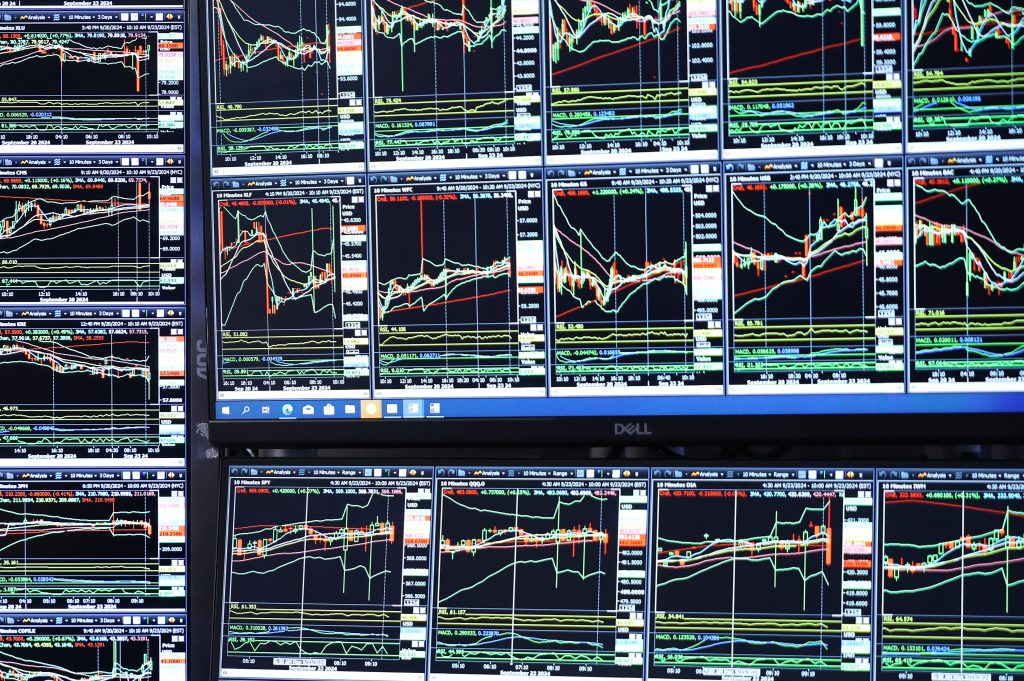

One of the interesting aspects of the meltdown in the crypto ecosystem is the fact that traditional finance remains almost completely unscathed.

Traditional financial institution exposure to crypto-assets, where it exists, appears to be limited by professional scepticism, good risk management practice, and effective regulatory mechanisms. All of these are

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day