More money was lost to fraud by US consumers in 2024 than ever before, newly released data from the Federal Trade Commission has revealed. In a press release, the FTC said consumers lost a total of $12.5 billion to fraud last year, a 25% increase on the previous year.

The number of fraud reports remained stable, however, the percentage of people who lost money due to fraud or scams increased by double digits.

“In 2023, 27% of people who reported a fraud said they lost money, while in 2024, that figure jumped to 38%,” the FTC said. Investment scams stole more money out of consumers’ pockets in 2024 than any other category, with the $5.7 billion figure showing a 24% increase in the category over the previous year.

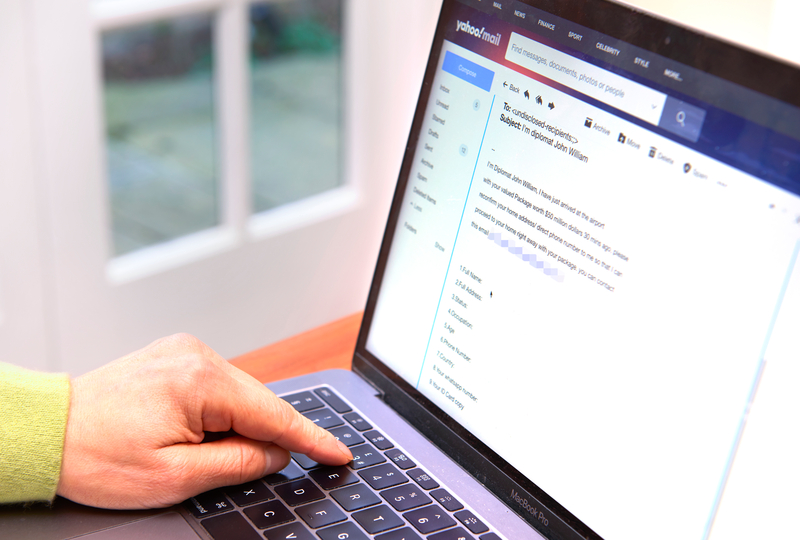

The second fraud category on the list was imposter scams, where criminals pretend to be someone they are not. Around $2.95 billion was stolen through this approach.

Also, consumers lost more money when paying via bank transfers or cryptocurrency than any other payment method, the latter showing the risky nature of dealing in digital assets.

Christopher Mufarrige, Director of the FTC’s Bureau of Consumer Protection, said: “The data we’re releasing today shows that scammers’ tactics are constantly evolving. The FTC is monitoring those trends closely and working hard to protect the American people from fraud.”

Other key stats

- The total number of consumer reports received by the FTC in 2024 was 2.6 million, around the same as 2023.

- $789m was lost to government imposter scams. This figure was only $171m in 2023.

- Online shopping and business and job opportunities scams also increased from around $250m to $750m.

- Between 2020 and 2024, the number of reports about employment agency scams tripled. The amount of money lost to these scams increased from $90m to $501m.

- Scammers used emails as the most common method of contacting potential victims. This was followed by phone calls, with text messages the third most common method.

- There were more than $1.1 million reports of identity theft in 2024.