The US Office of the Comptroller of the Currency (OCC) has proposed new regulations for bank mergers and acquisitions (M&A) in a bid to increase transparency around the process, while ensuring some deals do not slide through automatically without sufficient scrutiny.

The OCC reviews mergers in which the acquiring bank has a federal charter, and the process can involve other regulators.

This move by the bank regulator comes amid industry criticism that regulators are too opaque in their handling of bank deals and as smaller lenders struggle to keep up, leaving more consolidation in the market to seem inevitable.

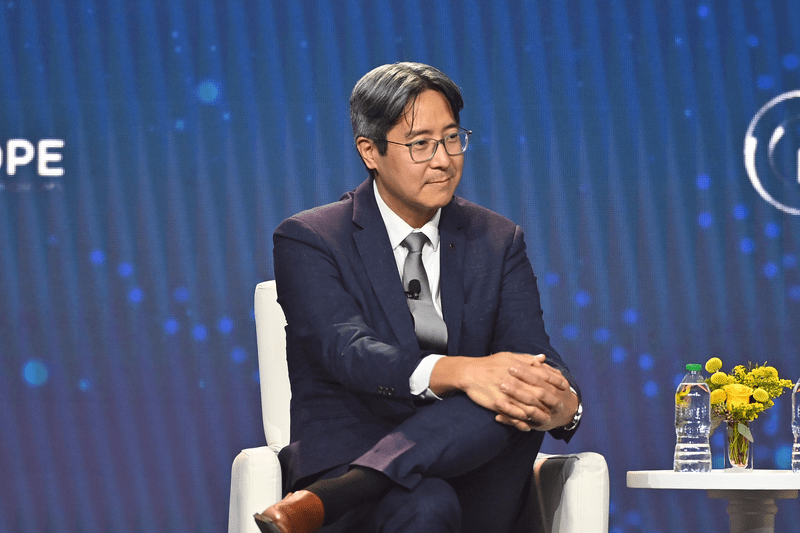

“You have two risks with mergers. One risk is that we approve too many mergers and therefore we’re approving bad mergers. The other risk is we approve too few mergers and therefore there are good mergers that should happen that aren’t.”

Michael Hsu, Acting Comptroller, OCC

Bank regulators’ merger policies came under explicit scrutiny last year when regulators engineered rescue deals, such as the sale of First Republic Bank to the institution that was already the largest bank in the US, JPMorgan Chase.

Adding transparency

After completing a review of its Comptroller’s Licensing Manual, the OCC said, it has “determined that additional transparency regarding the standards and procedures that the agency applies to its review of bank business combinations may be helpful to institutions and to the public”. That manual outlines the processes the OCC follows in reviewing and acting on proposed business combinations under the Bank Merger Act and other directives.

Michael Hsu, the acting comptroller, spoke to Reuters in an interview, saying the proposal will detail the types of deals that would typically secure approval and the issues that could complicate or derail transactions. He said increasing transparency around the process could speed up good deals and help banks steer clear of transactions that may hit regulatory roadblocks.

“You have two risks with mergers. One risk is that we approve too many mergers and therefore we’re approving bad mergers. The other risk is we approve too few mergers and therefore there are good mergers that should happen that aren’t,” Hsu said. “The purpose of being transparent is to encourage more accuracy on both ends.”

The OCC reviews mergers in which the acquiring bank has a federal charter, and the process can involve other regulators. Some mergers are problematic because the banks involved have supervisory issues, whereas banks that have a high supervisory rating with no lingering enforcement concerns are more likely to get the green light for a merger or acquisition, said Hsu.

“A lot of this was unwritten, the point of this is to just write it down,” he said.

The agency will also propose scrapping a 1996 policy under which some deals are automatically approved if the OCC does not act on the application within a certain timeframe, Hsu said.