increasing number of people are choosing to use digital banking, payments and other online services, with almost nine in ten adults (88% or 42.9 million) banking online or using a mobile app in 2022, up from 77% in 2017.

While there is an increasing number of people regularly using digital services, the FCA recognises that many people are still heavy users of cash (6% or 3.1 million) and reliant on face-to-face services. Through the Financial Services and Markets Act, the FCA will take on powers on access to cash and will expect firms to ensure that they meet all their customers’ needs.